Tariff Turmoil: How Trade Wars Are Shaking Global and Crypto Markets

The post Tariff Turmoil: How Trade Wars Are Shaking Global and Crypto Markets appeared first on Coinpedia Fintech News On April 6, 2025, veteran US President Donald Trump fueled the economic competition between the globe’s two greatest economies by imposing a blanket 50% tariff on […]

Research report

How to mine Bitcoin at home in 2025

Key takeaways Lottery mining is cheap and fun, but don’t count on hitting a block. Solo ASIC mining gives you complete control, but it’s a long-odds game. Pool mining is the most practical way to earn steady payouts at home. Cloud mining saves you the […]

Analysis

New York bill proposes legalizing Bitcoin, crypto for state payments

A New York lawmaker has introduced legislation that would allow state agencies to accept cryptocurrency payments, signaling growing political momentum for digital asset integration in public services. Assembly Bill A7788, introduced by Assemblyman Clyde Vanel, seeks to amend state financial law to allow New York […]

Litecoin

Canary Capital files S-1 for Litecoin ETF

Asset manager Canary Capital has filed registration documents for a spot Litecoin (LTC) exchange-traded fund (ETF) with United States regulators, according to Oct. 15 documents. The filing is the latest in a proliferation of proposed ETFs holding alternative cryptocurrencies ahead of the US presidential election […]

Litecoin

Asset manager Canary Capital has filed registration documents for a spot Litecoin (LTC) exchange-traded fund (ETF) with United States regulators, according to Oct. 15 documents.

The filing is the latest in a proliferation of proposed ETFs holding alternative cryptocurrencies ahead of the US presidential election in November.

Canary’s proposed ETF aims to hold spot LTC and closely track the performance of the CoinDesk Litecoin Price Index (LTX), according to the filings.

Litecoin is a decentralized peer-to-peer digital currency often pegged as a faster, lower-cost alternative to Bitcoin (BTC) for small payments.

Source: United States Securities and Exchange Commission

Related: Canary Capital follows Bitwise in filing for spot XRP ETF

Canary files for XRP ETF as well

On Oct. 9, Canary filed an S-1 for a proposed spot XRP (XRP) ETF. The filing came only days after crypto fund issuer Bitwise sought to register a similar ETF with the Securities and Exchange Commission.

“In short-term, this is likely [a] call option on November election,” Nate Geraci, president of financial advisory The ETF Store, said in a post on the X platform.

“Politics clearly matter here in short-term, but I think this is all inevitable over time,” Geraci said.

The XRP token was issued by crypto payments protocol Ripple in 2012.

In 2020, XRP became the subject of a hotly contested lawsuit brought by the SEC, which alleged the token launch amounted to an unregistered securities offering.

Filing the S-1 registration form is the first step toward launching an LTC ETF, but Canary must still wait for the SEC to review the documents.

The SEC needs to authorize a rule change permitting at least one national securities exchange to list the proposed ETF.

Three in four crypto owners said a candidate’s crypto policy will impact how they vote. Source: Gemini

United States Vice President and presidential candidate Kamala Harris is friendlier toward cryptocurrency than her boss, President Joe Biden, but not as pro-industry as rival and former President Donald Trump, Galaxy Research said on Oct. 14.

Under Biden, a Democrat, the SEC has taken an aggressive regulatory stance toward crypto, bringing upward of 100 regulatory actions against the industry.

In July, Trump promised to “fire” Gary Gensler, who currently heads the SEC.

Starting in September, Harris began to up her crypto game, listing blockchain technology among several emerging sectors where she wants the US to “remain dominant.”

Galaxy said “behind the scenes conversations […] suggest Harris is targeting a slightly more constructive approach” than Biden.

Magazine: Blockchain games aren’t really decentralized… but that’s about to change

Unspent transaction outputs distort BTC fungibility — Litecoin founder

Charlie Lee, the founder of Litecoin (LTC), made an appearance at this year’s Proof of Work Summit in Frankfurt, Germany, to contrast Litecoin’s privacy-enhancing features with the nearly inescapable transparency of the Bitcoin (BTC) network. Lee explained that the unspent transaction outputs (UTXOs), which underpin […]

Litecoin

Charlie Lee, the founder of Litecoin (LTC), made an appearance at this year’s Proof of Work Summit in Frankfurt, Germany, to contrast Litecoin’s privacy-enhancing features with the nearly inescapable transparency of the Bitcoin (BTC) network.

Lee explained that the unspent transaction outputs (UTXOs), which underpin the Bitcoin ledger, carry a history of how the transactions were spent — potentially ruining the fungibility of the digital asset. Lee told the audience:

“Because of the history attached to every Bitcoin that is spent, each Bitcoin is not equal to another Bitcoin — which is something that I think is important for money.”

A hypothetical example of this would be an onchain analytics company attaching labels to a Bitcoin address believed to be associated with illicit activities. The label may dissuade investors or traders from accepting BTC associated with the address — lowering the market price of those particular coins and sats.

Moreover, if the Bitcoin in question passes through centralized exchanges or other institutions with Know Your Customer controls, the assets could be frozen or seized at the behest of government authorities such as the United States Office of Foreign Assets Control (OFAC).

Related: Tornado Cash’s Roman Storm to stand trial after judge denies dismissal

The fight for privacy comes into sharper focus

Privacy on the Bitcoin network is notoriously difficult, but not impossible. On Sept. 20, a mysterious group of developers announced a fork of the privacy-preserving Samourai Wallet.

The Ashigaru Open Source Project uses CoinJoin and other mechanisms to mask Bitcoin transactions and builds on the work of the original Samourai team — though the new Ashigaru team has denied any connection to the previous developers.

Paul Brody, the global blockchain leader at EY, recently told Cointelegraph at Token2049 that a lack of privacy was hindering blockchain adoption. The executive explained that privacy matters, especially for large institutions that must keep certain information private.

Businesses “Are very happy to tell you how many tons of carbon they save,” Brody stated. “They just don’t want you to be able to see that on a week-to-week or a day-to-day basis.”

Magazine: Did Telegram’s Pavel Durov commit a crime? Crypto lawyers weigh in

MicroStrategy’s Bitcoin Holdings: Unraveling a High-Stakes Investment Strategy

The post MicroStrategy’s Bitcoin Holdings: Unraveling a High-Stakes Investment Strategy appeared first on Coinpedia Fintech News Recently, an announcement made by microstrategy microstrategy – Business Intelligence executive chairman Michael Saylor Michael Saylor Michael Saylor is a co-founder of Strategy (formerly MicroStrategy). Before founding Microstrategy, […]

Research report

The post MicroStrategy’s Bitcoin Holdings: Unraveling a High-Stakes Investment Strategy appeared first on Coinpedia Fintech News

Recently, an announcement made by microstrategy

executive chairman Michael Saylor

Michael Saylor

Michael Saylor is a co-founder of Strategy (formerly MicroStrategy). Before founding Microstrategy, he was a rocket scientist and studied aeronautics and astronautics at MIT on an Air Force scholarship. He dubs Bitcoin 'Digital Gold'.

He made some early investment in Bitcoin as soon as he realized it was going to be the next big thing in shaping decentralized finance from traditional finance. His firm Strategy has made Bitcoin their primary treasure reserve.

Quick Facts

Full Name

Michael J. Saylor

Birth

04-02-1965 in Lincoln, Nebraska

Education

BSc from MIT

Marital Status

To be updated / Unmarried

Nationality

American

Net Worth

$8.4B (Feb. 20205, Refer for realtime)

As per Forbes, Saylor bought another 17,732 bitcoins for $175 million in October 2020. Forbes covered Michael Saylor on its front page and called him "The Bitcoin Alchemist" as the latter's Net Worth hit a whopping $7.6B in January 2025.

Michael Saylor – Career Timeline

1983–1987: Studied Aeronautics & Astronautics and Science, Technology & Society at Massachusetts Institute of Technology (MIT).

1989: Co-founded MicroStrategy (Strategy).

1998: MicroStrategy IPO – Took MicroStrategy public on the NASDAQ at $12 per share.

2000: Accounting Scandal & Crash – MicroStrategy's stock plunged 62% in a day due to an accounting misstatement, wiping out billions in valuation.

2004–2019: MicroStrategy Rebuilds – Worked towards cloud-based analytics and AI-driven business intelligence, regaining stability.

2020: Bitcoin Strategy & Investment – Led MicroStrategy’s $425M Bitcoin investment. He made it the first publicly traded company to adopt Bitcoin.

2021: Bitcoin Evangelism – Became one of Bitcoin’s most vocal advocates, encouraging corporations and institutions to adopt BTC and blockchain.

2022: Stepped Down as CEO – Transitioned to Executive Chairman to focus entirely on Bitcoin strategy.

With a major focus on blockchain network growth, Saylor is considered one of the architects in shaping the growth of decentralized finance.

Useful Links to connect with Michael Saylor

Platform

Link to connect

Twitter (X)

Michael Saylor

MicroStrategy (Strategy) Official Website

MicroStrategy

Michael Saylor’s YouTube Channel

https://www.youtube.com/c/MichaelSaylor

Hope.com (Bitcoin Education by Saylor)

Bitcoin is Hope

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

about his $1 billion worth of Bitcoin personal investment created headlines. This move has reignited discussions around Bitcoin holdings, particularly those of public companies. MicroStrategy’s obsession with Bitcoin is well-known, having steadily increased its holdings since 2019.

