5 Best Altcoins to Buy Now: Top Cryptos to Invest in as They Gain Serious Traction in 2025

The post 5 Best Altcoins to Buy Now: Top Cryptos to Invest in as They Gain Serious Traction in 2025 appeared first on Coinpedia Fintech News Investors increasingly turn from speculative excitement to utility-driven initiatives as the crypto market develops and obtains mainstream acceptance. Strong […]

Sponsored

Memecoins Are Heating Up—Why Codename:Pepe and PEPE Might Outpace DOGE and SHIB This Cycle

The post Memecoins Are Heating Up—Why Codename:Pepe and PEPE Might Outpace DOGE and SHIB This Cycle appeared first on Coinpedia Fintech News Memecoins are capturing attention again, with fresh contenders emerging in the digital currency space. PEPE and a project called Codename:Pepe are rising as […]

Sponsored

How to use a crypto hardware wallet: A step-by-step guide

TL;DR This guide shows you how to set up and use a crypto hardware wallet, using the Trezor Safe 3 as an example. You’ll learn to safely store Bitcoin, Ethereum and other assets offline, with clear steps for wallet setup, seed phrase backup, PIN protection […]

Analysis

From ICO hype to AI utility: The evolution of crypto agents in Web3

The rise of AI-driven crypto agents is following a familiar trajectory that mirrors the initial boom, bust and resurgence of ICO-era projects. Just as early blockchain ventures thrived on hype before maturing into sustainable ecosystems, the current wave of AI agent projects is undergoing rapid […]

Analysis

The rise of AI-driven crypto agents is following a familiar trajectory that mirrors the initial boom, bust and resurgence of ICO-era projects. Just as early blockchain ventures thrived on hype before maturing into sustainable ecosystems, the current wave of AI agent projects is undergoing rapid market shifts.

A new report by HTX Ventures and HTX Research says that investors are growing cautious as competition in the sector intensifies, liquidity disperses and many projects struggle to define clear use cases. Still, as the sector moves beyond its speculative phase, AI-driven crypto agents are expected to evolve sustainable business models underpinned by genuine utility.

From meme hype to reality: The evolution of crypto agents

The initial wave of crypto agent projects in 2024 was driven by indiscriminate enthusiasm for AI projects. Following the impact of a $50,000 Bitcoin donation from Marc Andreessen in October 2024 and the success of token launchpads earlier in the year, many AI agent projects entered the space in Q1 of 2024 and rapidly diluted liquidity by Q1 of 2025. As with any emerging sector, early-stage hype did not always translate into long-term viability, and a cooling-off period in the crypto AI agent sector followed.

The market segment is now entering a more mature phase, and the focus is shifting from speculative excitement to revenue generation and product performance. The winners in this evolving landscape will be those that can generate stable revenue, cover the costs of running AI models and provide tangible value to users and investors alike.

AI agent applications emphasize real-world implementation and commercialization of this technology, particularly in areas like automated trading, asset management, market analysis and crosschain interaction. This approach aligns with multi-agent systems and DeFAI (decentralized finance + AI) initiatives like Hey Anon, GRIFFAIN and ChainGPT.

Recent research highlights the advantages of multi-agent systems (MAS) in portfolio management, particularly in cryptocurrency investments. Projects such as Griffain, NEUR, and BUZZ have already demonstrated how AI can help users interact with DeFi protocols and make informed decisions. Unlike single-agent AI models, multi-agent systems leverage collaboration among specialized agents to enhance market analysis and execution. These agents function in teams, such as data analysts, risk evaluators and trading execution units, each trained to handle specific tasks.

MAS frameworks also introduce inter-agent communication mechanisms, where agents within the same team refine predictions through collective learning, reducing errors in market trend analysis. The next phase of DeFAI will likely involve deeper integration of decentralized governance models, where multi-agent systems participate in protocol management, treasury optimization and onchain compliance enforcement.

DeepSeek-R1: A breakthrough in AI agent training

A breakthrough in AI agent technology arrived with DeepSeek-R1, an innovation that challenges traditional AI training methods. Unlike previous models, which relied on supervised fine-tuning (SFT) followed by reinforcement learning (RL), DeepSeek-R1 takes a different approach, optimizing entirely through reinforcement learning without an initial supervised phase. This shift has led to remarkable improvements in reasoning capabilities and adaptability, paving the way for more sophisticated AI-driven crypto agents.

To understand this paradigm shift, consider two different approaches to learning. In the Traditional SFT and RL model, a student first studies from a workbook, practicing problems with set answers (SFT), and then receives tutoring to refine their understanding (RL). In contrast, with the DeepSeek-R1 Model (Pure Reinforcement Learning), the student is thrown directly into an exam and learns through trial and error. This approach allows the student to improve dynamically based on feedback rather than relying on pre-defined answers.

Leveraging DeepSeek-R1’s pure RL model, AI agents learn through trial and error in real-world conditions, dynamically adjusting their strategies based on immediate feedback.

This method allows for greater adaptability, making it particularly useful for multi-agent AI systems in DeFi, where real-time market fluctuations require agents to make autonomous, data-driven decisions. For example, AI-powered agents can monitor liquidity pools, detect arbitrage opportunities and optimize asset allocations based on real-time market conditions. These agents adapt quickly to market fluctuations, ensuring more efficient capital deployment.

Launched in late November 2024, iDEGEN is the first crypto AI agent built on DeepSeek R1. This integration of DeepSeek’s R1 model emphasizes how crypto AI agents can inherit such enhanced reasoning capabilities, competing with other established AI models at a fraction of the cost.

This shift toward RL-powered, multi-agent AI in DeFi automation underscores why closed-source AI models (such as OpenAI’s GPT-based systems) are becoming an unsustainable expense. With workflows often requiring the processing of 10,000+ tokens per transaction, closed AI models impose significant computational costs, limiting scalability. In contrast, open-source RL models like DeepSeek-R1 allow for decentralized, cost-efficient AI development tailored for DeFi applications.

The future of AI agents in Web3

The key to longevity in this sector lies in continuous innovation, adaptability and cost efficiency. Open-source AI models like DeepSeek-R1 are lowering the barriers to entry, allowing blockchain-native startups to develop specialized AI solutions. Meanwhile, advancements in DeFAI and multi-agent systems will drive long-term integration between AI and decentralized finance.

The takeaway is clear: Projects must prove their value beyond hype. Those who develop sustainable economic models and leverage cutting-edge AI advancements will define the future of intelligent blockchain ecosystems. The ICO era of crypto agents is evolving, and the next wave of winners will be the ones that can turn innovation into long-term viability.

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Cointelegraph does not endorse the content of this article nor any product mentioned herein. Readers should do their own research before taking any action related to any product or company mentioned and carry full responsibility for their decisions.

How to use ChatGPT to predict crypto market trends

Key takeaways To generate crypto market insights via ChatGPT, collect accurate historical and real-time data on prices, trading volumes and market capitalization. Organize data into clear formats, such as tables with consistent date formats and labeled columns, to help ChatGPT identify patterns and trends. Use […]

Analysis

Key takeaways

- To generate crypto market insights via ChatGPT, collect accurate historical and real-time data on prices, trading volumes and market capitalization.

- Organize data into clear formats, such as tables with consistent date formats and labeled columns, to help ChatGPT identify patterns and trends.

- Use precise and focused prompts to guide ChatGPT in generating actionable insights, enhancing the relevance and clarity of its responses.

- Cross-check ChatGPT’s outputs with up-to-date information from reputable sources before making trading decisions to account for potential inaccuracies.

Predicting crypto market trends can feel like navigating a storm — unpredictable and fast-changing. Prices can spike or crash unexpectedly due to investor sentiment, regulatory changes or sudden events such as exchange hacks. For traders, staying ahead means finding reliable ways to analyze these movements and make informed decisions.

This is where ChatGPT can help.

By analyzing historical data and recognizing patterns, ChatGPT offers insights that can support better decision-making. But for AI tools to deliver meaningful results, especially when using ChatGPT for crypto investments, it’s essential to follow the right process. Combining well-structured data, clear prompts and effective risk management can improve the accuracy and usefulness of its insights.

This article explores practical ways of how to use ChatGPT for crypto market analysis — from collecting and organizing data to crafting effective prompts that help the model generate actionable insights.

How to harness ChatGPT for crypto market analysis

While predicting crypto trends will always have its challenges, using data-driven insights with ChatGPT can make market behavior easier to understand. With the right strategy, ChatGPT becomes a powerful tool to identify patterns, highlight emerging trends, and support smarter trading decisions.

Using ChatGPT effectively for crypto analysis involves four key steps:

- Step 1: Gathering data for analysis

- Step 2: Formatting data for analysis via ChatGPT

- Step 3: Writing clear and effective prompts

- Step 4: Caution! Verify ChatGPT insights before drawing conclusions

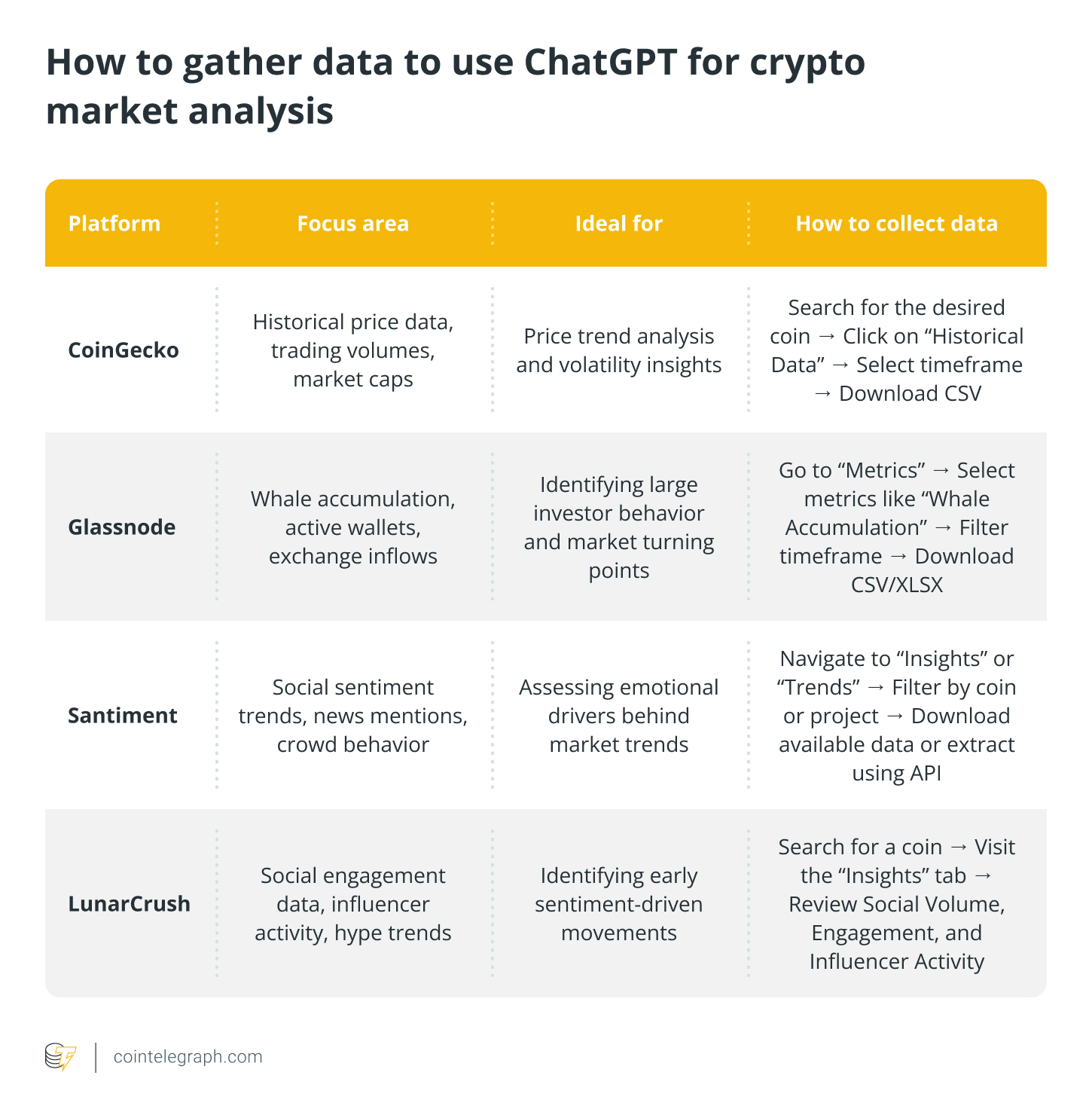

Step 1: Gathering data for analysis

When it comes to predicting crypto trends, data is everything. Without reliable data, even the most advanced tools like ChatGPT can deliver unreliable insights. Crypto markets are notoriously volatile, and understanding the patterns behind price movements, whale activity and investor sentiment requires trustworthy information from the right sources.

