100X MEMEBOX Launches to Redefine Wealth Building in Crypto

The post 100X MEMEBOX Launches to Redefine Wealth Building in Crypto appeared first on Coinpedia Fintech News 100X has officially launched one of its most powerful and forward-thinking ecosystem products to date—100X MEMEBOX—marking a bold leap into the future of structured, trend-driven wealth generation in […]

Sponsored

How to stake Solana (SOL) in 2025: A step-by-step guide for beginners

Key takeaways Staking Solana allows you to earn passive income through staking rewards while participating in network governance. There is no minimum requirement for staking Solana, but the practical minimum is around 0.01 SOL. All you need to start staking Solana is a SOL-compatible wallet. […]

AnalysisDOGE to $4? Dogecoin Plots a Comeback, While $0.20 Rival Token Shows Prospects of a 14560% Surge

The post DOGE to $4? Dogecoin Plots a Comeback, While $0.20 Rival Token Shows Prospects of a 14560% Surge appeared first on Coinpedia Fintech News Dogecoin has shown a 9.74% daily growth to reach $0.2021 in trading value and experts predict it will skyrocket to […]

Sponsored

Can Strategy Survive a Bitcoin Crash? The Company’s Risky Capital Model Under Scrutiny

The post Can Strategy Survive a Bitcoin Crash? The Company’s Risky Capital Model Under Scrutiny appeared first on Coinpedia Fintech News MicroStrategy Incorporated, recently renamed as Strategy, is the largest publicly traded corporate owner of Bitcoin, with 528,185 BTC purchased at an average price of […]

Research report

The post Can Strategy Survive a Bitcoin Crash? The Company’s Risky Capital Model Under Scrutiny appeared first on Coinpedia Fintech News

MicroStrategy Incorporated, recently renamed as Strategy, is the largest publicly traded corporate owner of Bitcoin, with 528,185 BTC purchased at an average price of $67,458, with total acquisition cost of $35.63 billion.

As of April 2025, its Bitcoin holdings are worth around $41.3 billion, with the most recent purchase of 22,048 BTC for $1.92 billion on March 30 at $86,969 per BTC. Bitcoin is now Strategy’s main treasury reserve asset, and its BTC Yield—a key performance indicator measuring Bitcoin per share—rose 11% YTD during Q1, aiming for 15% annually to 2027.

Microstrategy SEC filing

SEC filings in recent times point to the volatility that comes with Strategy’s Bitcoin model. During Q1 2025, the firm had a $5.91 billion unrealized loss caused by a price fall to $77,351, which was offset by a $1.69 billion tax benefit.

The capital structure of the company is comprised of $8.65 billion raised in the form of equity and debt since 2020, for funding continuous Bitcoin acquisitions. The highlight was raising $2 billion in February 2025 using zero-coupon convertible notes that are due in 2030. Strategy also went public with a preferred stock (STRK) offering during Q4 2024 and raised $584 million.

In spite of volatility, the firm’s overall Bitcoin holding is still in profit with an unrealized gain of 14.62%. Its software segment still lags behind, reporting $120.7 million in Q4 2024 revenue, down 3% YoY, and failing to produce positive operating cash flow. The firm depends greatly on financing for its operations and Bitcoin acquisitions, having done a 10-for-1 stock split in July 2024 to increase share availability.

Liquidation risk is contained at present. With $8.2 billion in unsecured loans and no collateralized loans for Bitcoin, Strategy could potentially repay all of its debt by selling 15% of its BTC at current market prices.

Bitcoin through shares

Executive Chairman Michael Saylor’s 46.8% voting share guarantees continuation of the Bitcoin-first strategy, and he asserts even a decline in Bitcoin’s price wouldn’t lead to a selloff.

Strategy’s equity and debt offering-based fund conversion strategy—using stock and note issuance to purchase BTC has been referred to as an “infinite money glitch.” Strategy purchases additional Bitcoin by issuing stock and notes at a premium, driving both BTC and MSTR’s stock upward.