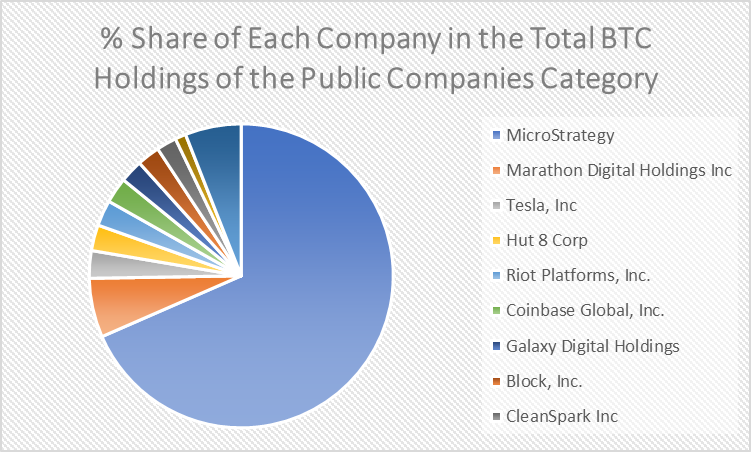

In this article, we will explore all the major data sets compatible to explain the current Bitcoin Holding scenario in the world. This will primarily focus on the top public companies by bitcoin holdings. Naturally, MicroStrategy is going to be the central point of this, as it is a company that holds nearly 68.45% of the total bitcoins held by the public companies category. This is expected to be a memorable journey. Please join!

Bitcoin Holdings by Category: Who Holds What?

Let’s start by breaking down the Bitcoin holdings by different categories. Of the 21 million Bitcoins, the maximum supply cap, approximately 2,609,343 BTC is held by ETFs, countries, public companies, private companies, BTC mining companies, and DeFi platforms.

| Category | Bitcoin Holding | Bitcoin Holding (%) |

| ETFs | 1,057,839BTC | 5.037% |

| Countries | 539,182BTC | 2.568% |

| Public Companies | 330,862BTC | 1.576% |

| Private Companies | 525,474BTC | 2.502% |

| BTC Mining Companies | 53,848BTC | 0.256% |

| DeFis | 155,986BTC | 0.743% |

The category of ETFs holds over 1,057,839BTC, which is nearly 5.037% of the maximum supply cap of BTC. Thus, this category tops the list in terms of Bitcoin Holdings by Category. The category of countries follows with 2.58% (539,182BTC), and the category of private companies sits in the third position in the list above the category of private companies, with 2.502% (525,474BTC. The category of public companies only holds 330,862BTC, which is just 1.576%. DeFis and BTC Mining Companies show as low as 0.743% and 0.256% Bitcoin Holdings, respectively.

By now, we have learned that the category of public companies do hold a considerable amount of BTC, though not as much as the top three categories like ETFs, countries and private companies.

Top Public Companies by Bitcoin Holdings

Here is the interesting part. Nearly 68.45% of the total bitcoins held by the category of public companies is held by MicroStrategy, which is at least 226,500BTC out of 330,862BTC. This is why we need to analyse MicoStrategy separately.

| Company | Bitcoin Holding | Bitcoin Holding (%) |

| MicroStrategy | 226,500BTC | 1.079% |

| Marathon Digital Holdings Inc | 20,818BTC | 0.099% |

| Tesla, Inc | 9,720BTC | 0.046% |

| Hut 8 Corp | 9,109BTC | 0.043% |

| Riot Platforms, Inc. | 9,084BTC | 0.043% |

| Coinbase Global, Inc. | 9,000BTC | 0.043% |

| Galaxy Digital Holdings | 8,100BTC | 0.039% |

| Block, Inc. | 8,027BTC | 0.038% |

| CleanSpark Inc | 7,082BTC | 0.034% |

| Bitcoin Group | 3,830BTC | 0.018% |

When the category of public companies holds around 1.576% of the total BTC supply cap, Microstrategy alone holds at least 1.079%. The second top in the list of the top public companies by bitcoin holdings, Marathon Digital Holdings Inc. only has 20,818BTC (0.099%). Tesla Inc, Hut 8 Corp and Riot Platforms Inc are the other top companies on the list. Tesla Inc and Hust 8 Corp show 9,720BTC and 9,109BTC respectively, and Riot Platforms Inc display 9,084BTC. Coinbase Global Inc and Galaxy Digital Holdings are also on the list with 0.043% and 0.039% Bitcoin Holdings percentages respectively. The BTC Holdings percentages of other major players like Block Inc., CleanSpark Inc. and Bitcoin Group range between 0.038% and 0.018%.

| Company | % of 330,862BTC (held by The Public Companies category) |

| MicroStrategy | 68.45% |

| Marathon Digital Holdings Inc | 6.29% |

| Tesla, Inc | 2.93% |

| Hut 8 Corp | 2.75% |

| Riot Platforms, Inc. | 2.74% |

| Coinbase Global, Inc. | 2.72% |

| Galaxy Digital Holdings | 2.44% |

| Block, Inc. | 2.42% |

| CleanSpark Inc | 2.14% |

| Bitcoin Group | 1.15% |

| Others | 5.97% |

As said earlier, MicroStrategy clearly dominates the category of public companies with 68.45%, that is this public company holds nearly 226,500BTC out of 330,862BTC (which is what the entire category holds). Marathon Digital Holdings Inc, though is the second topmost in the list, only has a 6.29% share in the category of total BTC holdings. Even poorer is the share of Tesla INC and the others. None of the others in the top ten list cross the mark of 3%. Tesla Inc. and Hunt 8 Corp show 2.93% and 2.75% respectively.

The Rise of MicroStrategy’s Bitcoin Holdings

Are you wondering how MicroStrategy has become such a big player in the public companies category in terms of bitcoin holdings? Let’s understand the path through which it has reached such a staggering peak of 226,500. On March 5th, 2021, the Bitcoin holdings of MicroStrategy were just 91,064BTC. In June the same year, it crossed the mark of 100,000BTC. On June 21st, 2021, it was nearly 105,085 BC. By the end of that year, it reached 124,051 BC. In 2022, the growth was slow. On December 24, 2022, it was just around 132,500 BTC.

The year 2023 was different and positive in every way for MicroStrategy’s Bitcoin Holdings. The number of BTC holdings grew from nearly 138,955BTC (on March 23, 2023) to 189,150BTC (on December 27, 2023). In 2024, it crossed another milestone, when it surpassed the mark of 200,000BTC in March. On March 11, 2024, it touched 205,000BTC. From that point, the growth was steady. On June 20, 2024, it recorded 226,331BTC. Now it stands at a peak of 226,500BTC. At present, we see nothing to assume that this range is likely to decrease any time in the near future. There are many who expect the crossing of the 300,000BTC mark by MicoStrategy. Is it possible?

The question can be answered better if we can go through MicroStrategy’s BTC purchase history. Did MicoStrategy make any significant BTC purchases in the recent past?

MicroStrategy Bitcoin Purchase History

Let’s do an analysis of MicroStrategy’s purchase history, and understand what it conveys about the company’s holding strategy.

| Date | BTC Purchased |

| 1st Aug, 2024 | 169 |

| 20th June, 2024 | 11,931 |

| 1st April, 2024 | 164 |

| 19th March, 2024 | 9,245 |

| 11th March, 2024 | 12,000 |

| 26th Feb, 2024 | 3,000 |

| 6th Feb, 2024 | 850 |

| 27th Dec, 2023 | 14,620 |

| 30th Nov, 2023 | 16,130 |

| 1st Nov, 2023 | 155 |

| 24th Sep, 2023 | 5,445 |

| 1st July – 27th July, 2023 | 467 |

| 29th April – 27th June, 2023 | 12,333 |

| 5th April, 2023 | 1,045 |

| 27th March, 2023 | 6,455 |

| 24th Dec, 2022 | 810 |

| 22nd Dec, 2022 | -704 |

| 1st Nov – 21st Dec, 2022 | 2,395 |

| 20th Sep, 2022 | 301 |

| 28th June, 2022 | 480 |

| 15th Feb – 5th April, 2022 | 4,167 |

| 1sth Jan – 31st Jan, 2022 | 660 |

| 30th Dec, 2021 | 1,914 |

| 29th Nov – 8th Dex, 2021 | 1,434 |

| 28th Nov, 2021 | 7,002 |

| 13th Sep, 2021 | 8,957 |

| 21st June, 2021 | 13,005 |

| 18th May, 2021 | 229 |

| 13th May, 2021 | 271 |

| 5th April, 2021 | 253 |

| 12th March, 2021 | 262 |

| 5th March, 2021 | 205 |

| 1sth March, 2021 | 328 |

| 24th Feb, 2021 | 19,452 |

| 2nd Feb, 2021 | 295 |

| 22nd Jan, 2021 | 314 |

| 21st Dec, 2020 | 29,646 |

| 4th Dec, 2020 | 2,574 |

| 14th Sep, 2020 | 16,796 |

| 11th Aug, 2020 | 21,454 |

It was on 11th August 2020 that MicroStrategy made its first Bitcoin purchase. On that day, it made a heavy purchase of 21,454. In that year itself, it made at least two more heavy purchases: the 16,796BTC purchase on 14th Sep and the 29,646BTC purchase on 21st Dec, 2020. What it indicated was that from the beginning stage itself, the public company had a strategy to consistently boost its BTC holdings.

| Year | BTC Purchased |

| 2024 | 37359BTC |

| 2023 | 56650BTC |

| 2022 | 8813BTC |

| 2021 | 53921BTC |

| 2020 | 70470BTC |

This year, 2024, so far, the company has purchased around 37,359 BTC. The highest purchase was made on 11th March. Days before, the BTC price touched an all-time peak of $73,000. Another purchase of similar intensity was made a couple of days after the peak day. On 19th March, nearly 9,245 BTC was purchased. Recently, on 20th June, around 11,931 BTC were purchased.