The type of data required depends on the kind of analysis being performed. For example:

- Price analysis requires accurate records of past prices, volume and market cap trends.

- Whale activity analysis focuses on large investor movements and wallet behavior.

- Sentiment analysis relies on tracking social media discussions, influencer mentions and crowd sentiment shifts.

Did you know? A study found that higher X post engagement generally correlates negatively with cryptocurrency prices, indicating that increased social media activity may precede price declines.

Step 2: Formatting data for analysis via ChatGPT

To predict crypto trends with ChatGPT, data must be structured in a way that highlights patterns, trends and key events. Poorly formatted data can lead to incomplete or incorrect outputs, so investing time in proper organization is crucial.

Structuring data for analysis

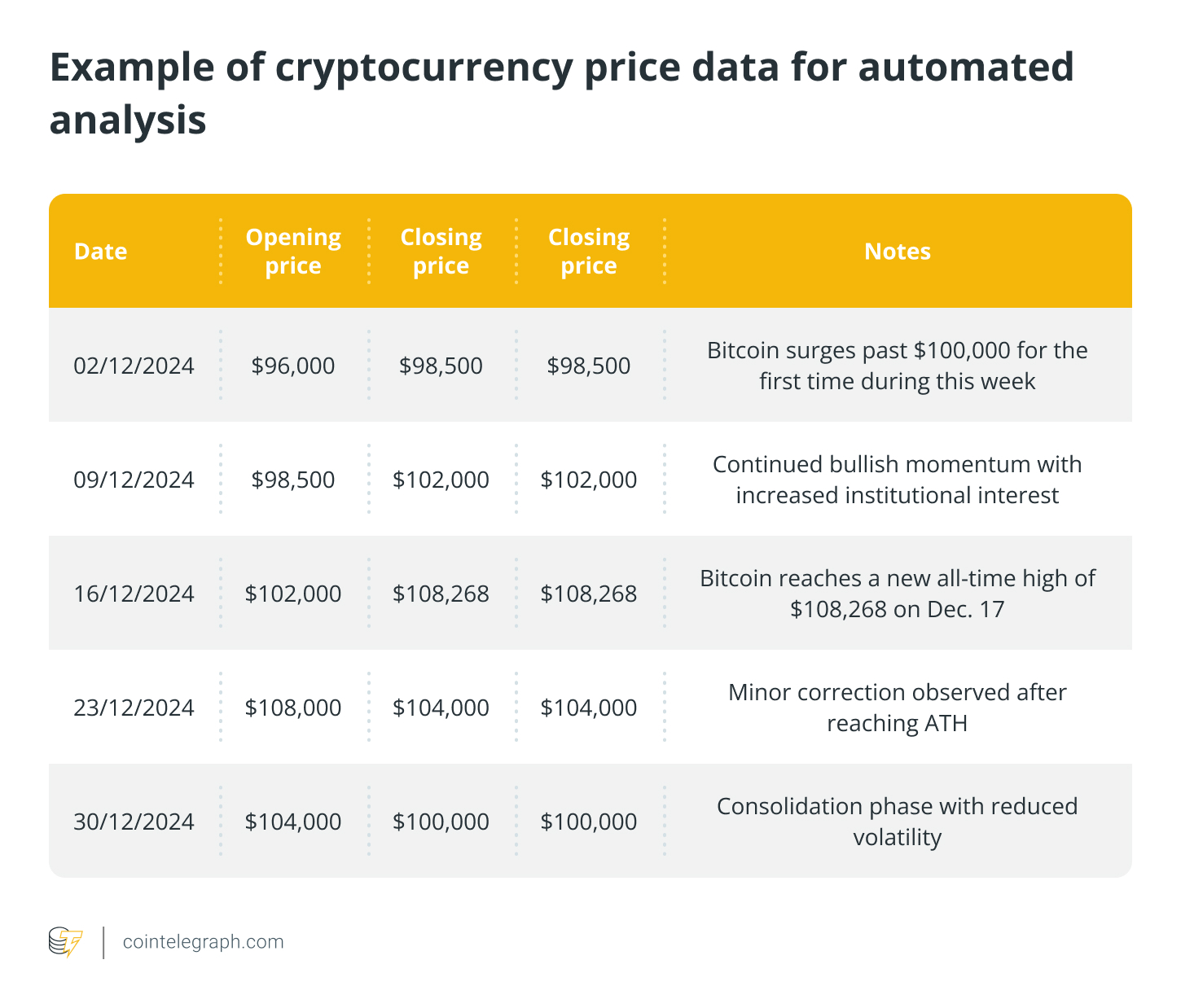

When formatting price data, focus on key points that reflect market trends. Include the date open price, close price and volume in chronological order to capture market movement. This article uses the Bitcoin (BTC) price data below to illustrate the process.

Gaps in data are common, especially in volatile markets. Filling missing entries with estimated values, such as moving averages, can improve continuity and make analysis more accurate.

For technical indicators, like the relative strength index (RSI) or the moving average convergence divergence (MACD), aligning the data with consistent timestamps is key.

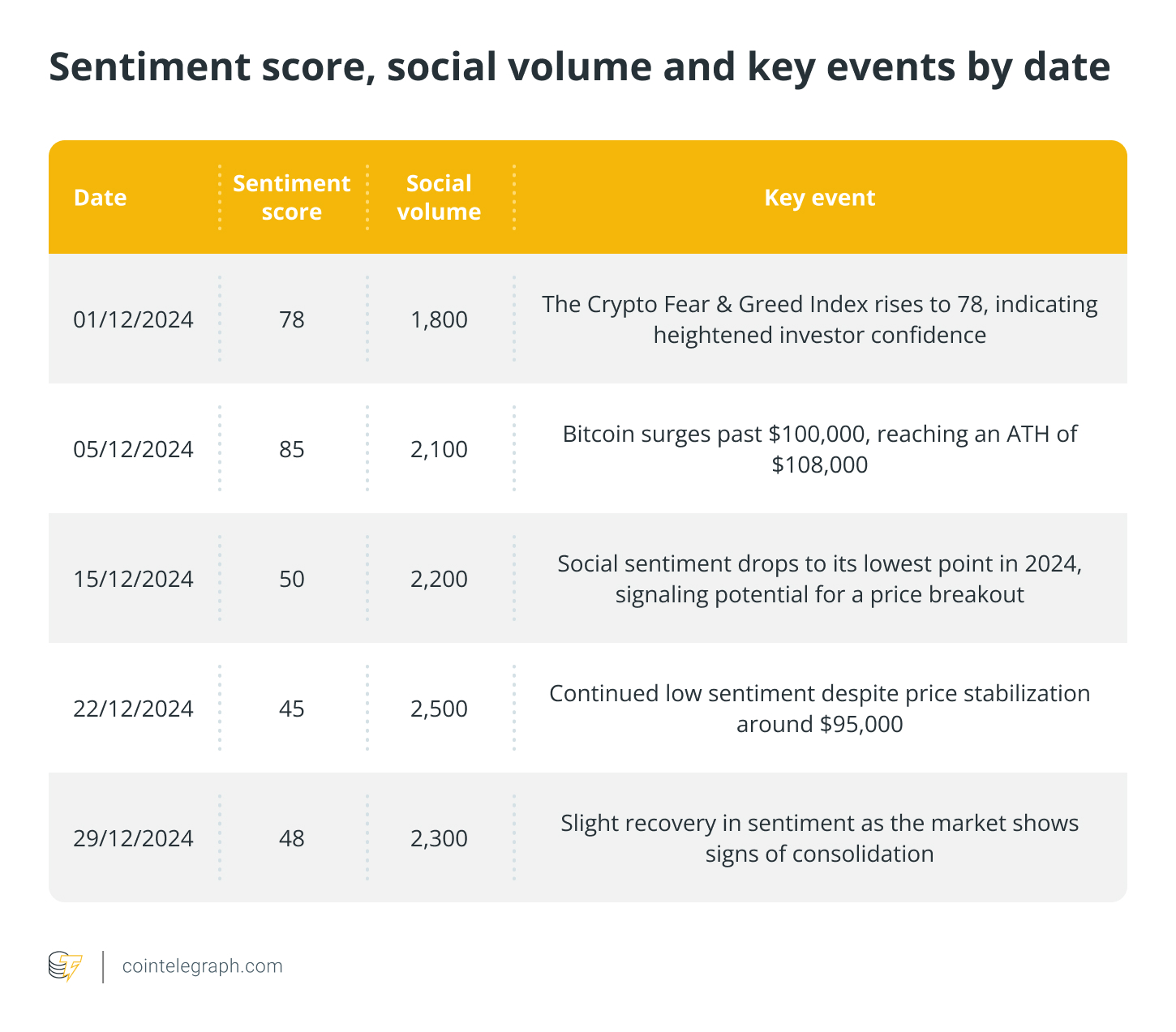

Sentiment data tends to be unstructured, which can make it challenging to analyze. To improve its clarity, combine sentiment scores with key dates and relevant events. For example:

Data cleaning and preparation

To maximize the accuracy of ChatGPT insights, take these steps:

- Ensure date formats are consistent (e.g., YYYY-MM-DD) to prevent misalignment.

- Remove duplicates to avoid skewed data patterns.

- Fill missing values by interpolating trends or forward-filling where necessary.

- Label data clearly to provide the necessary context for ChatGPT’s interpretation.

Did you know? A study found that ChatGPT’s sentiment analysis of news headlines can effectively predict daily stock returns, outperforming traditional methods.

Creating well-structured prompts is key to unlocking meaningful insights from ChatGPT, especially for ChatGPT crypto analysis. Poorly written prompts can confuse the model, resulting in incomplete or irrelevant responses. Clear prompts guide ChatGPT in focusing on the right data points and generating actionable insights.

Step 3: Writing clear and effective prompts

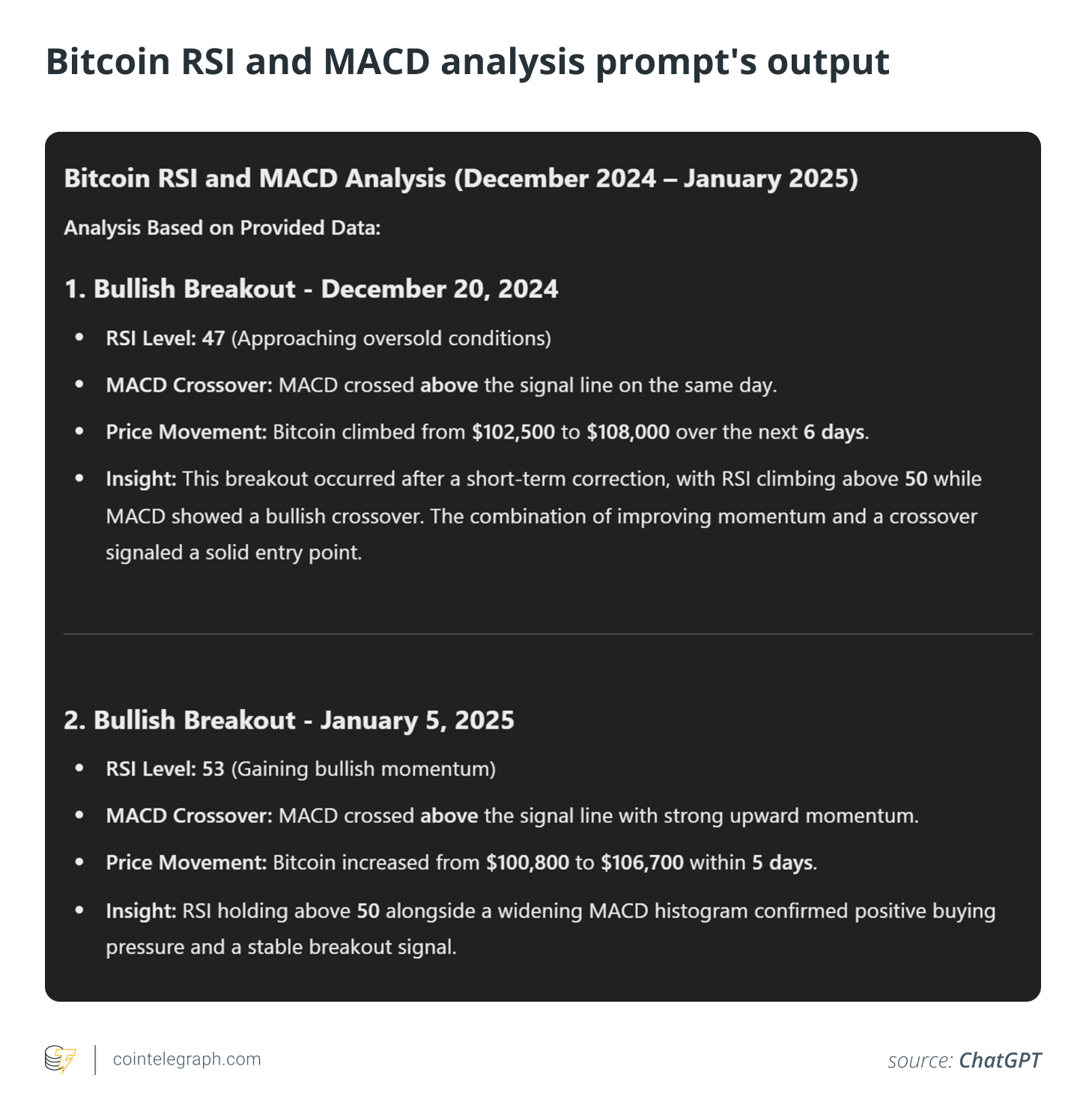

Effective prompts are built around three core principles: clarity, purpose and focus. The illustrations and prompts used in this article were experimented with using ChatGPT-4o.