This model relies on investor faith and sustained appreciation of Bitcoin. Any extended decline in Bitcoin’s price may test its capacity to raise capital or service its obligations.

Critics point to centralization risks, possible tax burdens on $18 billion of unrealized gains, and regulatory attention from organizations such as the SEC. At the same time, the stock of the company experienced a 336% jump in 2024, although it dropped by 55% from a high of $543 in November to $250 by February 2025.

In summary, Strategy’s aggressive Bitcoin approach continues to provide returns but with high risk of exposure to market volatility, debt risk, and regulatory issues. Its success will depend on Bitcoin’s long-term trend and Saylor’s dogged adherence to the “never sell” mantra.

Tariff Turmoil: How Trade Wars Are Shaking Global and Crypto Markets

The post Tariff Turmoil: How Trade Wars Are Shaking Global and Crypto Markets appeared first on Coinpedia Fintech News On April 6, 2025, veteran US President Donald Trump fueled the economic competition between the globe’s two greatest economies by imposing a blanket 50% tariff on […]

Research report

The post Tariff Turmoil: How Trade Wars Are Shaking Global and Crypto Markets appeared first on Coinpedia Fintech News

On April 6, 2025, veteran US President Donald Trump fueled the economic competition between the globe’s two greatest economies by imposing a blanket 50% tariff on all imports from China.

Dubbed as “Liberation Day,“ the action was designed to bring new life to American manufacturing, but instead set off a financial chain reaction that spilled well outside of conventional markets right into the center of crypto.

Global Market reaction on Tariffs

The initial response was pandemonium in all financial markets worldwide. The MSCI Asia-Pacific Index dropped more than 3%, and the Shanghai Composite plummeted by 4.7% an indication of serious investor nervousness in China. European markets were not immune either: Germany’s DAX and the UK’s FTSE 100 fell under the weight of dented export expectations.

On the other side of the Atlantic, American indices plummeted. The Dow Jones Industrial Average fell 600 points, while the NASDAQ dipped close to 2.5%. The hardest hit were semiconductor and electronics firms depending heavily on Chinese production. Fear drove investors into havens, driving gold to a 12-month high and sending U.S. Treasury yields down.

Crypto Market Reacted

The crypto space, which many at one time praised as a hedge against macro dislocation, wasn’t immune. Bitcoin (BTC) dropped close to 9% in the first 48 hours after the news. Ethereum (ETH) followed suit, dropping more than 8%. Risk sentiment had well and truly turned, and the digital asset market, inextricably linked to global investor sentiment, was subjected to sharp liquidation.

Asia-specific tokens such as NEO (baptismally referred to as the “Chinese Ethereum”) and VeChain (VET), which is associated with larger Chinese logistics and supply chain companies, experienced gruesome declines falling 12% and 15% respectively. Even US-preferred instruments were not exempt: Solana (SOL) fell by 10%, most of its drop coming courtesy of its extreme vulnerability to DeFi and institutionality trading.

While it was Layer-1 blockchains that bore the bulk of the blow, stablecoins were not spared either. Tether (USDT) redemption volumes spiked, particularly on Asian exchanges such as Binance and OKX, indicative of a flight to cash. Decentralized exchanges (DEXs) such as Uniswap and PancakeSwap, on the other hand, experienced major volume declines, indicating that retail investors were taking liquidity out of the market instead of trading the dip.

So why did stocks and crypto sell off in sync?

For one, crypto remains a speculative asset class. During periods of uncertainty, speculative assets are the first to be dumped. Second, big institutionals now control a significant proportion of crypto volume. These institutions play macro strategies—when fear increases, their capital reverses and moves to safer bets such as cash, gold, or short-term government bonds.

Worsening the situation further were early rumors of capital controls in Hong Kong and Singapore two key crypto hubs. Speculation that regulators might restrict crypto transactions to control capital flight led to further panic, especially among investors based in Asia.