It was in the year 2020 that the most number of BTC purchases occurred. In that year, over 70,470 BTC purchases took place. The year 2022 was not a good year in terms of MicoStrategy’s BTC Purchases. In that year, the company made no purchase of more than 8,813 BTC. It was the only time a negative purchase happened. On 22nd December 2022, a negative purchase of -704 was reported.

The year of 2021 and 2023 were identical. In both these years, not less than 50,000 BTC were purchased. Interestingly, the nature of purchase in each year was different. In 2021, it was a mix of small and large purchases. The smallest of those purchases was the purchase of 205 BTC, reported on 5th March 2021, and the largest was the purchase of 19,452 BTC, reported on 24th Feb, 2021. In 2023, at least three big purchases were reported: the 14,620 BTC purchase on 27th Dec, the 16,130 BTC purchase on 30th Nov, and the 12,333 BTC purchase between 29th April and 27th June.

Top Private Companies by Bitcoin Holdings

Before going to the conclusion part, we can go through the nature of the BTC holdings of the private companies category and understand how it is different from the public companies category.

| Companies | Bitcoin Holding | Bitcoin Holding (%) |

| Mt. Gox | 200,000BTC | 0.952% |

| Block.one | 140,000BTC | 0.667% |

| Tether Holdings LTD | 75,354BTC | 0.359% |

| Xapo Bank | 38,931BTC | 0.185% |

| BitMEX | 36,794BTC | 0.175% |

| The Tezos Foundation | 17,500BTC | 0.083% |

| Stone Ridge Holdings Group | 10,000BTC | 0.048% |

| Massachusetts Mutual | 3,500BTC | 0.017% |

| Lisk Foundation | 1,898BTC | 0.009% |

| Seetee AS | 1,170BTC | 0.006% |

Here, we can clearly see that unlike the public companies category, there is no domination of the top player. The difference between the number of Bitcoins held by the topmost in the list of the top private companies Bitcoin Holding and the second topmost is just 60,000 BTC. Mt.Gox, the topmost company in the list, holds around 200,000 BTC, and Block.one , the runner-up in the list, has 140,000 BTC. Tether Holdings LTD, Xapo Bank and BitMEX are the other important companies on the list. Tether Holdings LTD has around 75,354 BTC, and Xapo Bank and BitMEX have 38,931 BTC and 36,794 BTC, respectively.

Endnote

MicroStrategy’s aggressive Bitcoin acquisition strategy has positioned it as a key player in the public companies category. Despite a slight slowdown in 2022, the company regained momentum in 2023, with several high-volume purchases. As we move further into 2024, it’s worth watching whether MicroStrategy will surpass its 2020 record for Bitcoin acquisitions and what impact this will have on the broader market.

Also Read: Case Studies of Countries with Significant Crypto Adoption

Case Studies of Countries with Significant Crypto Adoption

The post Case Studies of Countries with Significant Crypto Adoption appeared first on Coinpedia Fintech News Crypto is the new trend in the global economy. It has created several impressive headlines in the recent past, as some of the economic powers have changed its attitude […]

Research report

The post Case Studies of Countries with Significant Crypto Adoption appeared first on Coinpedia Fintech News

Crypto is the new trend in the global economy. It has created several impressive headlines in the recent past, as some of the economic powers have changed its attitude towards the sector. Notably, the global crypto adoption has significantly increased in the recent past. Some countries like El Salvador have implemented certain bold policies, encouraging others to change their stand towards cryptos. Here our attempt is to explore the crypto scenario in those countries which have performed better in the crypto adoption analysis.

Some of the facts this report shares may leave you stunned. And, certain ones may disappoint you. But this mix of contradictions make this report an exceptional one. Don’t miss it.

Top Countries by Crypto Adoption Percentage

The United Arab Emirates, Vietnam and the United States are the top three countries in terms of percentage of population who own crypto.

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| United Arab Emirates | 3M | 30.4% |

| Vietnam | 21M | 21.2% |

| US | 53M | 15.6% |

| Iran | 12M | 13.5% |

| Philippines | 16M | 13.4% |

| Brazil | 26M | 12% |

| Saudi Arabia | 4M | 11.4% |

| Singapore | 665K | 11.1% |

In the United Arab Emirates, nearly three million people own crypto, which is at least 30.4% of its population. Though the United States has 53 million crypto owners, it could not get the top post and remains in the third position, as only 15.6% of its population are crypto owners. Vietnam, which remains in the second spot, has around 21 million crypto owners. In this Asian country, at least 21.2% of its population are crypto owners. Iran and Philippines, with 13.5% and 13.4%, stay in the 4th and 5th positions.

Notably, Brazil has over 26 million crypto owners, but only 12% of its population own cryptocurrencies. Saudi Arabia, with 11.4%, and Singapore, with 11.1%, are notable members.

Top Countries by Number of Crypto Owners

If we only consider the number of crypto owners, things will change slightly. In this list, we have India and China as the top two players. The USA, though has a significant number of crypto owners, is still in the third position. Why?

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| India | 93.5M | 6.55% |

| China | 59.1M | 4.15% |

| USA | 26M | 15.6% |

| Brazil | 26M | 12% |

| Vietnam | 21M | 21.2% |

| Pakistan | 15.9M | 6.6% |

| Philippines | 16M | 13.4% |

| Nigeria | 13.3M | 5.93% |

| Indonesia | 12.2M | 4.4% |

| Russia | 8.7M | 6.1% |

India has over 93.5 million crypto owners, and China has over 59.1 million. The said fact is impressive, but it does not make these countries prominent players. The reason is simple. Only 6.55% of the Indian population owns cryptocurrencies, and in China, the scenario is even worse. The Chinese crypto community enjoying the benefits of crypto ownership is just 4.15% of its total population. Certainly, the USA and Brazil, with 15.6% and 12%, deserve to be considered as top players.

Other prominent countries in the list are Vietnam (21M), Pakistan (15.9M), Philippines (16M), Nigeria (13.3M), Indonesia (12.2M), and Russia (8.7M). Among these, Vietnam and Philippines are significant, as the former’s crypto ownership percentage against its population is as high as 21.2%, and the latter’s is over 13.4%.

Crypto Adoption by Region

Let’s make the analysis a little more interesting. How about entering a little bit deeper and doing a regional-focused analysis? Sounds great, right?

For our convenience, we can divide our geography into three segments: the Europe, Middle East and Africa segment, the Amercians segment and the Asia-Pacific segment.

Crypto Adoption in Europe, Middle East and Africa

Like what the name suggests, the Europe, Middle East and Africa segment covers the countries in the Europe, Middle East and Africa region.

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| Nigeria | 13.3M | 5.93% |

| Russia | 8.7M | 6.1% |

| Ukraine | 3.9M | 10.57% |

| UK | 3.9M | 5.74% |

Generally, people expect that a European country would be a dominant player in the list. To an extent, the expectation is right. But in terms of the number of crypto owners index, none of the European countries match the performance of Nigeria, in which nearly 13.3 million people are crypto owners. Russia, a European superpower, with 8.7M crypto owners, stays in the second position. Ukraine and the UK have 3.9M and 3.9M crypto owners respectively. In the list, Ukraine does have an upperhand, as at least 10.57% of its population are crypto owners. In Nigeria, only 5.93% of its population are crypto-owners, and in Russia and the UK, the values are just 6.1% and 5.74% respectively.

Crypto Adoption in the Americas

There are some surprises in the American segment also. As you know, this segment primarily covers the USA, Canada and Latin America. There is a rumour that the entire crypto industry revolves around this region. Is there any truth to that? Let’s see!

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| USA | 26M | 15.6% |

| Brazil | 26M | 12% |

| Mexico | 8.4M | 6.55% |

| Argentina | 4.45M | 9.73% |

| Canada | 2.7M | 7% |

The USA is the leading player in the region in the crypto adoption landscape, undoubtedly. Otherwise, it would not have such a large number of crypto users. It has over 26 million crypto users – the US crypto community makes at least 15.6% of the country’s total population. Does it sound impressive? But when we consider the adoption rate in other prominent players in the region, it sounds doubtful whether these values are high enough to be considered as a country with the best crypto adoption environment.

Even Brazil has over 26 million crypto users. In that Latin American country, at least 12 percent of its total population own cryptocurrencies. The case is similar in Mexico, where there are over 8.4 million crypto owners – roughly 6.55% of the population. Even Argentina has over 4.45 million crypto owners. Contrary to the general expectation, Canada is very weak in terms of crypto adoption. It only has 2.7 million crypto owners – approximately under seven percent of the country’s total population.

Crypto Adoption in Asia-Pacific

The analysis of the crypto adoption scenario in the Asian-Pacific segment can definitely leave most non-Asians perplexed – particularly those in the developed west. Why? Just go through the below given numbers. Isn’t it enough to ring the bell?

| Countries | No. of Crypto Owners | Crypto Adoption Percentage |

| India | 93.5M | 6.55% |

| China | 59.1M | 4.15% |

| Vietnam | 20.9M | 21.2% |

| Pakistan | 15.9M | 6.6% |

| Philippines | 15.8M | 13.4% |

| Indonesia | 12.2M | 4.4% |

| Thailand | 6.9M | 9.61% |

| Japan | 5.1M | 4.13% |

| Bangladesh | 4.3M | 2.5% |

No longer can anyone deny the dominant role that the Asia Pacific region plays in the crypto sector. India and China alone have over 1526M crypto owners. In Vietnam, at least 21.2% of its population are crypto owners, and in the Philippines, more than 13.4% of its population are crypto owners. Even in Bangladesh and Pakistan – which are currently struggling due to political unrest and economic uncertainties, there are over 4.3 million and 15.9 million crypto owners respectively. Japan is a crucial player, with 6.9 million crypto owners. Thailand, known for its flourishing tourism sector, even has 6.9 million crypto users.