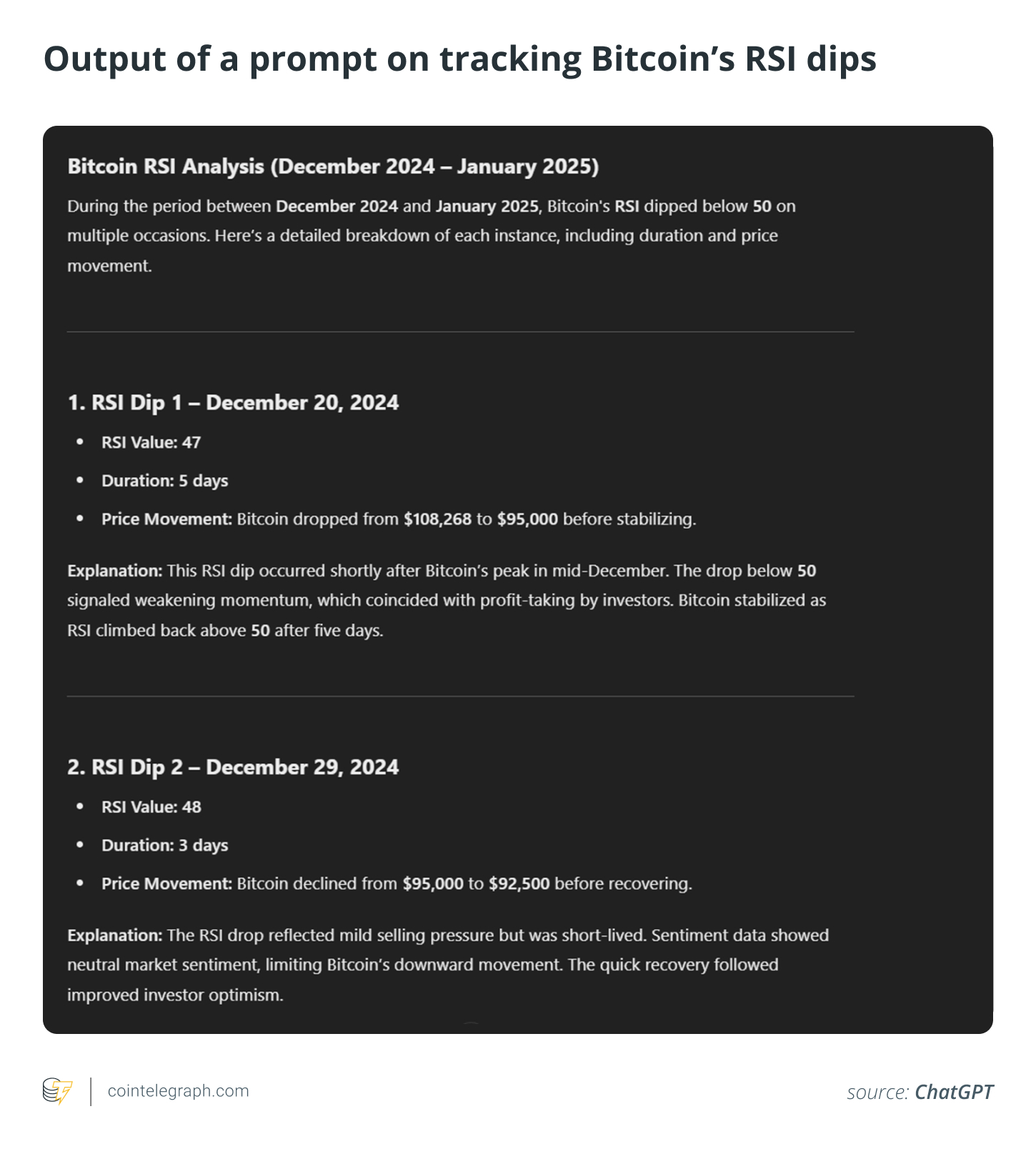

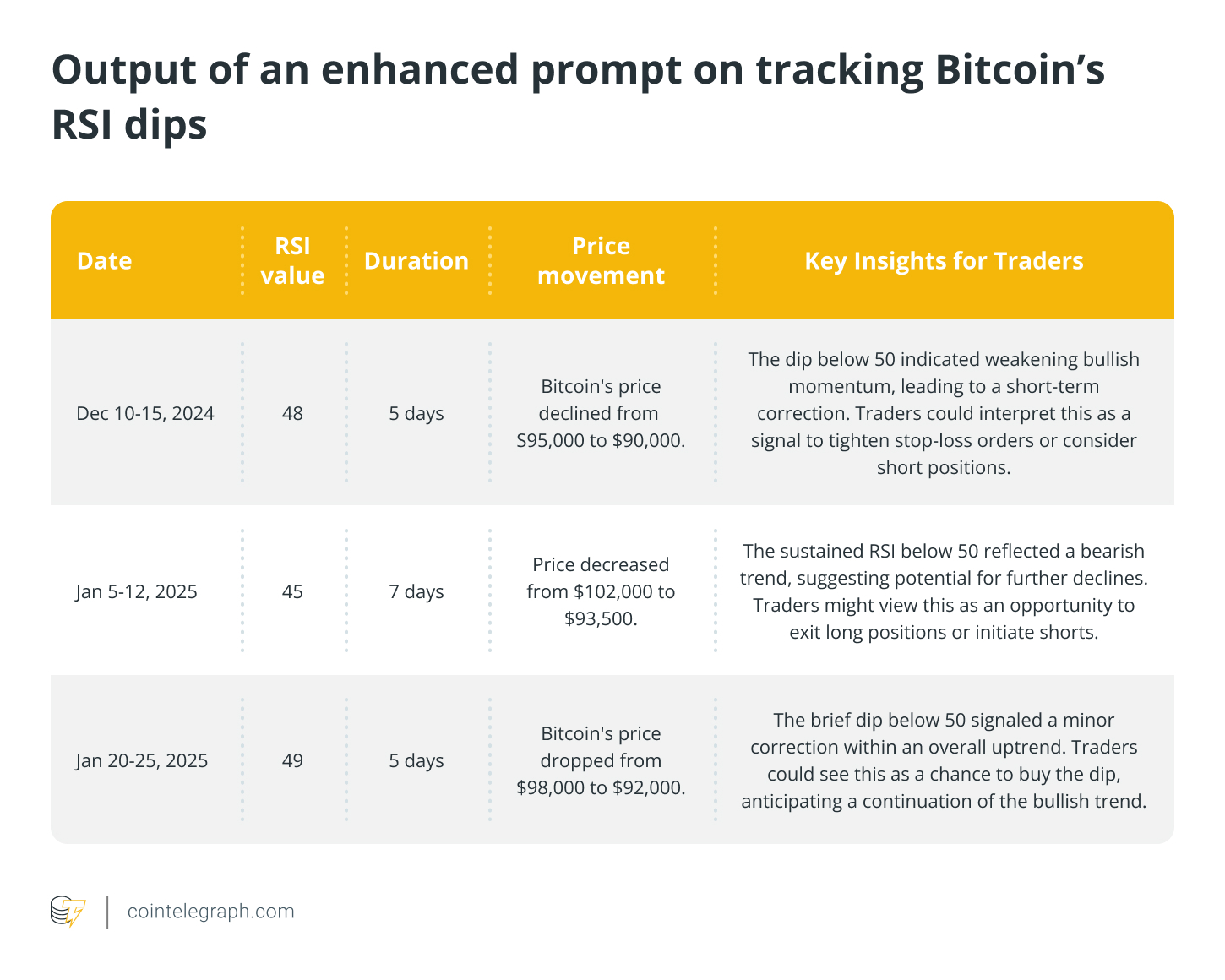

Also, please note that ChatGPT outputs only show trimmed versions for illustration purposes. The original outputs are too long to display in full, but they provide detailed insights into each RSI dip, including exact price movements, duration and trader takeaways.

- Clarity: Use precise language that defines exactly what is needed. Avoid vague requests like:

“Is Bitcoin bullish?”

Instead, provide clear instructions with relevant details: “Analyze Bitcoin’s RSI and MACD data between December 2024 and January 2025. Identify points where both indicators aligned with bullish breakouts.”

- Purpose: Be specific about the outcome you expect. For example:

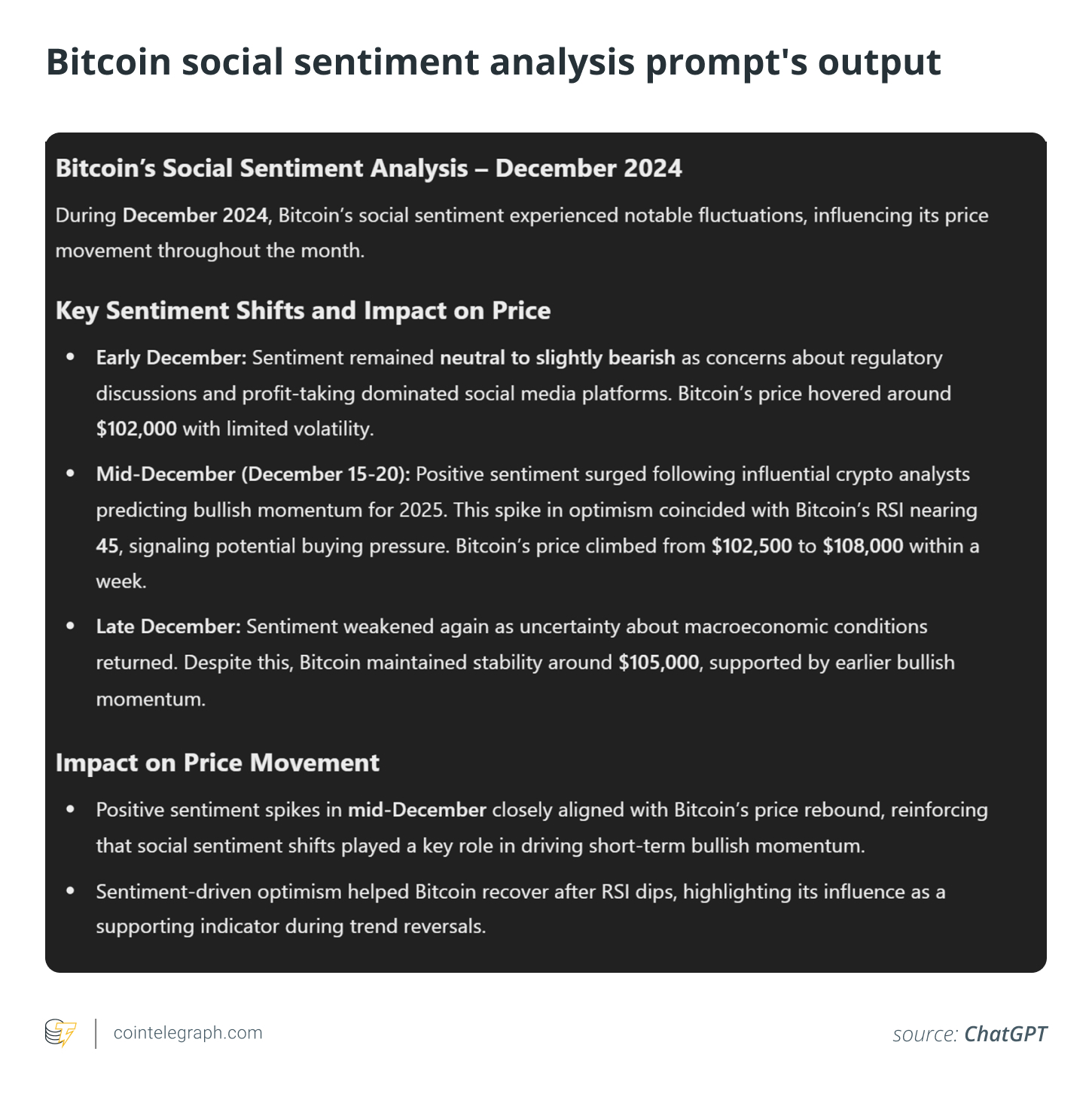

“Summarize how Bitcoin’s social sentiment changed in December 2024 and highlight its impact on price movement.”