‘Is the Asia-Pacific adopting cryptos much faster than other two regions’ is a question that can create a lot of headlines in the coming days. With Hong Kong and Singapore, the two prominent financial hubs in the region, eagerly revamping its financial environment to embrace the new possibilities after the advent of the crypto and blockchain technology, the said question is less likely to sound this much indigestible in the future.

Countries with Cryptocurrency as a Legal Tender

Do you know that certain countries have recently accepted cryptocurrencies as legal tender?

El Salvador is the first country to accept cryptos as legal tender. The Central African Republic is the second. In El Salvador, the policy to accept crypto as legal tender was adopted on 9th June 2021. Approximately a year later, on 23rd April, 2022, the Central African Republic joined the league, boldly.

It is said that many counties particularly in the Africa and Latin America region have such a plan.

Crypto Adoption Index Score

Let’s approach the crypto adoption scenario from a different angle. The data set developed by Henley & Partners is an easy way to do so. This data set allows us to approach the crypto adoption scenario using some interesting parameters like public adoption and infrastructure adoption.

At first, we can consider the two prime parameters, public adoption, and infrastructure adoption, and see which country will come at the top in the list when these three are considered together. And later, we can take each parameter individually and see how the scenario changes. Ready?

When we consider these two parameters together, the UK gets the maximum score of 23.2. Australia and Singapore follow with 23 and 22.6 scores.

| Countries | Crypto Adoption Index Score |

| UK | 23.2 |

| Australia | 23 |

| Singapore | 22.8 |

| USA | 22.6 |

| Switzerland | 21.8 |

| UAE | 21.7 |

| Hong Kong | 20.8 |

| Canda | 19.7 |

| Turkey | 18.5 |

| Malta | 17.0 |

USA is in the fourth position with 22.6 score. Switzerland and UAE follow with 21.8 and 21.7 respectively. Hong Kong, Canada, Turkey and Malta are the other prominent players. Hong Kong scores 20.8. Canada, Turkey and Malta show 19.7, 18.5 and 17, respectively.

Crypto Adoption Score By Public Adoption

Time to consider each parameter individually. First, we can consider the parameter of public adoption.

| Countries | Score |

| Singapore | 7.1 |

| UAE | 7.1 |

| USA | 6.3 |

| UK | 5.5 |

| Australia | 5.1 |

| Canada | 5.1 |

| Mauritius | 4.7 |

| Hong Kong | 4.6 |

| Switzerland | 3.9 |

| Malta | 3.6 |

Singapore and UAE dominate with the same score of 7.1. USA follows with a score of 6.3. The UK and Australia report 5.5 and 5.1 respectively, and Canada and Mauritius record 5.1 and 4.7 respectively. Hong Kong and Switzerland are other two important players. The former has a score of 4.6 and the latter has a score of 3.9. Malta, with 3.6 score, also enjoys a place in the list.

Crypto Adoption Score By Infrastructure Adoption

Let’s consider the parameter of infrastructure adoption. As expected, the US is the country which enjoys the top position in the list.

| Countries | Score |

| USA | 9.6 |

| Canada | 9.3 |

| Switzerland | 9.2 |

| Australia | 9.1 |

| UK | 7.7 |

| Hong Kong | 7.5 |

| Thailand | 7.5 |

| Monaco | 7.5 |

| Greece | 7.5 |

| New Zealand | 7.4 |

The US shows a score of 9.6. Canada, Switzerland, and Australia closely follow with 9.3, 9.2 and 9.1, respectively. The UK, Hong Kong, Thailand, Monaco, Greece and New Zealand are the other countries who sit in this list. The UK has a score of 7.7, and New Zealand 7.4. The four remaining ones have the same score of 7.5.

Countries with the Best Regulatory and Tax Environment for Cryptos

One of the prime factors that influence a country’s crypto adoption is its regulatory and tax environment. In the Henly & Partners’ data set, there are provisions to generate a score considering the parameters of crypto regulation and tax environment.

The below is the list of these countries which score the highest when the said parameters are considered.

Singapore naturally remains in the top most position with 18.5, reflecting how dedicated is the Asian region in developing their environment to embrace the emerging digital finance possibilities.

| Countries | Score |

| Singapore | 18.5 |

| Switzerland | 16.5 |

| Antigua and Barbuda | 15.8 |

| Hong Kong | 15.7 |

| UAE | 15.6 |

| Mauritius | 15.4 |

| Netherlands | 14.7 |

| Malaysia | 14.5 |

| Malta | 14.4 |

| Monaco | 14.4 |

Switzerland and Antigua and Barbuda are the countries that follow Singapore. Switzerland shows 16.5, and Antigua and Barbuda displays 15.8. Another Asian financial centre, Hong Kong, with 15.7, enjoys the fourth position in the list. UAE and Mauritius score 15.6 and 15.4 respectively. Netherlands, Malaysia, Malta and Monaco are the other prominent players. Their scores range from 14.7 to 14.4.

Top Countries with the Best Economic Factors for Crypto Adoption

Is creating a crypto friendly regulatory and tax environment enough to improve the crypto adoption scenario of a country? In most cases, it is inadequate. The fact is that in the absence of a right economic environment, any effect to revamp a country’s regulatory scenario would be counter productive.

As per the Henley & Partners data set, here are the top countries with the best economic factors suitable for the flourishing of the crypto adoption environment.

The list is dominated by two powerful financial hubs from the Asia-Pacific region. You may have already guessed it. Yes, Hong Kong, with 9.1, and Singapore, with 8.9, are the two countries which sit in the top most positions in the list.

| Countries | Score |

| Hong Kong | 9.1 |

| Singapore | 8.9 |

| Switzerland | 8.6 |

| UAE | 8.4 |

| New Zealand | 8.4 |

| Luxembourg | 8.3 |

| USA | 8.2 |

| Netherlands | 8.1 |

| Thailand | 8.1 |

| Canada | 8.1 |

Switzerland, with 8.6, and UAE, with 8.4, remain in the third and fourth positions, respectively. New Zealand, Luxembourg, the USA, the Netherlands, Thailand and Canada are the other prominent countries in the list. New Zealand and Luxembourg and the USA have 8.4, 8.3 and 8.2 scores respectively. All the three remaining ones. the Netherlands, Thailand and Canada display the same score of 8.1.

Endnote

In conclusion, what is clear from the data collected is that the Asia-Pacific region currently leads the world in crypto adoption, with countries like Singapore and Hong Kong poised to become global hubs for the crypto economy. As these nations continue to innovate and set new standards, they are likely to shape the future of digital finance and serve as a model for others to follow. It does not mean that the other regions perform poorly in crypto adoption. It is important to watch the developments in certain important crypto economies like the USA, India, China, Thailand, the Philippines, El Salvador, the Central Asian Republic, Brazil and even Bangladesh and Pakistan. One thing is clear that this crypto revolution is set to continue, and is likely to transform the lives of millions in near future.

Plus Token Ponzi-linked wallet moves $2B ETH after 3.3 years of dormancy

Update (Aug. 8 at 1:48 am UTC): Lookonchain deleted the X post that is the subject of this article after analysts argued the X post was inaccurate as most of the funds had been sold in 2021. A new article covering that latest development can […]

Litecoin

Update (Aug. 8 at 1:48 am UTC): Lookonchain deleted the X post that is the subject of this article after analysts argued the X post was inaccurate as most of the funds had been sold in 2021. A new article covering that latest development can be found here.

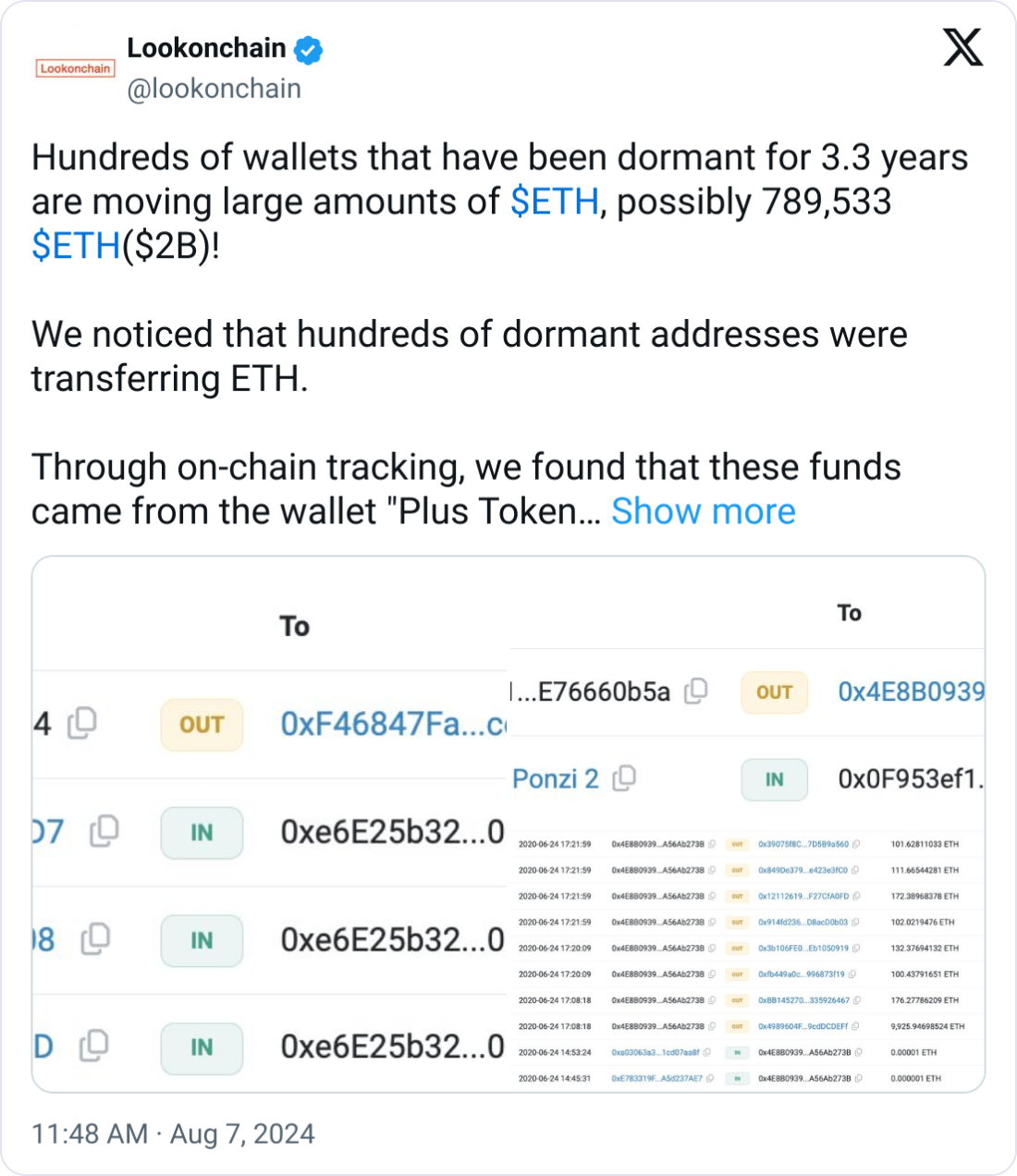

Hundreds of cryptocurrency wallets that have remained inactive for over three years have suddenly started shifting large amounts of Ether (ETH).

According to onchain analyst Lookonchain, up to 789,533 ETH was linked to the Plus Token Ponzi scheme and has not been moved since April 2021.

Onchain tracking revealed the tokens were associated with the “Plus Token Ponzi 2” wallet, which dispersed the ETH to thousands of smaller wallets in 2020.

Related: Judge labels 2 obscure altcoins as commodities in $120M Ponzi case

Chinese authority involvement

During the crackdown, Chinese authorities seized around $4.2 billion in multiple crypto assets, including the Plus Token scam.

The assets included 194,775 Bitcoin (BTC), 833,083 ETH, 497 million XRP (XRP), 6 billion Dogecoin (DOGE) and other assets such as Bitcoin Cash (BCH), Litecoin (LTC) and USDT (USDT).

Although the combination of seized tokens was worth around $4.2 billion in late 2020, the total funds are now worth around $13.5 billion as current asset prices are much higher.

Related: FBI busts $43M crypto and Las Vegas hospitality Ponzi scheme

Implications for the crypto market

The reactivation of these wallets and the potential for a sell-off of the seized funds by the Chinese authorities could trigger panic in the market, but this has yet to be seen.

At the time of writing, ETH’s price was around $2,474, up around 1% on the day, and so far, the ETH outflows from the wallets began at 10:17 am UTC on Aug. 7.

Related: New York jury convicts two promoters of IcomTech crypto ‘Ponzi’

What defines a Ponzi?

On July 4, an Illinois district judge sided with the United States Commodity Futures Trading Commission (CFTC) in labeling two altcoins as commodities in a crypto Ponzi scheme case.

The Ponzi scheme defrauded its victims by promising “steady returns” of 15% annually from investments in “digital asset commodities.”

According to the CFTC, the digital currencies involved in the case fell “into the same general class at Bitcoin, on which there is regulated futures trading.”

Magazine: How crypto bots are ruining crypto — including auto memecoin rug pulls

Trump’s $35 Trillion Debt Plan: Analysing The Impact on Cryptos

The post Trump’s $35 Trillion Debt Plan: Analysing The Impact on Cryptos appeared first on Coinpedia Fintech News Recently, Donald Trump proposed an audacious idea: using Bitcoin to address the United States’ staggering national debt. This suggestion has ignited intense debate, particularly within the cryptocurrency […]

Research report

The post Trump’s $35 Trillion Debt Plan: Analysing The Impact on Cryptos appeared first on Coinpedia Fintech News

Recently, Donald Trump proposed an audacious idea: using Bitcoin to address the United States’ staggering national debt. This suggestion has ignited intense debate, particularly within the cryptocurrency community. Can Bitcoin truly be a remedy for the national debt? What would this mean for the crypto industry, and how might Bitcoin’s price be affected? Let’s explore these questions in detail!

Understanding the US Debt Crisis

As per the official data published by the US government, the national debt of the United States, or the amount of outstanding borrowing the government accumulated over the nation’s history, is nearly $35.05 trillion, as of 6th August, 2024.

Here’s a snapshot of the national debt’s growth over the past century:

| Year | U.S. National Debt |

| 1923 | $403 B |

| 1943 | $2.40 T |

| 1963 | $3.07 T |

| 1983 | $4.20 T |

| 2003 | $11.24 T |

| 2013 | $21.93 T |

| 2023 | $33. 17T |

In 1923, almost 100 years ago, the US national debt was just $403 B. Between 1923 and 1943, the growth of the depth was comparatively slower. In 1943, the debt was a little more than $2.40 T. In 1963 and 1983, the values were $3.07 T and $4.20T. Between 1943 and 1983, the depth growth was majorly stagnant. Post 1983, it was a period of sharp rise. In 2003, the debt reached as high as $11.24 T. In 2013, it nearly doubled to $21.93 T. In 2023, it reached a shocking high of $33.17 T. Now, it stands at $35.05 trillion.

What reveals a country’s ability to pay down the country’s debt to its GDP ratio. Shocking is the US’ debt to its GDP ratio. It now stands far above one hundred per cent. In fact, it surpassed the mark of 100% as early as 2013 itself. In 2023, it was 123%.

Here is the US’ debt-to-GDP ratio:

| Year | US Debt to GDP |

| 1948 | 96% |

| 1958 | 58% |

| 1974 | 32% |

| 1996 | 66% |

| 2001 | 55% |

| 2020 | 127% |

| 2023 | 123% |

In 1948, the ratio was around 96%. But it fell to 58% in 1958, and further to 32% in 1974. In 1996, it reached 66%. Later, in 2001, it cooled down to 55%. Later, it saw a sharp rise. In 2020, it touched a peak of 127%. In 2023, it slightly came down to 123%.

The data indicates that the biggest crisis the United States and its people now face is its growing debt and the weakening debt-to-GDP ratio.

Trump’s Bitcoin Debt Solution Plan Explained

Trump’s Bitcoin debt solution revolves around using Bitcoin and cryptos to manage the US debt. In a recent interview, he proposed that Bitcoin could be used strategically to address the growing financial burden. Making Bitcoin a strategic reserve was a major part of his plan.

BTC Holdings Owned by Governments

The United States government at present owns nearly 207,189 bitcoins, which is 0.98% of the total holdings. The current value of its entire holdings is $10,458,345,453.

As per a data set published in bitcointreasuries.com, here are the top governments by BTC Holdings.

| Country | No. of BTC | Value | Percentage |

| USA | 207,189 | $10,458,345,453 | 0.987% |

| China | 194,000 | $9,792,600,080 | 0.924% |

| UK | 61,000 | $3,079,116,520 | 0.29% |

| Ukraine | 46,351 | $2,339,674,259 | 0.221% |

| Germany | 22,846 | $1,153,204,853 | 0.109% |

| El Salvador | 5,748.76 | $290,181,998 | 0.027% |

| Finland | 1,981 | $99,995,571 | 0.009% |

| Georgia | 66 | $3,331,503 | 0.0% |

China is the country that holds the highest number of BTCs after the USA. It owns nearly 194,000 BTC (0.92%), valued at $9,792,600,080. The UK, Ukraine and Germany are also top players with 61,000, 46,351, and 22,846 BTCs respectively.

The Feasibility of Trump’s Plan

The current price of Bitcoin is $55,645.47 and its market cap is $1,095,191,354,069. For Trump’s plan to work, each Bitcoin would need to be worth $180 million. Critics argue that expecting BTC to reach such an astronomical value is unrealistic.

Peter Schiff, a financial expert, opines that Trump’s proposal is unrealistic. He claims that the idea of Bictoin reaching such high values without causing inflation is logically inconsistent.

Bitcoin Annual Price Change Analysis

This analysis shows how Bitcoin’s value fluctuates each year. It is capable of providing insights into growth trends.

In 2023, the annual price change of Bitcoin was +155.4%. In 2013, 2011 and 2017, Bitcoin witnessed massive changes of +4,435%, +1,435% and +1.369%. Since 2011, only three times that Bitcoin witnessed a negative yearly price change. In 2018, 2022 and 2014, it marked negative changes of -73.3%, -64.3% and -57.6%. This year the value stands at around +32.3%.

Potential Impact on the Crypto Industry

If Trump’s plan were to gain traction, it could have significant impacts on the crypto industry. Increased government involvement in Bitcoin could lead to more regulations. But, it could also boost confidence in Bitcoin.

BTC Historical Price Change Analysis

In the last 24 hours, Bitcoin has seen a rise of 5.0% ($2,134 change). Year to Date, the change is +30.3%, which is $12,799. In the last six months, a change of +27.6%, which is around $11,907, has been recorded. In the Q1 of 2024, the BTC provided a return of +68.7%. But, the last quarter, that is the Q2 of 2024, was a period of great volatility. The period ended with an unimpressive return of -12%. In April and June, BTC saw negative returns of -14.7% and -7.02%. In May, it witnessed a positive return of +11.1%. In the second quarter’s closing price was just $62,743, far less than the first quarter’s price of $71,262. In the last three months, a negative return of -11.8% was recorded, and in the last 30 days, a return of -4.27% was reported.