- Focus: Include relevant conditions, such as timeframes, data sources or key indicators, to ensure the analysis is targeted and relevant. For instance:

“Identify instances where Bitcoin’s RSI dipped below 50 between December 2024 and January 2025. Describe how long each dip lasted and explain the resulting price movement.”

Prompt examples for crypto market trend analysis

Here are examples of effective prompts tailored for different types of crypto insights:

- Technical analysis prompt: “Analyze Bitcoin’s RSI dips below 30 from 2024 onward. Identify how long it typically took for the price to recover.”

- Sentiment analysis prompt: “Summarize Bitcoin sentiment trends on Reddit and Twitter throughout 2024. Identify patterns linked to price surges.”

- Strategy development prompt: “Create a trading strategy for Bitcoin using RSI, MACD, and whale accumulation data. Identify optimal entry and exit points.”

How to improve prompt quality

If ChatGPT’s response lacks detail or produces irrelevant insights, improving the prompt structure can enhance the outcome. Instead of rephrasing the same request, focus on adjusting the prompt’s depth, scope or context. Try these approaches for better results:

- Add more data references: Refer to RSI, MACD or other indicators to improve precision.

- Define the timeframe more clearly: Limiting the analysis period often provides sharper insights.

- Request comparative analysis: Asking ChatGPT to compare conditions across different timelines or trends can reveal more meaningful insights.

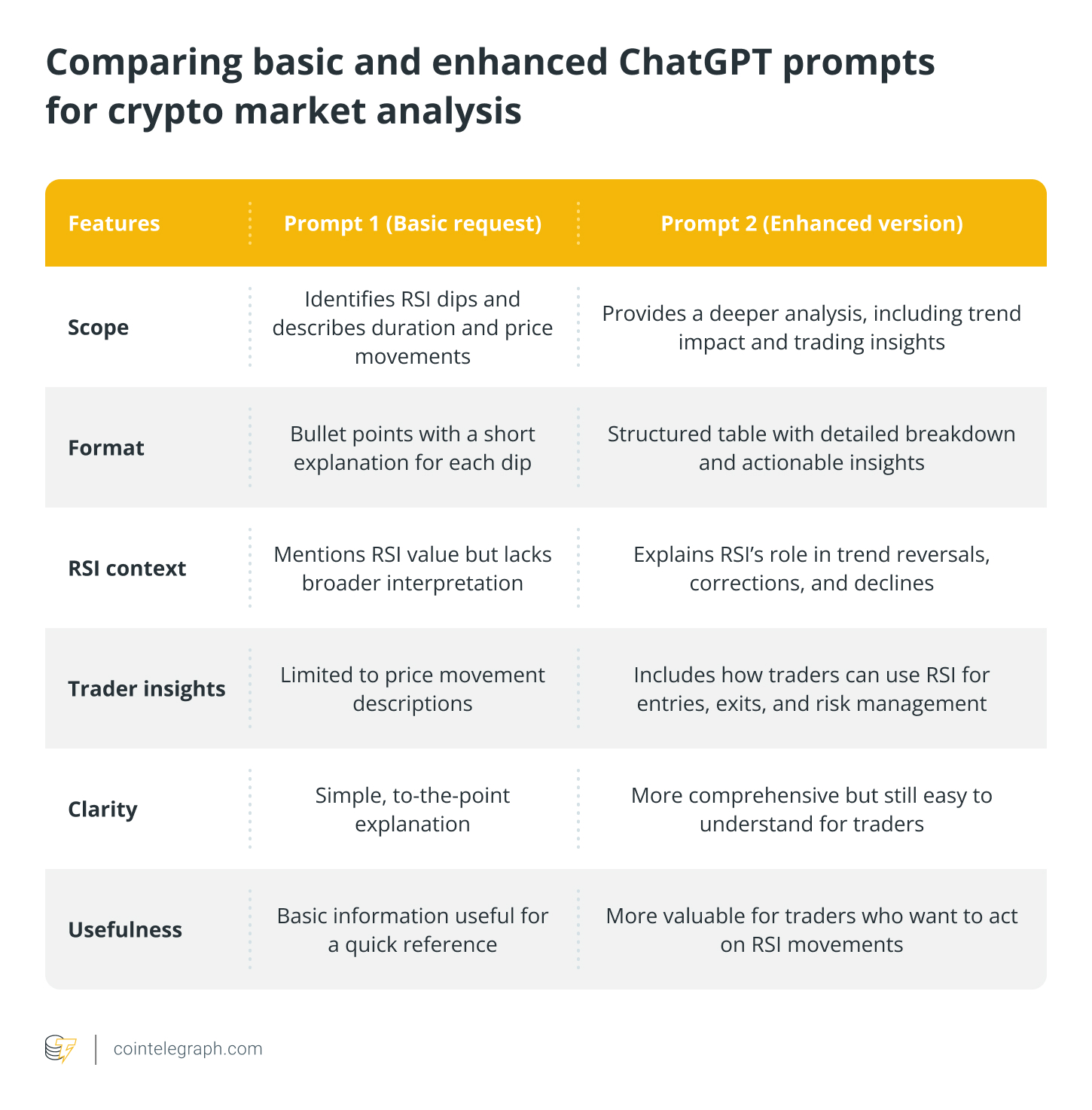

When tested on GPT-4o, a refined prompt produced significantly better results. The basic prompt, “Analyze Bitcoin RSI data,” returned vague and incomplete insights.

In contrast, an enhanced prompt — “Analyze Bitcoin’s RSI dips below 50 between December 2024 and January 2025. For each dip, identify the exact dates, duration, and the corresponding price movement. Explain whether the dips signaled trend reversals, corrections, or further declines. Additionally, provide insights in simple language, focusing on how traders can interpret these RSI movements for better decision-making in market entries and exits. Prepare a structured table summarizing each dip, including columns for date, RSI value, duration, price movement, and key insights for traders” — generated clear, actionable insights in contrast to previous output, as seen above.

The below table summarizes key differences in the outputs of Prompt 1 and Prompt 2:

As observed, taking the time to write clear, targeted prompts significantly improves ChatGPT’s ability to provide meaningful and actionable insights for crypto market analysis.

However, results may vary as ChatGPT may not yield the same outputs all the time due to differences in prompt wording, data interpretation and inherent variability in AI-generated responses. Also, traders should cross-check insights with real-time data and multiple sources for informed decision-making.

Step 4: Caution! Verify ChatGPT insights before drawing conclusions

Insights generated by ChatGPT can provide useful guidance, but verifying those insights is crucial before making investment decisions. Crypto markets are volatile, and relying solely on AI crypto market predictions without cross-referencing data may lead to poor outcomes.

Verifying ChatGPT insights

To confirm the accuracy and relevance of ChatGPT’s insights:

- Cross-check with trusted data sources: If ChatGPT highlights a bullish signal based on RSI trends, compare this finding with live data from platforms like TradingView, CoinGecko or Glassnode to confirm the signal’s validity.

- Review key market conditions: Market behavior often depends on broader economic events, news or geopolitical factors. If ChatGPT identifies a pattern, check if major events align with the prediction.

- Test insights on a demo account: Before applying any suggested strategy, test it in a risk-free environment using demo trading platforms to assess its effectiveness.

Applying verified insights

Once insights are verified, applying them effectively is essential:

- Set clear entry and exit points: If crypto trading with ChatGPT suggests a bullish breakout pattern, establish specific price points to minimize risk and secure profits.

- Use stop-loss orders: Protect investments by setting stop-loss points that limit potential losses if the trend reverses unexpectedly.

- Diversify approach: Even when ChatGPT identifies promising trends, combining insights from multiple data sources helps reduce reliance on a single prediction.

Did you know? A survey by Mercer Investments in 2024 revealed that 54% of investment managers have already integrated AI into their investment processes, while over 90% are either currently using or planning to adopt AI tools.

Limitations of using ChatGPT for crypto market predictions

While ChatGPT can be a valuable tool for analyzing market trends, it has several limitations:

- Lack of real-time data: ChatGPT does not have live access to market prices, trading volumes or real-time sentiment. External data sources are needed for up-to-date analysis.

- No predictive accuracy guarantee: ChatGPT analyzes historical patterns and sentiment but cannot predict future price movements with certainty. Market conditions can change rapidly due to unforeseen factors.

- Data quality dependence: The accuracy of insights depends on the quality of the input data. If outdated or biased information is provided, the analysis may be misleading.

- Limited understanding of market manipulation: ChatGPT cannot detect wash trading, pump-and-dump schemes or other forms of market manipulation that can influence crypto prices.

- No personal financial advice: ChatGPT does not provide personalized investment recommendations. Traders should combine AI-generated insights with technical analysis, fundamental research and risk management strategies.

As the saying goes, “Past performance is not indicative of future results.” AI tools like ChatGPT can support decision-making, but they should never replace critical thinking. Thus, always cross-check AI-driven insights with reliable market research before making any trading decisions.

The future of ChatGPT in predicting crypto market trends

As AI technology continues to evolve, using ChatGPT for crypto forecasting is expected to become more refined and integrated with real-time data platforms. Future developments could include:

- Enhanced data integration: While ChatGPT cannot access live market data directly, integrating it with financial data providers like Finnhub or Polygon.io via APIs may allow real-time data retrieval.

- Improved prediction models: AI models are rapidly improving their ability to identify complex patterns, potentially enhancing prediction accuracy.

- Automated trading strategies: Future updates may enable traders to automate strategies based on ChatGPT insights, with alerts for optimal entry and exit points.

While ChatGPT is already a valuable tool, its capabilities will likely expand further as AI continues to develop, providing crypto traders with even more effective analysis and strategic insights

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

What are address poisoning attacks in crypto and how to avoid them?

Address poisoning attacks are malicious tactics used by attackers who can reroute traffic, interrupt services, or obtain unauthorized access to sensitive data by inserting bogus data or changing routing tables. The integrity of data and network security are seriously threatened by these assaults, which take […]

Analysis

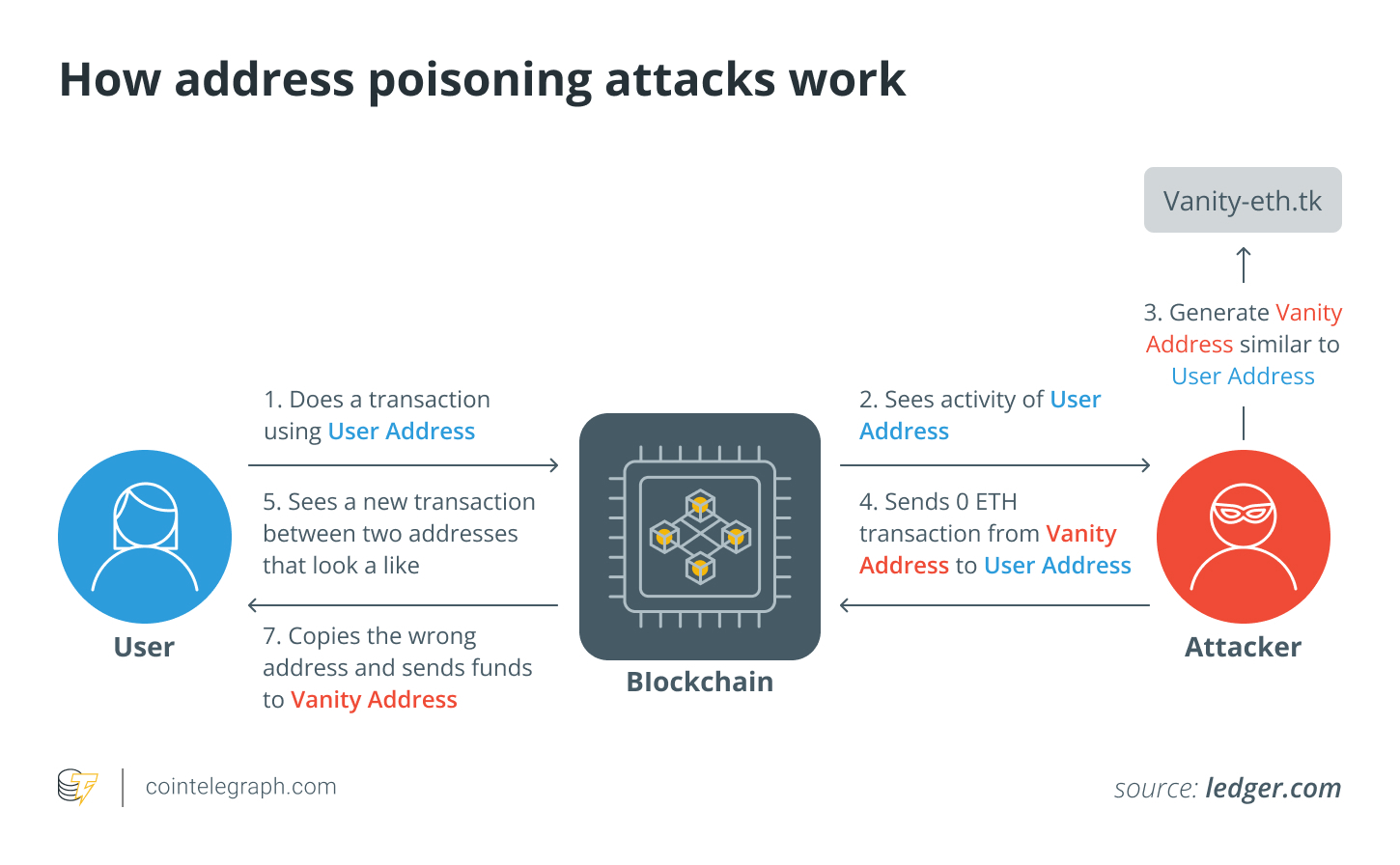

Address poisoning attacks are malicious tactics used by attackers who can reroute traffic, interrupt services, or obtain unauthorized access to sensitive data by inserting bogus data or changing routing tables. The integrity of data and network security are seriously threatened by these assaults, which take advantage of flaws in network protocols.