At present, the price of BTC stands at around $55,124. In the beginning of the month, the price was around $65,246. On 2nd, 4th and 5th August, the Bitcoin market witnessed long red candlesticks. Between 1st and 6th August 2024, a steep drop in price occurred in the market. The trend we are witnessing now in the market is in stark contrast to the one we saw last month, when the price experienced an upward momentum between 8th July and 28th July. Actually, it was in late July, especially on 29th July, that this new selling pressure stepped in. Between 29 July and 5th Aug, we see only one green candle.

Endnote

Trump’s proposal to use Bitcoin to tackle the $35 trillion US debt is undeniably bold. While it highlights the increasing interest in cryptocurrencies as potential strategic assets, it also raises questions about feasibility and market impact.

By examining inflation data, government Bitcoin holdings, historical price trends, and recent changes, we gain a clearer understanding of the potential and challenges of this idea. Whether Trump’s plan benefits the crypto industry remains uncertain, but it undoubtedly fuels crucial discussions about the future of cryptocurrency and its role in the global economy.

Also Check Out: Bitcoin and Ethereum Q2 Price Movement Analysis Report

As the debate heats up, one thing is clear: Trump’s Bitcoin proposal could either revolutionize how we think about national debt or simply add more fuel to the crypto fire. Stay tuned to see where this bold idea will lead!

Number of crypto ATMs installed nears its all-time record

The number of cryptocurrency ATMs installed worldwide has spiked 17.8% to 38,279 over the last 12 months — inching closer to its record of 39,541 set in December 2022. As of 2024, there have been 2,564 new cryptocurrency ATMs installed, indicating a positive trend compared […]

Litecoin

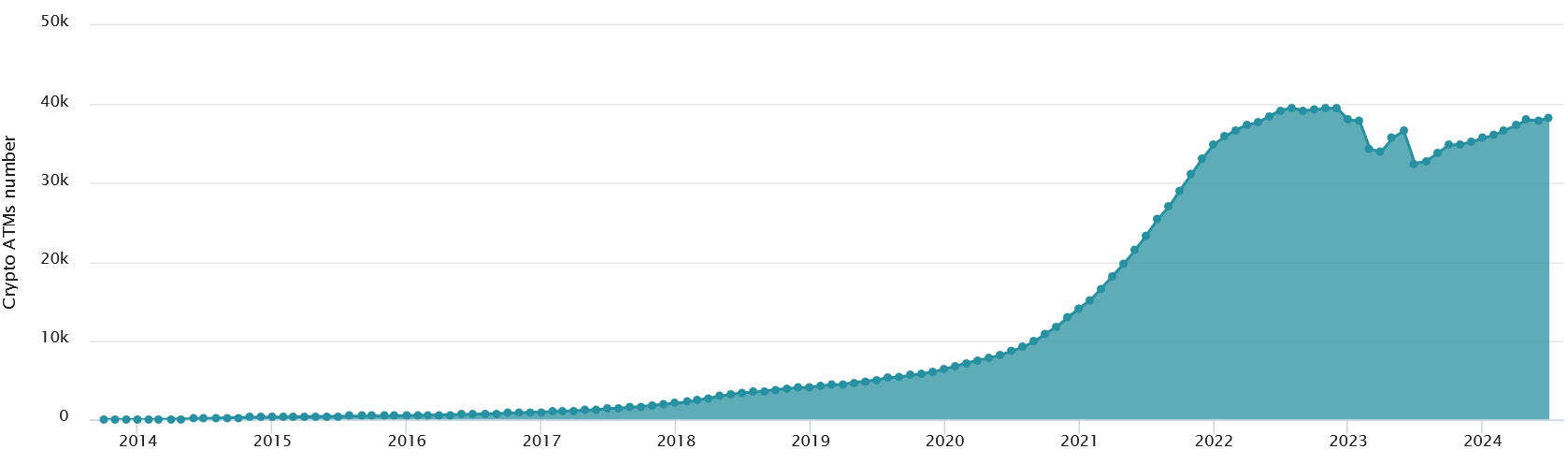

The number of cryptocurrency ATMs installed worldwide has spiked 17.8% to 38,279 over the last 12 months — inching closer to its record of 39,541 set in December 2022.

As of 2024, there have been 2,564 new cryptocurrency ATMs installed, indicating a positive trend compared to the net loss of 2,861 machines in 2023, according to Coin ATM Radar.

The tally increased every month between July 2023 and May 2024.

Installations from May to June fell by 115, but June rebounded strongly with a net increase of 377.

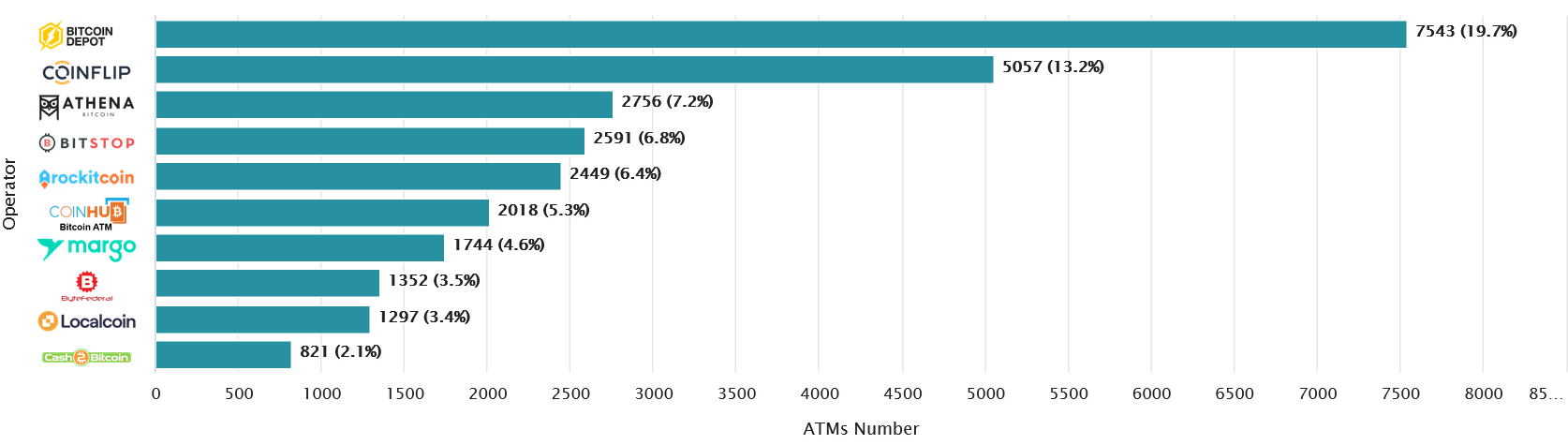

Bitcoin Depot, Coinflip and Athena Bitcoin are the leading cryptocurrency ATM operators, with 7,543, 5,057 and 2,756 machines, respectively.

Bitcoin (BTC) is by far the most popular cryptocurrency transacted with, while Bitcoin Cash (BCH), Ether (ETH) and Litecoin (LTC) also feature prominently

More than 82% of the world’s cryptocurrency ATMs are in the United States, while Canada comes in second at 7.7%.

Australia has seen a surge in installations, increasing nearly 17-fold to 1,107 machines over the last two years.

At the current installation rate, Australia is well-positioned to surpass Europe’s 1,584 ATMs.

Other countries with significant cryptocurrency ATM installations include Spain (313), Poland (279), El Salvador (215), Poland (211), Germany (177) and Hong Kong (169).

Romania, Georgia, Switzerland, Austria and New Zealand are the other countries with more than 100 ATMs.

Among the 193 United Nations-recognized countries worldwide, 72 host a cryptocurrency ATM.

Related: Corporate adoption is in ‘amateur league’ despite Bitcoin ETFs

Between December 2022 and July 2023, installations experienced a significant net decline, reaching an 18-month low of 32,764.

Coin ATM Radar’s data suggests cryptocurrency ATM manufacturer BitAccess contributed to that fall, with its net installations falling 26% from 9,160 in August 2022 to 6,774 in January 2024.

However, it has managed to increase its net installations by 1,208 since then.

Magazine: El Salvador’s national Bitcoin chief has been orange-pilling Argentina

Cboe reorganization will merge or eliminate digital arm’s activities

Equity exchange network Cboe Global Markets has announced plans to reorganize its digital assets trading operations, including eliminating its digital spot market. Cboe said it will remove digital asset derivative trading from Cboe Digital and integrate it into its Global Derivatives and Clearing businesses. The […]

Litecoin

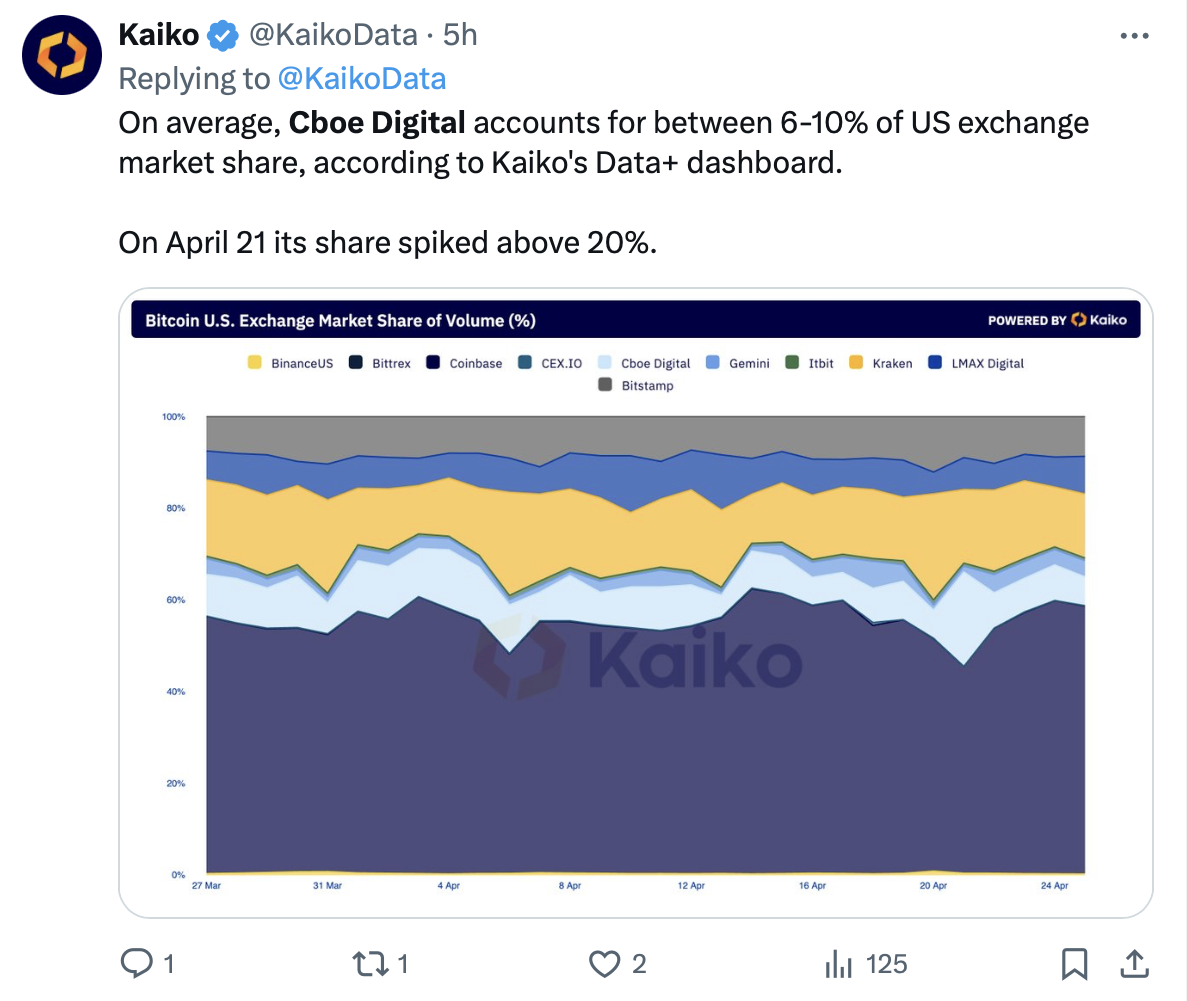

Equity exchange network Cboe Global Markets has announced plans to reorganize its digital assets trading operations, including eliminating its digital spot market.

Cboe said it will remove digital asset derivative trading from Cboe Digital and integrate it into its Global Derivatives and Clearing businesses. The Cboe Digital Spot Market will close in the third quarter of 2024. The exchange will move cash-settled Bitcoin (BTC) and Ether (ETH) futures contracts from the Cboe Digital Exchange to the Cboe Futures Exchange in the first half of 2025, subject to regulatory review and “certain corporate approvals.”

The Cboe Digital clearing arm, Cboe Clear Digital, will be “aligned” with Cboe Clear Europe under the unified leadership of Cboe Clear Europe president Vikesh Patel. The exchange said in a statement that:

“These changes are being made as part of Cboe’s strategic review, taking into consideration the lack of regulatory clarity in the digital space, and are aligned with Cboe’s longer term strategy.”

Cboe Digital offers Bitcoin, Bitcoin Cash (BCH), Ether, USD Coin (USDC) and Litecoin (LTC) products. The potential status of ETH as a security may be a factor in the current reorganization.

The exchange went on to note that it would enjoy significant savings from closing its digital spot trading arm. It called the $2 million to $4 million savings it would experience in 2024 an “immaterial impact” on its 2024 net revenue, but added that savings would reach $11 million to $15 million annually.

Related: Decentralized dilemma: Could Ethereum survive if SEC ruled ETH a security?

“We expect to continue to see greater demand for exchange-traded [digital asset] derivatives to help manage crypto exposures, hedge risk and enhance capital and operational efficiencies,” Cboe Global Markets global president David Howson said.

Cboe greatly expanded its presence in the digital asset space through the May 2022 acquisition of ErisX, which operated a spot market, derivatives market and clearing platform and was transformed into Cboe Digital. The timing of that deal was unfortunate, as the crypto winter was just around the corner.

In August 2022, Cboe declared a $460 million goodwill impairment in its second-quarter earnings results due to its acquisition of ErisX. A goodwill impairment is the amount a company loses from buying an asset for a sum greater than the asset’s book value when the value of that asset later declines. In November 2022, Cboe Digital brought 13 investor partners into the business.

Magazine: DeFi, derivatives and fixing an antiquated financial system: Kristin Boggiano

Coinbase to launch DOGE futures, says it ‘transcended’ meme origins

Crypto exchange Coinbase believes Dogecoin’s (DOGE) “enduring popularity” suggests it has transcended its meme origins to become a staple in the cryptocurrency industry, with the exchange now planning to launch futures trading products for the cryptocurrency. In three separate letters to the United States Commodity Futures […]

Litecoin

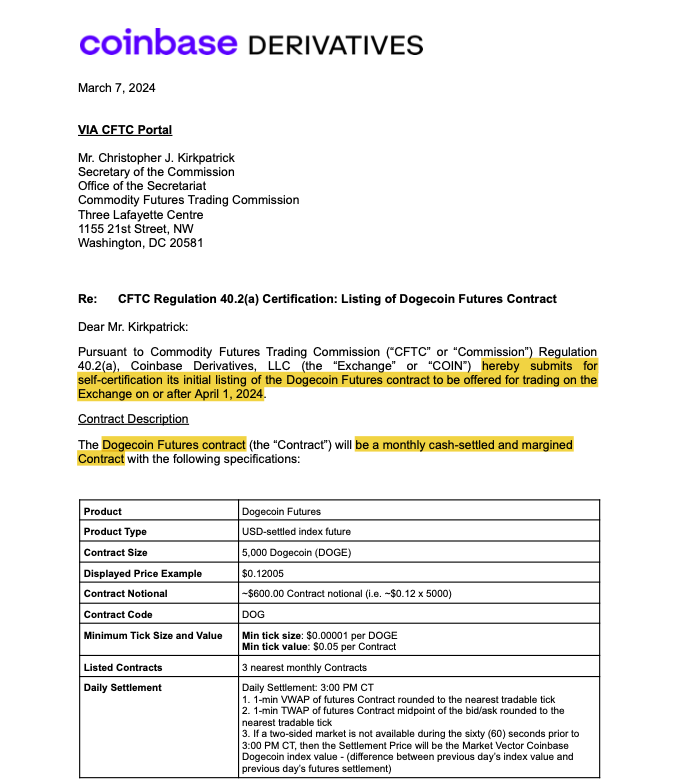

Crypto exchange Coinbase believes Dogecoin’s (DOGE) “enduring popularity” suggests it has transcended its meme origins to become a staple in the cryptocurrency industry, with the exchange now planning to launch futures trading products for the cryptocurrency.

In three separate letters to the United States Commodity Futures Trading Commission (CFTC) on March 7, Coinbase Derivatives announced its plans to launch cash-settled futures contract products for Dogecoin, Litecoin (LTC) and Bitcoin Cash (BCH) as soon as April 1.

Notably, the letters said that Coinbase Dervitiatives could list the futures contracts on its platform before receiving any official approval from the CFTC.

Coinbase explained that it would invoke the “self-certification” method to launch the futures contracts so long as they followed the regulatory guidelines laid out by the agency.

“Coinbase Derivatives […] hereby submits for self-certification its initial listing of the Dogecoin Futures contract to be offered for trading on the Exchange on or after April 1, 2024,” read the letter concerning the Dogecoin futures product.

Coinbase justified its announcement of listing Dogecoin by claiming that the memecoin had transcended its origin as merely a joke and had risen to become a foundational element of the crypto industry.

“Dogecoin’s enduring popularity and the active community support suggest that it has transcended its origins as a meme to become a staple of the cryptocurrency world.”

The price of DOGE is currently up 17% on the day and is trading for $0.15 at the time of publication, according to data from CoinMarketCap.

While several market commentators across social media seemed puzzled by the move, analysts hinted that listing futures contracts could have been a calculated move by Coinbase to force the hand of the Securities and Exchange Commission.

Related: Franklin Templeton goes ‘full degen’ with investor note on memecoins

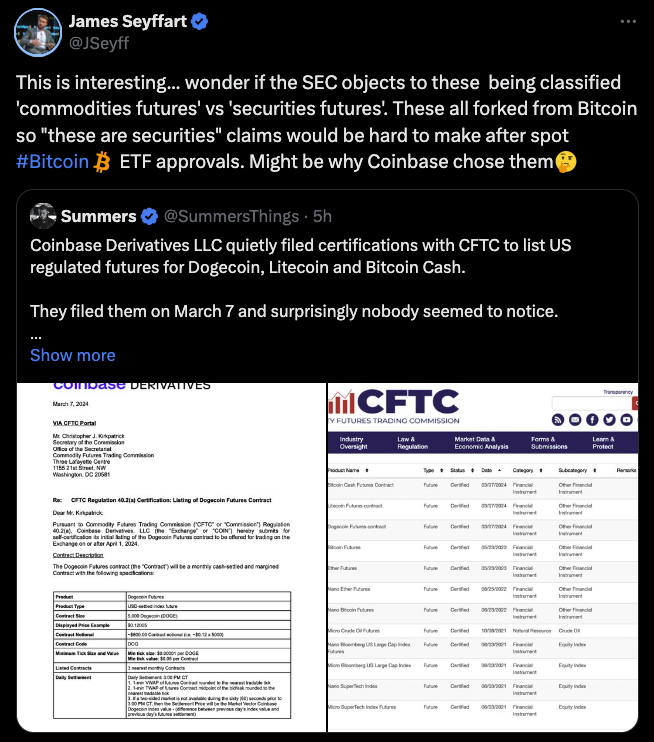

In a March 20 post to X, Bloomberg exchange-traded fund analyst James Seyffart noted that the filings may have been a strategic play to force the SEC from classifying any crypto assets that were based on the same proof-of-work consensus mechanism as Bitcoin from being declared a “security.”