This article will explain what address poisoning attacks are, their types and consequences, and how to protect oneself against such attacks.

Address poisoning attacks in crypto, explained

In the world of cryptocurrencies, hostile actions where attackers influence or deceive consumers by tampering with cryptocurrency addresses are referred to as address poisoning attacks.

On a blockchain network, these addresses, which are made up of distinct alphanumeric strings, serve as the source or destination of transactions. These attacks use a variety of methods to undermine the integrity and security of cryptographic wallets and transactions.

Address poisoning attacks in the crypto space are mostly used to either illegally acquire digital assets or impair the smooth operation of blockchain networks. These attacks may encompass:

Theft

Attackers may trick users into transmitting their funds to malicious addresses using strategies such as phishing, transaction interception or address manipulation.

Disruption

Address poisoning can be used to disrupt the normal operations of blockchain networks by introducing congestion, delays or interruptions in transactions and smart contracts, reducing the effectiveness of the network.

Deception

Attackers frequently attempt to mislead cryptocurrency users by posing as well-known figures. This undermines community trust in the network and might result in erroneous transactions or confusion among users.

To protect digital assets and the general integrity of blockchain technology, address poisoning attacks highlight the significance of strict security procedures and constant attention within the cryptocurrency ecosystem.

Related: How to mitigate the security risks associated with crypto payments

Types of address poisoning attacks

Address poisoning attacks in crypto include phishing, transaction interception, address reuse exploitation, Sybil attacks, fake QR codes, address spoofing and smart contract vulnerabilities, each posing unique risks to users’ assets and network integrity.

Phishing attacks

In the cryptocurrency realm, phishing attacks are a prevalent type of address poisoning, which involves criminal actors building phony websites, emails or communications that closely resemble reputable companies like cryptocurrency exchanges or wallet providers.

These fraudulent platforms try to trick unsuspecting users into disclosing their login information, private keys or mnemonic phrases (recovery/seed phrases). Once gained, attackers can carry out unlawful transactions and get unauthorized access to victims’ Bitcoin (BTC) assets, for example.

For instance, hackers might build a fake exchange website that looks exactly like the real thing and ask consumers to log in. Once they do so, the attackers can gain access to customer funds on the actual exchange, which would result in substantial financial losses.

Transaction interception

Another method of address poisoning is transaction interception, in which attackers intercept valid cryptocurrency transactions and change the destination address. Funds destined for the genuine receiver are diverted by changing the recipient address to one under the attacker’s control. This kind of attack frequently involves malware compromising a user’s device or network or both.

Address reuse exploitation

Attackers monitor the blockchain for instances of address repetition before using such occurrences to their advantage. Reusing addresses can be risky for security because it might reveal the address’s transaction history and vulnerabilities. These weaknesses are used by malicious actors to access user wallets and steal funds.

For instance, if a user consistently gets funds from the same Ethereum address, an attacker might notice this pattern and take advantage of a flaw in the user’s wallet software to access the user’s funds without authorization.

Sybil attacks

To exert disproportionate control over a cryptocurrency network’s functioning, Sybil attacks entail the creation of several false identities or nodes. With this control, attackers are able to modify data, trick users, and maybe jeopardize the security of the network.

Attackers may use a large number of fraudulent nodes in the context of proof-of-stake (PoS) blockchain networks to significantly affect the consensus mechanism, giving them the ability to modify transactions and potentially double-spend cryptocurrencies.

Fake QR codes or payment addresses

Address poisoning can also happen when fake payment addresses or QR codes are distributed. Attackers often deliver these bogus codes in physical form to unwary users in an effort to trick them into sending cryptocurrency to a location they did not plan.

For example, a hacker might disseminate QR codes for cryptocurrency wallets that look real but actually include minor changes to the encoded address. Users who scan these codes unintentionally send money to the attacker’s address rather than that of the intended receiver, which causes financial losses.

Address spoofing

Attackers who use address spoofing create cryptocurrency addresses that closely resemble real ones. The idea is to trick users into transferring money to the attacker’s address rather than the one belonging to the intended recipient. The visual resemblance between the fake address and the real one is used in this method of address poisoning.

An attacker might, for instance, create a Bitcoin address that closely mimics the donation address of a reputable charity. Unaware donors may unintentionally transfer money to the attacker’s address while sending donations to the organization, diverting the funds from their intended use.

Smart contract vulnerabilities

Attackers take advantage of flaws or vulnerabilities in decentralized applications (DApps) or smart contracts on blockchain systems to carry out address poisoning. Attackers can reroute money or cause the contract to behave inadvertently by fiddling with how transactions are carried out. Users may suffer money losses as a result, and decentralized finance (DeFi) services may experience disruptions.

Consequences of address poisoning attacks

Address poisoning attacks can have devastating effects on both individual users and the stability of blockchain networks. Because attackers may steal crypto holdings or alter transactions to reroute money to their own wallets, these assaults frequently cause large financial losses for their victims.

Beyond monetary losses, these attacks may also result in a decline in confidence among cryptocurrency users. Users’ trust in the security and dependability of blockchain networks and related services may be damaged if they fall for fraudulent schemes or have their valuables stolen.

Additionally, some address poisoning assaults, such as Sybil attacks or the abuse of smart contract flaws, can prevent blockchain networks from operating normally, leading to delays, congestion or unforeseen consequences that have an effect on the entire ecosystem. These effects highlight the need for strong security controls and user awareness in the crypto ecosystem to reduce the risks of address poisoning attacks.

Related: How to put words into a Bitcoin address? Here’s how vanity addresses work

How to avoid address poisoning attacks

To protect users’ digital assets and keep blockchain networks secure, it is crucial to avoid address poisoning assaults in the cryptocurrency world. The following ways may help prevent being a target of such attacks:

Use fresh addresses

By creating a fresh crypto wallet address for each transaction, the chance of attackers connecting an address to a person’s identity or past transactions can be decreased. For instance, address poisoning attacks can be reduced by using hierarchical deterministic (HD) wallets, which create new addresses for each transaction and lessen the predictability of addresses.

Utilizing an HD wallet increases a user’s protection against address poisoning attacks because the wallet’s automatic address rotation makes it more difficult for hackers to redirect funds.

Utilize hardware wallets

When compared to software wallets, hardware wallets are a more secure alternative. They minimize exposure by keeping private keys offline.

Exercise caution when disclosing public addresses

People should exercise caution when disclosing their crypto addresses in the public sphere, especially on social media sites, and should opt for using pseudonyms.

Choose reputable wallets

It is important to use well-known wallet providers that are known for their security features and regular software updates to protect oneself from address poisoning and other attacks.

Regular updates

To stay protected against address poisoning attacks, it is essential to update the wallet software consistently with the newest security fixes.

Implement whitelisting

Use whitelisting to limit transactions to reputable sources. Some wallets or services allow users to whitelist particular addresses that can send funds to their wallets.

Consider multisig wallets

Wallets that require multiple private keys to approve a transaction are known as multisignature (multisig) wallets. These wallets can provide an additional degree of protection by requiring multiple signatures to approve a transaction.

Utilize blockchain analysis tools

To spot potentially harmful conduct, people can track and examine incoming transactions using blockchain analysis tools. Sending seemingly trivial, small quantities of crypto (dust) to numerous addresses is a common practice known as dusting. Analysts can spot potential poisoning efforts by examining these dust trade patterns.

Unspent transaction outputs (UTXOs) with tiny amounts of cryptocurrency are frequently the consequence of dust transactions. Analysts can locate possibly poisoned addresses by locating UTXOs connected to dust transactions.

Report suspected attacks

Individuals should respond right away in the event of a suspected address poisoning attack by getting in touch with the company that provides their crypto wallet through the official support channels and detailing the occurrence.

Additionally, they can report the occurrence to the relevant law enforcement or regulatory authorities for further investigation and potential legal action if the attack involved considerable financial harm or malevolent intent. To reduce possible risks and safeguard both individual and group interests in the cryptocurrency ecosystem, timely reporting is essential.

How to buy food with Bitcoin?

Key takeaways In 2025, you can have your digital wallet ready to pay with Bitcoin directly at 15,000 merchants and restaurants worldwide. Whether you’re using your own Bitcoin wallet to pay directly at accepting merchants or pay with cards, you’ll find plenty of options to […]

Analysis

Key takeaways

- In 2025, you can have your digital wallet ready to pay with Bitcoin directly at 15,000 merchants and restaurants worldwide.

- Whether you’re using your own Bitcoin wallet to pay directly at accepting merchants or pay with cards, you’ll find plenty of options to buy food with Bitcoin.

- Bitcoin has evolved since Laszlo Hanyecz’s first purchase of food. A new whole payment structure has formed around Bitcoin, with innovative creative ways to use it to pay for food.

- Bitcoin payment processors, such as Bitrefill and BitPay, are now known globally. They handle thousands of transactions each month.

As Bitcoin becomes more accepted worldwide, many retailers, restaurants and food delivery services are embracing it. They now allow customers to pay for food with Bitcoin (BTC).

You can still buy food with Bitcoin, even if merchants don’t accept it directly. Use methods like crypto cards or crypto gift cards to make your purchase.

Bitcoin has long been recognized as a strong store of value, but its potential goes beyond that. As the world moves toward greater decentralization, Bitcoin is increasingly positioned to challenge traditional payment systems that rely on third-party approval. The primary purpose of Bitcoin is to bypass banks and financial institutions and enable direct payments with no censorship or confiscation.

Bitcoin’s creator, Satoshi Nakamoto, created a peer-to-peer electronic cash system to make people more independent from financial intermediaries, so you may as well start using the cryptocurrency as intended.

This article will show you how to pay for food with Bitcoin. You’ll learn different methods for grocery stores, restaurants and food retailers, both in-store and online.