“Wonder if the SEC objects to these being classified ‘commodities futures’ vs ‘securities futures,’” wrote Seyffart. “These [are all based on] Bitcoin so ‘these are securities’ claims would be hard to make after spot Bitcoin ETF approvals.”

In 2022, Coinbase acquired the CFTC-regulated FairX derivatives exchange to roll out crypto derivatives trading for its customers in the United States.

Coinbase stated at the time: “We want to make the derivatives market more approachable for our millions of retail customers.”

Magazine: Inside Pink Drainer — Security analyst defends his crypto scam franchise

Crypto landscape: ten years of growth, change, advances and retreats

While some digital assets have stood the test of time, others have tumbled below the thousands of new digital currencies that exist today. Price of Bitcoin on Christmas Day 2023: $43,2542022: $16,8492021: $50,8882020: $23,7602019: $7,2662018: $4,0212017: $14,3022016: $8942015: $4562014: $3182013: $669 — CoinGecko (@coingecko) December […]

Litecoin

While some digital assets have stood the test of time, others have tumbled below the thousands of new digital currencies that exist today.

Price of Bitcoin on Christmas Day

2023: $43,254

2022: $16,849

2021: $50,888

2020: $23,760

2019: $7,266

2018: $4,021

2017: $14,302

2016: $894

2015: $456

2014: $318

2013: $669— CoinGecko (@coingecko) December 25, 2023

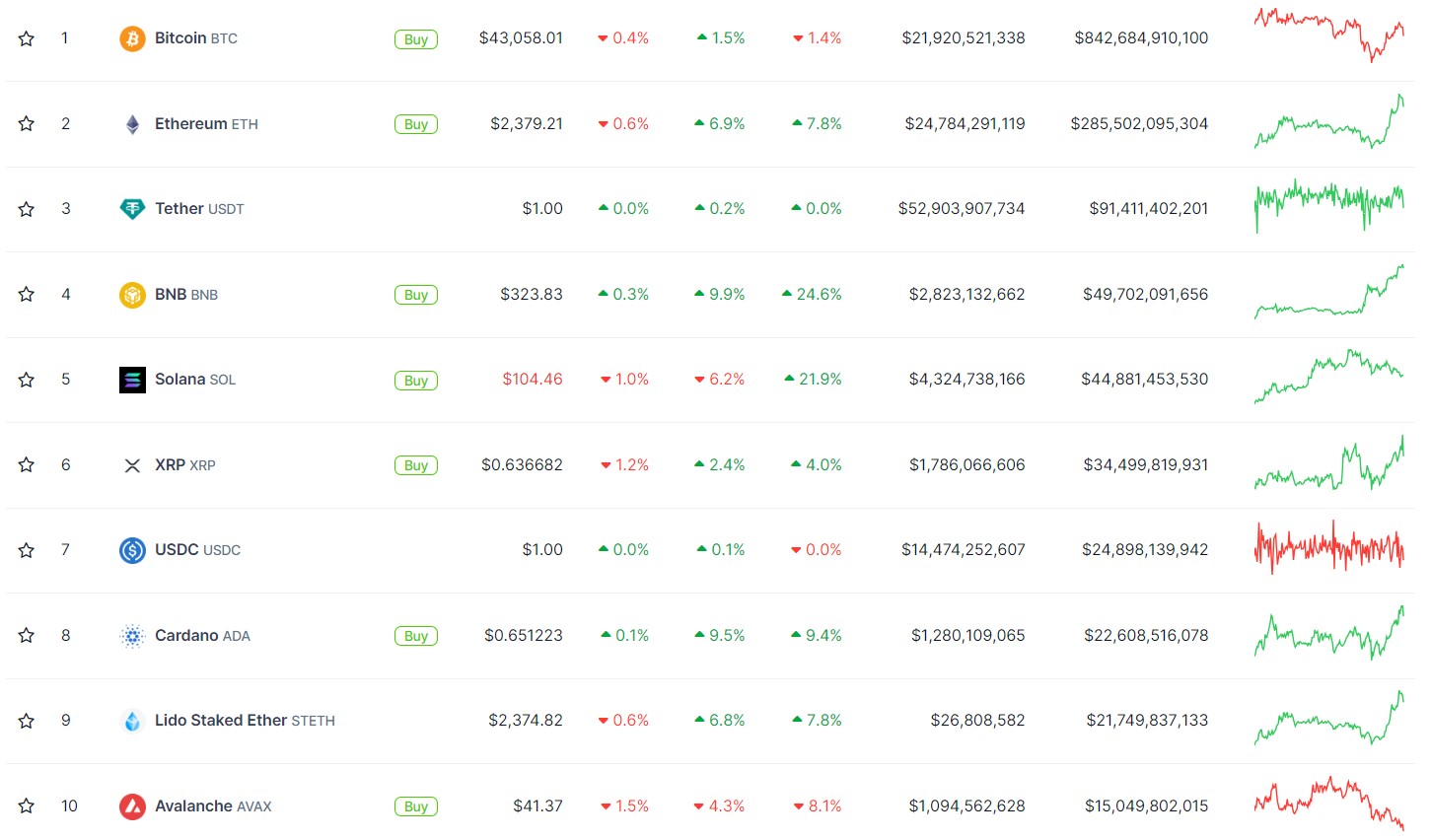

On Dec. 28, the total market capitalization for the crypto space stood at around $1.77 trillion, with Bitcoin (BTC) still leading the charge at $842 million. It’s followed by market leaders like Ether (ETH), BNB (BNB), and Solana (SOL), as well as stablecoins like Tether (USDT) and USD Coin (USDC).

Projects like XRP (XRP), Cardano (ADA) and Avalanche (AVAX) are also in the top ten digital assets by market cap and have proved their resilience over the years. In addition, Lido Staked Ether (stETH), which represents staked ETH in the liquid staking protocol Lido and combines the value of the initial deposit and staking rewards, is also in the top ten.

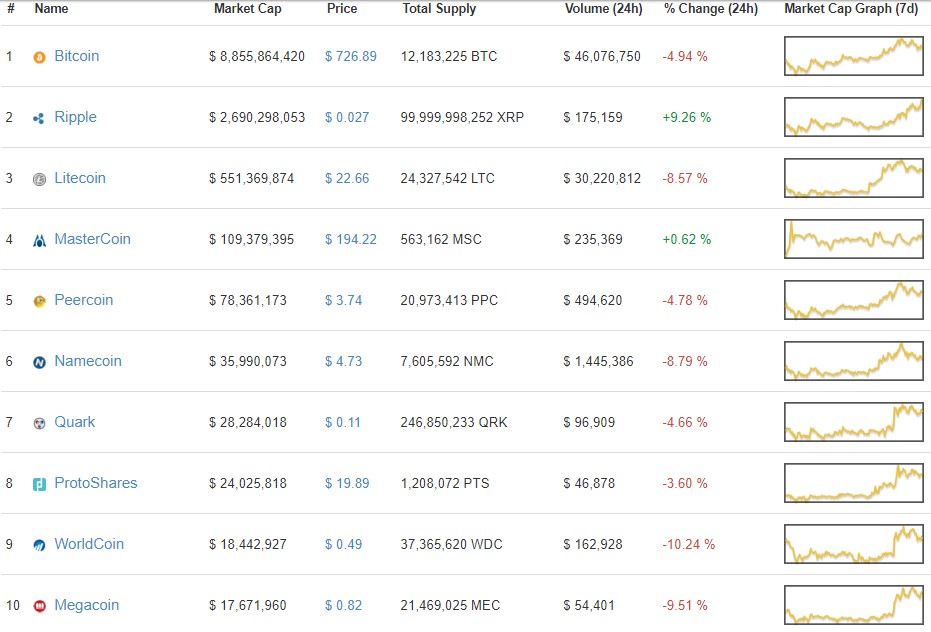

On Dec. 28, 2013, the top ten tokens by market cap looked very different compared to today. A snapshot from coin data tracker CoinMarketCap shows that the total market cap for crypto was around $12 billion. BTC traded at $726.89, with a total market cap of $8.8 billion. This means that the digital asset has grown by almost 100 times since then.

Related: ‘Revenge of the ETH’ — Is Ethereum’s 9% jump the start of something big?

Another token leading the charts ten years ago was Ripple, now known as XRP. A decade ago, the token followed BTC, taking the number two spot in market capitalization. The token traded at $0.027 with a market cap of $2.6 billion. The next token was Litecoin (LTC), which cost $22.66 at the time and had a $550 million market cap. Both coins had price appreciations and are still some of the most traded tokens today.

While the top three tokens have grown in price and total valuation, the same can’t be said for the rest of the list. MasterCoin, now known as Omni, used to be in the top four, with a market cap of around $100 million. Today, the token is ranked 2337 at CoinGecko, with a total valuation of $1 million.

From the top five up to the top ten tokens a decade ago, the crypto assets have either fallen off into the ranks of thousands or have been delisted from coin-tracking websites altogether. Within the ranks, a token with the same name as Sam Altman’s Worldcoin (WLD) can be seen, but it had a different ticker, WDC. The token has no relation to today’s popular eye-scanning crypto project.

Magazine: Lushsux: A decade of ass-whoopin’ and skullduggery in a single NFT