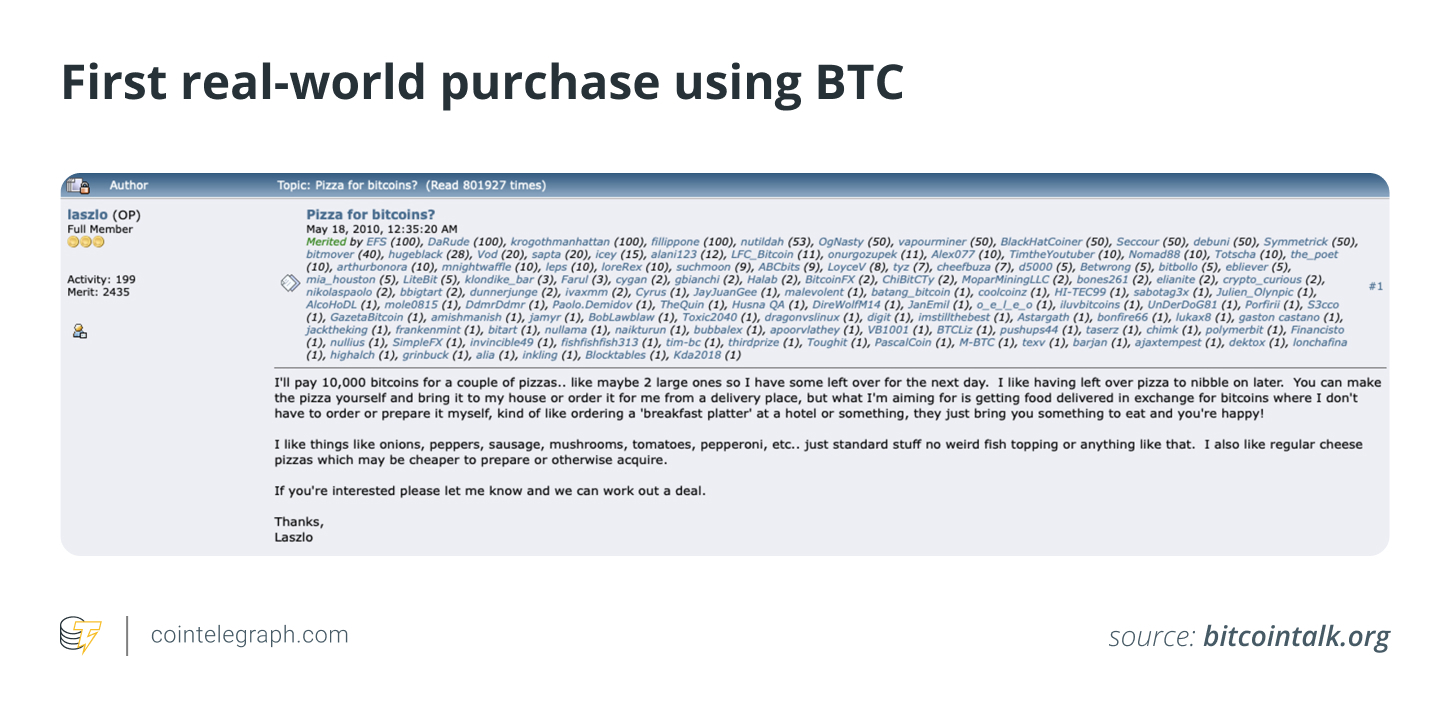

Did you know? The first Bitcoin transaction to buy food was executed by Laszlo Hanyecz on May 22, 2010, which later became the famous Bitcoin Pizza Day. He paid 10,000 BTC for two pizzas, worth $40 at the time.

Can you buy food with Bitcoin?

The short answer is yes, definitely. Depending on the country you’re in, there may be different options presented to you.

The benefit of using a Bitcoin payment for food directly is to avoid the intermediary and higher costs while performing a pure Bitcoin transaction as Satoshi had intended.

Although most merchants do not accept BTC as payment yet, Bitcoin cards, gift cards and food delivery portals that accept Bitcoin, even indirectly, are pretty much available everywhere.

All you need to do is refill the card with some cryptocurrency, and the payment processor will directly exchange Bitcoin for local currency.

1. Pay for your food via direct Bitcoin payments

Although the number of merchants accepting Bitcoin is increasing globally, very few are still fully embracing the cryptocurrency as a payment method. When Bitcoin is accepted, normally, a Lightning wallet is used for fast payments and very low fees.

You can visit https://btcmap.org/ to find Bitcoin-friendly food companies around the world. Just choose a nearby area to see where you can use the digital currency.

Depending on the jurisdiction, fast food companies that accept Bitcoin include groups like Burger King and Subway. McDonald’s fully accepts BTC as a direct payment in El Salvador and as a pilot program in Lugano, Switzerland.

You can also pay with Bitcoin at specific restaurants such as Mastro’s (at selected US locations) and Tahini’s, a Canadian-Middle Eastern chain with some US presence. This crypto-friendly restaurant even holds Bitcoin as a reserve asset.

Accepting Bitcoin directly for online orders is less common unless the merchants partner with a delivery service that supports crypto. It’s possible to pay with Bitcoin for food delivery at companies like Manufy in the US that also accept Bitcoin directly.

You can also buy groceries with crypto directly at many Bitcoin-friendly grocery stores. Whole Foods in the UK, US and Canada accepts BTC via the Flexa network’s Spedn app at specific locations. One of South Africa’s largest grocery retailers, Pick n Pay, is a supermarket accepting Bitcoin payments. It rolled out Bitcoin payments across many of its stores following a successful pilot.

El Salvador is deservedly known as a Bitcoin country, and in most cases, restaurants, grocery stores and online retailers allow their customers to pay with Bitcoin directly.

Many small municipalities are adopting Bitcoin as a widely used currency. Other than El Salvador, in places like Lugano, Switzerland and Mossel Bay, South Africa, many merchants, mostly small retailers, accept Bitcoin as a legitimate method of payment.

How to pay with Bitcoin directly

- You can download a custodial or non-custodial Lightning wallet directly on your mobile.

- Transfer some Bitcoin there to pay for everyday expenses.

- Position your wallet to scan merchant QR codes.

- Your purchase finalizes in just a few seconds.

Did you know? Subway was the first major food chain to accept Bitcoin. The first Bitcoin purchase at a Subway occurred in 2013 in Moscow, Russia.

2. Bitcoin cards, an alternative way to pay for your food

Many services offer Bitcoin-funded debit cards that convert Bitcoin to fiat at the point of sale. BitPay, Wirex and Binance are well-known companies. They support Bitcoin and crypto payments at grocery stores like Walmart. They can also convert cryptocurrency into various currencies.

The benefit of Bitcoin cards is that the conversion into fiat is instant, without the need for the store to accept Bitcoin directly. The crypto card provider partners with companies like Visa and Mastercard to make sure that your card is accepted by the vast majority of vendors and merchants.

How to pay with Bitcoin cards

- Sign up with one of the crypto card services available.

- Link your Bitcoin wallet.

- Add funds.

- Use the card at selected merchants by swiping it at checkout like a normal card.

- Connect the card to your Apple or Google Pay to pay directly with your mobile.

How to use Bitcoin gift cards to pay for food

Bitcoin gift cards are Bitcoin vouchers that you can buy to purchase food from popular delivery platforms like Uber Eats, DoorDash or Grubhub. Services like BitPay, CoinGate and Bitrefill let you order food online with Bitcoin.

Bitcoin gift cards are also widely used for grocery shopping at Walmart, Whole Foods, Safeway and Lidl. The gift cards can be used for shopping in-store or online services, or pick-up or delivery.

How to pay with Bitcoin cards

- Buy the card with Bitcoin at selected stores or platforms.

- Receive the digital gift card.

- Choose the merchant you want to pay with the gift card.

- Pay at the checkout with the gift card.

Paying with Bitcoin gift cards is one of the most widely available methods, particularly helpful when the chosen restaurant or merchant doesn’t accept crypto directly yet.

Precautions when paying with Bitcoin for food

While Bitcoin offers a convenient and decentralized payment method, it’s essential to take certain precautions to ensure a safe and smooth transaction:

- Security of wallet: Always use a trusted and secure Bitcoin wallet, whether custodial or non-custodial, to store your cryptocurrency. Ensure your wallet’s private keys are kept safe and inaccessible to unauthorized users.

- Transaction fees: While Bitcoin payments are designed to be cheaper than traditional payment methods, transaction fees may still apply, especially when using the Lightning Network for fast payments. Be aware of the fees associated with each payment method.

- Merchant reliability: Ensure that the merchant or restaurant you’re purchasing from is legitimate and accepts Bitcoin through trusted payment processors. Avoid using random or unverified third-party services.

- Bitcoin volatility: Bitcoin’s price can fluctuate rapidly, so be prepared for potential price changes between when you make your payment and when the merchant processes it. This is especially true when converting Bitcoin to local fiat currencies.

- Regulations and acceptance: Depending on your location, some regions may have different regulations surrounding Bitcoin payments. Make sure you are aware of local cryptocurrency laws and whether merchants in your area are legally allowed to accept Bitcoin.

Remember, the security of your funds is just as important as how you use them. Taking precautions now will ensure your assets remain safe while enjoying the convenience of paying with Bitcoin.

XRP, ADA, SOL go parabolic after Trump US crypto reserve post: Will other altcoins follow?

Bitcoin (BTC) witnessed solid buying over the weekend as US President Donald Trump announced that Bitcoin, Ether (ETH), XRP (XRP), Solana (SOL) and Cardano (ADA) would be included in a crypto strategic reserve. The announcement massively pumped the chosen coins, which made it risky for […]

Litecoin

Bitcoin (BTC) witnessed solid buying over the weekend as US President Donald Trump announced that Bitcoin, Ether (ETH), XRP (XRP), Solana (SOL) and Cardano (ADA) would be included in a crypto strategic reserve. The announcement massively pumped the chosen coins, which made it risky for a fresh entry after the rally. The coins in this article have been selected for their technical setups rather than the Trump-based pump.

Apart from the crypto strategic reserve, in a sign that could create new demand for Bitcoin, BlackRock added the iShares Bitcoin ETF Trust (IBIT) to its $150 billion model portfolio, according to a Bloomberg report. The global investment firm is adding 1% to 2% allocation to portfolios that allow for alternative assets. This move opens the doors for a potential new demand for the Bitcoin ETF.

Crypto market data daily view. Source: Coin360

However, some analysts believe that Bitcoin could witness some more pain in the near term. They anticipate Bitcoin to drop near $70,000 before starting the next leg of the bull move. Nexo dispatch analyst Iliya Kalchev told Cointelegraph that Bitcoin could “establish firm support in the $72,000 to $80,000 range.”

Could Bitcoin manage to hold above $90,000? If that happens, select altcoins apart from the ones chosen for the crypto strategic reserve may find buyers. Let’s look at the top cryptocurrencies that look strong on the charts.

Bitcoin price analysis

Bitcoin has reached the 20-day exponential moving average ($92,366), indicating aggressive buying at lower levels.

BTC/USDT daily chart. Source: Cointelegraph/TradingView

Sellers will try to stall the relief rally at the 20-day EMA. If the price turns down from the 20-day EMA, the BTC/USDT pair could drop to $85,000, which is a crucial support to watch out for.

If the price rebounds off $85,000, the pair could rise above the 20-day EMA. The pair may then rally to the 50-day simple moving average ($97,704). Such a move will signal that the pair may have bottomed out in the near term.

If bears want to retain the advantage, they will have to swiftly pull the price below $83,000. If they manage to do that, the pair could retest the critical $78,258 support.

BTC/USDT 4-hour chart. Source: Cointelegraph/TradingView

The 20-EMA has started to turn up on the four-hour chart, and the relative strength index (RSI) has jumped into the overbought zone, indicating that the bulls are on a comeback. If the price remains above $90,000, the pair could climb to $96,000 and then $100,000.

The first sign of weakness will be a break below the 50-simple moving average. That could sink the pair to the 20-EMA, which is likely to attract buyers. The bears will be back in the driver’s seat if they pull the pair below $83,000.

Hedera price analysis

Hedera (HBAR) rose above the 20-day EMA ($0.22) and reached the 50-day SMA ($0.26) on March 1.

HBAR/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA is the critical support to watch out for on the downside. If the price rebounds off the 20-day EMA, it will signal a change in sentiment from selling on rallies to buying on dips. The bulls will again try to propel the HBAR/USDT pair above the 50-day SMA. If they can pull it off, the pair may rise to $0.32.

Contrarily, a break and close below the 20-day EMA suggests that the bears remain sellers on rallies. The pair may slump to $0.18, where the bulls will try to arrest the decline.

HBAR/USDT 4-hour chart. Source: Cointelegraph/TradingView

The pair turned down from $0.26 but is likely to find support at the 20-EMA on the four-hour chart. If the price rebounds off the 20-EMA with force, it will signal buying on dips. That improves the prospects of a rally to $0.28.

Instead, if the price continues lower and breaks below the 20-EMA, it will suggest that the bulls are losing their grip. The pair may tumble to the 50-SMA, which is likely to act as strong support.

Litecoin price analysis

Litecoin (LTC) has been trading inside a symmetrical triangle pattern, indicating indecision between the buyers and sellers.

LTC/USDT daily chart. Source: Cointelegraph/TradingView

The flattish 20-day EMA ($122) and the RSI near the midpoint do not give a clear advantage either to the bulls or the bears. If the price rises and sustains above the 20-day EMA, the bulls will try to push the LTC/USDT pair above the resistance line. If they succeed, the pair may rise to $147.

Contrarily, a close below the moving averages suggests that the short-term advantage has tilted in favor of the bears. The pair may skid to the support line, which is a crucial level for the bulls to defend because a break below it may sink the pair to $86.

LTC/USDT 4-hour chart. Source: Cointelegraph/TradingView

The pair has dipped below the moving averages on the four-hour chart, indicating that the bears are trying to take charge. If the price sustains below the moving averages, the pair could descend to $114 and then to the support line.

Buyers will have to push and maintain the price above the moving averages to open the doors for a rise to $132 and later to the resistance line. The up move could pick up momentum after the price closes above the resistance line.

Related: Here’s what happened in crypto today

Monero price analysis

Monero (XMR) bounced off the $205 level and rose above the moving averages, signaling solid buying on dips.

XMR/USDT daily chart. Source: Cointelegraph/TradingView

The flattish 20-day EMA ($224) and the RSI near the midpoint suggest that the XMR/USDT pair may swing between $205 and $245 for a few days. If the price stays above the 20-day EMA, the pair could retest the $245 resistance.

On the contrary, if buyers fail to maintain the price above the moving averages, it will suggest a lack of demand at higher levels. The bears will then try to pull the price down to the support of the range at $205.

XMR/USDT 4-hour chart. Source: Cointelegraph/TradingView

The 20-EMA has started to turn up on the four-hour chart, and the RSI is in the positive zone, indicating an advantage to buyers. The pair could rise to $238, where the bears are expected to step in.

On the downside, a break and close below the 20-EMA suggests that the bears are back in the game. The pair may slide to $216, and if this level cracks, the next stop could be the solid support at $205.

Celestia price analysis

Celestia (TIA) has risen above the moving averages, and the bulls are trying to sustain the price above the breakdown level of $4.14.

TIA/USDT daily chart. Source: Cointelegraph/TradingView

If they manage to do that, it will signal that the markets have rejected the breakdown. There is minor resistance at $4.50, but if the level is crossed, the TIA/USDT pair could climb to $5.50. Sellers are expected to defend the $5.50 level aggressively.

This positive view will be invalidated in the near term if the price turns down and breaks below the 20-day EMA ($3.66). That could sink the pair to $3 and subsequently to $2.72. Such a move will suggest that the bears have flipped the $4.14 level into resistance.

TIA/USDT 4-hour chart. Source: Cointelegraph/TradingView

Both moving averages have started to turn up, and the RSI is in positive territory on the four-hour chart, indicating an advantage to buyers. The first sign of weakness will be a break and close below the moving averages. If that happens, the pair could drop to $3.40 and later to $3.

If buyers want to retain the advantage, they will have to defend the 20-EMA and quickly push the price above $4.31. The $4.50 level may prove to be a stiff resistance, but if the buyers overcome it, the pair could jump to $5.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Price analysis 2/28: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, LTC, LINK, AVAX

Bitcoin (BTC) dropped close to $78,000 on Feb. 28, but lower levels attracted solid buying by the bulls. CryptoQuant founder and CEO Ki Young Ju said in a post on X that selling after a 30% correction could be a “noob” mistake as Bitcoin rose […]

Litecoin

Bitcoin (BTC) dropped close to $78,000 on Feb. 28, but lower levels attracted solid buying by the bulls. CryptoQuant founder and CEO Ki Young Ju said in a post on X that selling after a 30% correction could be a “noob” mistake as Bitcoin rose to a new all-time high after falling 53% in 2021.

Select whales seem to be building a position during the dip. A Bitcoin whale, known as “Spoofy,” bought 4,000 Bitcoin worth roughly $344 million when the price was between $82,000 and $85,000. Crypto analyst Saint Pump said on X that Spoofy builds his position “extremely slowly” and may buy more if the markets fall further.

Crypto market data daily view. Source: Coin360

The current correction has not deterred Standard Chartered’s long-term view. In a CNBC interview, Standard Chartered head of digital assets research Geoffrey Kendrick said that Bitcoin could recover to $200,000 this year and surge to $500,000 before President Trump finishes his second term.

Could Bitcoin start a recovery, pulling altcoins higher? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin closed below the $85,000 support on Feb. 26, and the bears successfully defended the level on Feb. 27.

BTC/USDT daily chart. Source: Cointelegraph/TradingView

Sellers tried to sink the BTC/USDT pair to $73,777, but the bulls purchased the dip to $78,258 on Feb. 28. Buyers will try to push the price back above the $85,000 to $90,000 resistance zone. If they manage to do that, it will suggest that a short-term bottom may be in place.

Conversely, if the price turns down sharply from the overhead resistance zone, it indicates selling on every minor rally. The pair could then descend to the vital support at $73,777, where buyers are expected to step in.

Ether price analysis

Ether (ETH) rebounded off the $2,111 support, indicating that the bulls are trying to keep the price inside the large range.

ETH/USDT daily chart. Source: Cointelegraph/TradingView

The bulls will attempt to stretch the recovery to the 20-day EMA ($2,611) and then to the downtrend line. Sellers are expected to aggressively defend the downtrend line. If the price turns down from the overhead resistance, the ETH/USDT pair could retest the $2,111 level. If this support cracks, the pair may sink to $2,000 and later to $1,900.

Contrary to this assumption, a break and close above the downtrend line suggests that the bears are losing their grip. The pair could rise to the 50-day SMA ($2,932).

XRP price analysis

XRP (XRP) turned down from the support line of the symmetrical triangle pattern on Feb. 26, suggesting that the bears have flipped the level into resistance.

XRP/USDT daily chart. Source: Cointelegraph/TradingView

The XRP/USDT pair dipped below the $2.06 support on Feb. 28, but the bears could not sustain the lower levels. Buyers will attempt to push the price above the 20-day EMA. If they can pull it off, it will signal that the bulls are back in the game.

Contrarily, if the price turns down from the 20-day EMA, it will suggest that the bears remain active at higher levels. That increases the possibility of a drop to the crucial support at $1.77.

BNB price analysis

BNB (BNB) rebounded off the support near $557, indicating that the bulls are trying to defend the level.

BNB/USDT daily chart. Source: Cointelegraph/TradingView

The BNB/USDT pair will attempt a relief rally, which is expected to face strong selling at the 20-day EMA ($634). If the price turns down sharply from the 20-day EMA, it increases the likelihood of a break below $557. If that happens, the pair could collapse to $500. Buyers are expected to fiercely defend the zone between $460 and $500.

On the upside, a break and close above the 20-day EMA suggests the selling pressure is reducing. The pair could then reach the 50-day SMA ($656).

Solana price analysis

Solana (SOL) slipped below the $133 support on Feb. 28, but the long tail on the candlestick shows solid buying at lower levels.

SOL/USDT daily chart. Source: Cointelegraph/TradingView

There is minor resistance at $147, but it is likely to be crossed. If the price holds above $147, the SOL/USDT pair could reach the 20-day EMA ($169). Sellers are expected to pose a strong challenge at the 20-day EMA, but if the bulls prevail, the pair could extend its recovery to the 50-day SMA ($201).

This optimistic view will be negated if the price turns down and breaks below $125. The pair could then plummet to $110.

Dogecoin price analysis

Buyers failed to push Dogecoin (DOGE) back above the support line, suggesting that the bears have flipped the level into resistance.

DOGE/USDT daily chart. Source: Cointelegraph/TradingView

The selling resumed on Feb. 28, and the bears will try to sink the price to $0.15. However, the RSI has slipped into the oversold zone, suggesting that a relief rally could be around the corner. Buyers will have to push and maintain the DOGE/USDT pair above the 20-day EMA ($0.24) to start a sustained recovery.

The failure to push the price back above the 20-day EMA increases the risk of a drop to $0.13 and then to $0.10.

Cardano price analysis

Cardano (ADA) is witnessing a tough battle between the bulls and the bears at the support line of the descending channel pattern.

ADA/USDT daily chart. Source: Cointelegraph/TradingView

If the price sustains below the support line, the selling could pick up, and the ADA/USDT pair may drop to $0.50. Buyers are expected to defend the $0.50 level with all their might because a close below it could sink the pair to $0.33.

If the price turns up from the support line, the pair could reach the 20-day EMA (0.73). This is a vital overhead resistance to watch out for because a break above it suggests that the pair may remain inside the channel for some more time.

Related: Bitcoin price metric hits ‘optimal DCA’ zone not seen since BTC traded in $50K to $70K range

Litecoin price analysis

Litecoin (LTC) has been oscillating inside a symmetrical triangle pattern, indicating indecision between the bulls and the bears.

LTC/USDT daily chart. Source: Cointelegraph/TradingView

The 20-day EMA ($122) is flattish, and the RSI is just above the midpoint, indicating a balance between supply and demand. If the price sustains above the 20-day EMA, the bulls will try to push the LTC/USDT pair above the resistance line. If they succeed, the pair could rally to $147.

Conversely, a break below the 50-day SMA ($117) opens the gates for a drop to the support line. If this level gives way, the pair could plunge to $80.

Chainlink price analysis

The failure of the bulls to start a strong recovery from the support line triggered another round of selling by the bears in Chainlink (LINK).

LINK/USDT daily chart. Source: Cointelegraph/TradingView

If the price sustains below the support line, the selling could accelerate, and the LINK/USDT pair could drop to $12.71 and, subsequently, to $10.

If buyers want to prevent the downside, they will have to swiftly push the price back above $16. The pair could then rise to the 20-day EMA ($17.42), which is likely to act as a stiff resistance. Buyers will have to push the price above the 20-day EMA to suggest that the break below the support line may have been a bear trap.

Avalanche price analysis

Avalanche (AVAX) tried to rise above the breakdown level of $22.35 on Feb. 27, but the bears held their ground.

AVAX/USDT daily chart. Source: Cointelegraph/TradingView

The bears resumed selling on Feb. 28. If the price breaks and maintains below $20, the AVAX/USDT pair could retest the solid support at $17.29. This is an important level to watch out for because a break below it may sink the pair to $15.

Time is running out for the bulls. They will have to push and maintain the price above the 20-day EMA ($24.55) to start a recovery. The pair may rise to $27.50, which is again expected to act as a resistance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Why is Litecoin (LTC) price up today?

Litecoin (LTC) has outperformed the broader crypto market vastly in the last 24 hours, rising over 9% to reach $127.85 on Feb. 27. LTC/USD four-hour price chart. Source: TradingView In contrast, the crypto market’s combined valuation has dropped by 3% amid a sour risk-on mood […]

Litecoin

Litecoin (LTC) has outperformed the broader crypto market vastly in the last 24 hours, rising over 9% to reach $127.85 on Feb. 27.

LTC/USD four-hour price chart. Source: TradingView

In contrast, the crypto market’s combined valuation has dropped by 3% amid a sour risk-on mood led by underwhelming Nvidia earnings and US President Donald Trump’s latest tariff announcements.

Key drivers behind Litecoin’s gains include:

-

Announcement of Litecoin’s own domain, “.ltc“

-

LTC’s rising strength against Bitcoin (BTC).

-

Strengthening chart technicals.

Litecoin announces official domain extension “.ltc“

Litecoin’s price gains today appear after the cryptocurrency’s official X handle announced the launch of its own domain extension.

What to know:

-

On Feb. 25, 2025, Litecoin announced the launch of its official domain extension, “.ltc,” in collaboration with Unstoppable Domains.

Source: Litecoin Official X Handle

-

Litecoin’s move mirrors Ethereum’s .eth domains, which have gained popularity as an essential part of Web3 identity solutions.

-

With .ltc domains, users can register personalized blockchain-based addresses instead of relying on long alphanumeric wallet addresses.

-

Domain extension should ideally make sending and receiving LTC payments seamless by reducing the chances of errors in transactions.

-

LTC’s price has risen by approximately 22% since the domain extension announcement.

LTC/USD daily price chart. Source: TradingView

LTC’s strength against Bitcoin is improving

Litecoin’s gains today are also due to its consistently strong performance against Bitcoin, which controls about 60% of the entire crypto market valuation.

Key points:

-

The LTC/BTC pair has climbed approximately 40% year-to-date.

-

In comparison, Ether (ETH) and Solana (SOL) have plunged by over 24.45% and 20.50% against Bitcoin, respectively.

LTC/BTC vs. ETH/BTC and SOL/BTC year-to-date performance chart. Source: TradingView

-

Litecoin’s crypto market dominance has improved due to the ongoing exchange-traded fund (ETF) buzz.

-

Ether and Bitcoin saw similar uptrends ahead of their spot ETF approvals in 2024.

ETH/BTC daily chart ft. uptrend before Ether ETF’s approval in July 2024. Source: TradingView

-

Earlier in February, Eric Balchunas, Bloomberg’s senior ETF analyst, noted that there is a 90% likelihood of a Litecoin ETF being approved in 2025.

-

On the Polymarket betting platform, the odds for a spot Litecoin ETF approval by 2025’s end was 75% as of Feb. 27.

Litecoin ETF approval odds by 2025. Source: Polymarket

-

On Feb. 19, the US Securities and Exchange Commission acknowledged CoinShares spot Litecoin filings ETF.

Litecoin hashrate is rising

Litecoin is bucking the market downtrend as network fundamentals strengthen, with miners accumulating and hashrate reaching new highs.

Notably:

-

Litecoin’s hashrate has hit an all-time high of 2.25 PH/s, signaling increased network security and miner confidence.

Litecoin hashrate chart. Source: CoinWarz

-

Onchain data shows miners reducing selling pressure and increasing reserves, creating a potential supply squeeze.

Related: Litecoin txs surge 243% in 5 months amid ETF hype: Santiment

-

The miner reserve chart further exhibits a rounding bottom pattern, indicating a shift from long-term selling to accumulation.

Litecoin miner reserve chart. Source: TradingView/recontour

-

Reduced miner selling, rising network strength, and sustained demand position LTC for further upside potential.

LTC is eyeing $360 next

Litecoin’s gains today are part of its prevailing inverse head and shoulders (IH&S) pattern, a classic bullish reversal setup signaling a potential breakout.

Key takeaways:

-

An IH&S is a technical pattern that forms after a downtrend and consists of three key troughs: a left shoulder, a lower head, and a right shoulder, forming underneath a neckline resistance.

-

The pattern resolves when the price decisively breaks above the neckline and rises by as much as the maximum distance between the head’s trough and neckline.

LTC/USD four-hour price chart. Source: TradingView

-

As of Feb. 27, Litecoin was forming the pattern’s right shoulder while eyeing the breakout above its neckline resistance of around $130.

-

The resulting target is around $160, suggesting a potential rally by March if the breakout sustains.

-

Failure to hold above $130 could lead to a retest of lower support levels near the 50-4H EMA ($123.80) and approaching the 200-4H EMA ($120.41).

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Litecoin (LTC) price rallies while Bitcoin and the wider crypto market crash

Litecoin (LTC) demonstrated a V-shaped recovery of 20% after dropping to $106 on Feb. 25. After a brief decline below the 50-day and 100-day exponential moving averages (EMAs), the altcoin has regained a bullish position and is currently outperforming a majority of assets within the […]

Litecoin

Litecoin (LTC) demonstrated a V-shaped recovery of 20% after dropping to $106 on Feb. 25. After a brief decline below the 50-day and 100-day exponential moving averages (EMAs), the altcoin has regained a bullish position and is currently outperforming a majority of assets within the crypto market.

Litecoin 1-hour chart. Source: Cointelegraph/TradingView

Litecoin has “one of the best charts in crypto”

Litecoin’s current performance implies it is on an asymmetric rally versus the wider crypto market, and most LTC futures traders maintain a clear directional bias. Data highlights a clear trend where LTC’s open interest has consistently peaked at $140.

Litecoin open interest, funding rate and liquidation chart. Source: Velo.data

During LTC’s recent correction, its open interest dropped from $885 million to $525 million, which is a 40% drop between Feb. 20 and Feb. 26. However, a majority of the OI declined within the first three days. It remained flat during LTC’s drawdown in the past two days.

In the past 24 hours, a flash OI spike of 10% was observed alongside a price rise, which might imply fresh long positions from traders. The rise in the funding rate further confirmed that more longs were currently active than shorts.

In light of that, Tyler, an anonymous crypto trader, said that the altcoin presented “one of the best charts in crypto.”

The sentiment was followed up by Poseidon, a crypto analyst who predicted that Litecoin is targeting a new all-time high at $300.

However, a technical analyst, Mihir, believed the long-term target could be even higher.

The analyst said,

“LTC hit $350 USD during 2017 — a 310x move. It retested the 2017 high during the 2020 bull run but failed to make a new ATH. In the current (2023-2025) bull run, it hasn’t moved much yet, but it is indicating an upside move this year. If it breaks above $250 USD, then $1,000 is feasible.”

Litecoin 1-month analysis by Mihir. Source: X.com

Related: M2 money supply could trigger a ‘parabolic’ Bitcoin rally — Analyst

Overhead resistance hangs at $140

As illustrated in the chart below, Litecoin’s weekly price action is exhibiting strength, and a candle close above $133 will mark its highest level since January 2022. However, the altcoin has failed to break above its overhead resistance at $140 over the past three months.

With supply-side liquidity (yellow box) available on the upside, LTC needs a weekly close above $133 to invalidate its resistance range.

Litecoin 1-week chart. Source: Cointelegraph/TradingView

Related: Bitcoin sets new 3-month low as analyst eyes $93.5K reclaim ‘this week’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Nasdaq files to list Grayscale Polkadot ETF

US securities exchange Nasdaq has requested to list a Grayscale exchange-traded fund (ETF) holding the Polkadot network’s native token, DOT (DOT), filings showed. If approved, the Grayscale Polkadot Trust would add to the asset manager’s expanding suite of publicly traded crypto funds. The filing adds to […]

Litecoin

US securities exchange Nasdaq has requested to list a Grayscale exchange-traded fund (ETF) holding the Polkadot network’s native token, DOT (DOT), filings showed. If approved, the Grayscale Polkadot Trust would add to the asset manager’s expanding suite of publicly traded crypto funds.

The filing adds to the litany of applications with the US Securities and Exchange Commission by exchanges and asset managers seeking to list ETFs tied to alternative cryptocurrencies, or altcoins.

The SEC must review and approve the filings before trading can commence.

Nasdaq proposal to list and trade Grayscale’s Polkadot Trust. Source: Nasdaq

Related: Grayscale launches Pyth investment fund

Grayscale’s ETF expansion

Grayscale already lists two spot Bitcoin (BTC) ETFs and a spot Ether (ETH) ETF. It is also seeking to list ETFs holding Solana (SOL), Litecoin (LTC), XRP (XRP), Dogecoin (DOGE) and Cardano (ADA).

Additionally, the asset manager is seeking permission to list an ETF holding a diversified basket of cryptocurrencies, including several altcoins.

Grayscale operates dozens of single-asset crypto funds that are not traded on public exchanges.

In February, the company launched an investment fund for the Pyth Network’s native token. In January, it launched a non-listed investment fund for Dogecoin, the most popular memecoin by market capitalization.

In December, Grayscale launched two new investment funds for Lido and Optimism’s governance tokens — LDO (LDO) and OP (OP), respectively.

Grayscale’s single-asset crypto products. Source: Grayscale

Related: SEC acknowledges filing for Grayscale’s spot Cardano ETF

Crypto ETF filings proliferate

Grayscale is among upward of half a dozen asset managers seeking the SEC’s approval to list altcoin ETFs. Other issuers have proposed ETFs for altcoins, including Hedera (HBAR) and Official Trump (TRUMP).

Asset manager 21Shares is also seeking to list a Polkadot ETF.

Issuers are also waiting on SEC approval for proposed changes to existing ETFs, including allowances for staking, options and in-kind redemptions.

The SEC softened its stance on cryptocurrency after US President Donald Trump started his second term.

Under former President Joe Biden, the federal agency brought upward of 100 lawsuits against crypto firms, alleging various securities law violations. In 2024, the SEC approved spot Bitcoin and Ether ETFs but stymied proposed ETFs tied to other cryptocurrencies.

Bloomberg Intelligence has set the odds of an XRP ETF approval in the US at 65%. Its estimates for Litecoin and Solana ETF approval odds are even higher, at 90% and 70%, respectively.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

Litecoin txs surge 243% in 5 months amid ETF hype: Santiment

Daily transactions on the Litecoin network have hit $9.6 billion per day as exchange-traded fund issuers have been making moves to list their proposed Litecoin ETFs in the United States. Litecoin’s (LTC) market capitalization surged by 46% from Feb. 2 to 19, showing increased investor […]

Litecoin

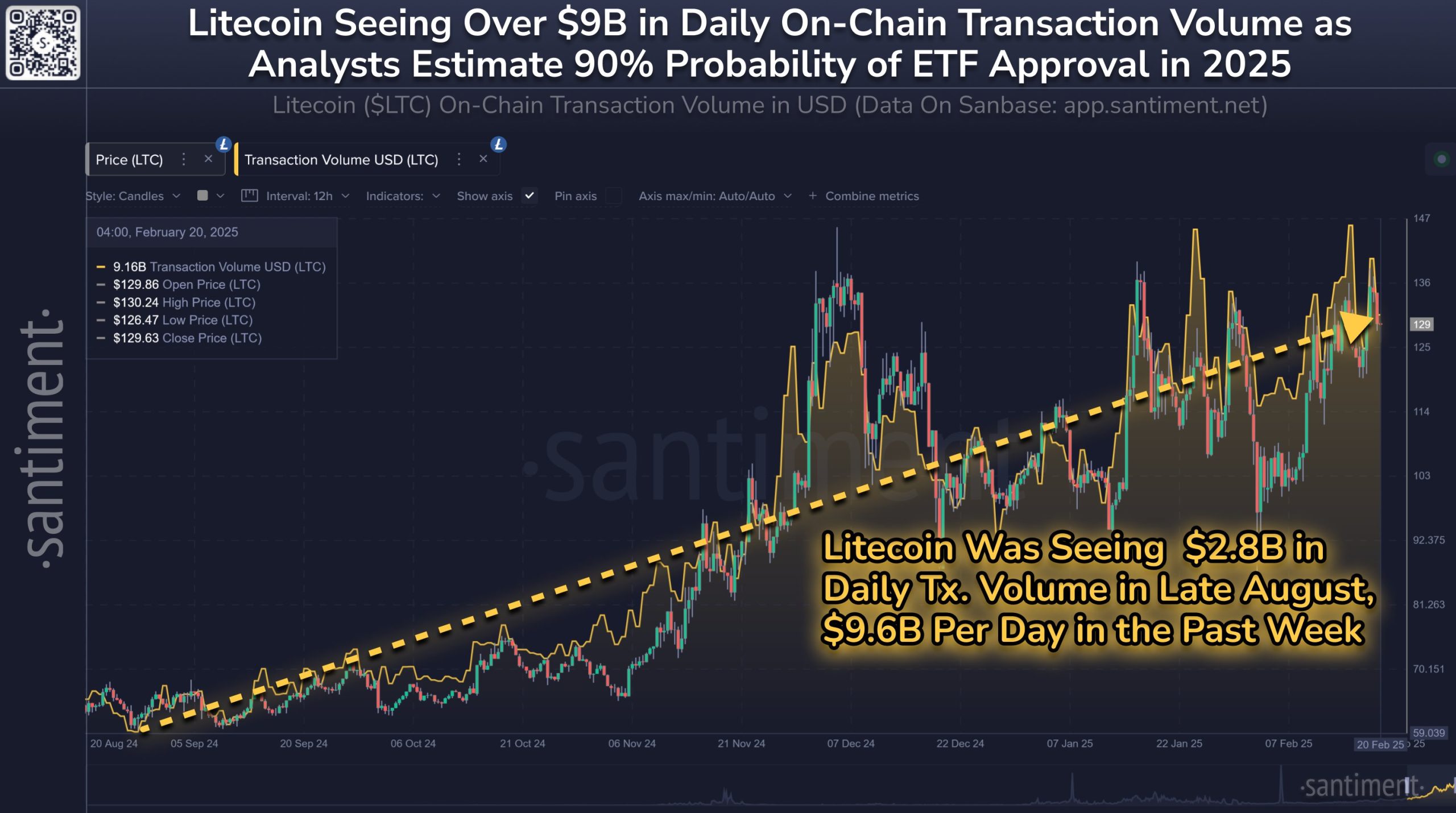

Daily transactions on the Litecoin network have hit $9.6 billion per day as exchange-traded fund issuers have been making moves to list their proposed Litecoin ETFs in the United States.

Litecoin’s (LTC) market capitalization surged by 46% from Feb. 2 to 19, showing increased investor interest, reported Santiment on Feb. 21. It added that part of this growth comes from “its strong rise in network utility, which has been processing $9.6 billion in daily transaction volume over the past 7 days.”

Litecoin had around $2.8 billion in daily transaction volume in late August so current levels represent a surge of 243% in five months. Additionally, LTC prices have doubled since early November, outpacing the broader crypto market, which has seen gains of 42% over the same period.

Litecoin daily transaction volume vs price. Source: Santiment

“There is clear growing excitement around a potential Litecoin ETF, 13 months after Bitcoin’s first ETFs were approved by the SEC,” said Santiment.

The Securities and Exchange Commission posted an acknowledgment for a rule change to list the CoinShares spot Litecoin ETF on the Nasdaq on Feb. 19.

Meanwhile, a listing of Canary Capital’s Litecoin ETF was spotted on the Depository Trust and Clearing Corporation (DTCC) system under the ticker LTCC on Feb. 20.

The DTCC is a key part of global financial markets and processes trillions of dollars in securities transactions each day, explained the Litecoin Foundation, which added, “It’s a key preparatory step for the fund’s potential launch.”

Source: Litecoin Foundation

Bloomberg ETF analyst Eric Balchunas cautioned that it doesn’t mean the product is approved or ready to start trading, “but it does show the issuer is making preparations for when it is.” He added that the analysts’ odds for approval this year were still at 90%.

Related: Analyst says spot Bitcoin ETFs used for ‘massive market manipulation’ — Is he right?

LTC prices spiked around 8.5% in response to the DTCC listing, climbing from an intraday low of $127 to $138 before a slight pullback on Feb. 21.

The asset has risen almost 30% over the past fortnight, outperforming Bitcoin (BTC), which has remained tightly range-bound since it fell back into five figures in early February.

Magazine: ETH whale’s wild $6.8M ‘mind control’ claims, Bitcoin power thefts: Asia Express