As Bitcoin struggled, gold shone again. The Gold Shares (GLD) ETF recorded its largest one-day inflow in half a year. U.S. manufacturing ETFs experienced fleeting optimism, but most high-growth technology stocks particularly chipmakers such as Nvidia and TSMC got hammered.

In the cryptocurrency universe, those with lesser geographic and trade exposure performed better. Chainlink (LINK), which is decentralized in its oracle infrastructure, lost less than most, and some investors predicted that utility-based tokens would provide more stability in macro-driven routs.

Tariffs drama continuous

The tariff drama is more than politics it’s a stress test of the old and new economy. It demonstrated to us that crypto isn’t this digital island nation that is in some way proof against real world events. Whenever systemic risk beckons, any asset be it fiat, gold, or crypto adapts.

It also reshaped the narrative around Bitcoin’s “digital gold” thesis. While it has outperformed in some local crises (like inflation in Argentina or sanctions on Russia), in a globally synchronized panic, Bitcoin failed to serve as a safe haven. That doesn’t diminish its long-term value proposition, but it’s a reminder: we’re not there yet.

While the world grapples with this latest kick in the teeth of the U.S.–China dynamic, investors and crypto fans will have to reset expectations. Volatility is the new normal, yet in that chop is opportunity.

Builders will redouble efforts on decentralization. Regulators will catch up on how essential good crypto standards are. And investors if smart will learn to hedge risk, control emotions, and diversify better.

After all, Bitcoin was the product of a crisis. Perhaps this one will be the crucible out of which fresh innovation emerges once more.

How to mine Bitcoin at home in 2025

Key takeaways Lottery mining is cheap and fun, but don’t count on hitting a block. Solo ASIC mining gives you complete control, but it’s a long-odds game. Pool mining is the most practical way to earn steady payouts at home. Cloud mining saves you the […]

Analysis

Key takeaways

- Lottery mining is cheap and fun, but don’t count on hitting a block.

- Solo ASIC mining gives you complete control, but it’s a long-odds game.

- Pool mining is the most practical way to earn steady payouts at home.

- Cloud mining saves you the hassle but usually isn’t worth the cost.

Bitcoin is rapidly gaining legitimacy, and you couldn’t be blamed for wanting to peek behind the curtain to see how it’s made.

Throughout 2024 and into 2025, you’ve seen a whirlwind of institutional investment from companies like Strategy, which continues to aggressively accumulate Bitcoin (BTC), and Metaplanet, Japan’s listed company that recently adopted BTC as a treasury reserve asset.

Moreover, on the regulatory front, the return of a US President Donald Trump administration signals a friendlier stance toward crypto, with talk of rolling back SEC overreach and possibly supporting US-based mining.

Across the Atlantic, the MiCA (Markets in Crypto-Assets) regulation has gone into effect in the EU, offering clearer guidelines and reducing regulatory uncertainty for retail investors and miners alike.

Then there’s the price. Bitcoin finally broke the long-anticipated $100,000 resistance level in early 2025, following a post-halving supply shock and increased ETF-driven demand. As institutions pour in and supply tightens, more individuals are re-evaluating how to get involved.

Whatever your motivation, one thing’s certain: You want to mine from the comfort of your home.

This article will explain four realistic ways to mine Bitcoin at home in 2025, what gear you’ll need, how much it might cost, and what kind of returns you can expect.

Did you know? Bitcoin mining has developed into a sizable industry, with revenues growing by over 6,700% from 2021 to 2025.

Option 1: Lottery mining – Low power, high risk, rare rewards

If you’re working with a limited budget but still want to try Bitcoin mining, lottery mining offers an interesting — if highly unpredictable — way.

In July 2024, a solo miner using just three TH/s of hash power — roughly what you’d get from two small USB devices — successfully mined an entire Bitcoin block. The reward was 3.192 BTC, worth over $200,000 at the time. Statistically, that kind of result should take thousands of years. But with some luck and help from the Solo CKPool platform, it actually happened.

These wins are extremely rare, but they do happen. And that’s what keeps some people interested.

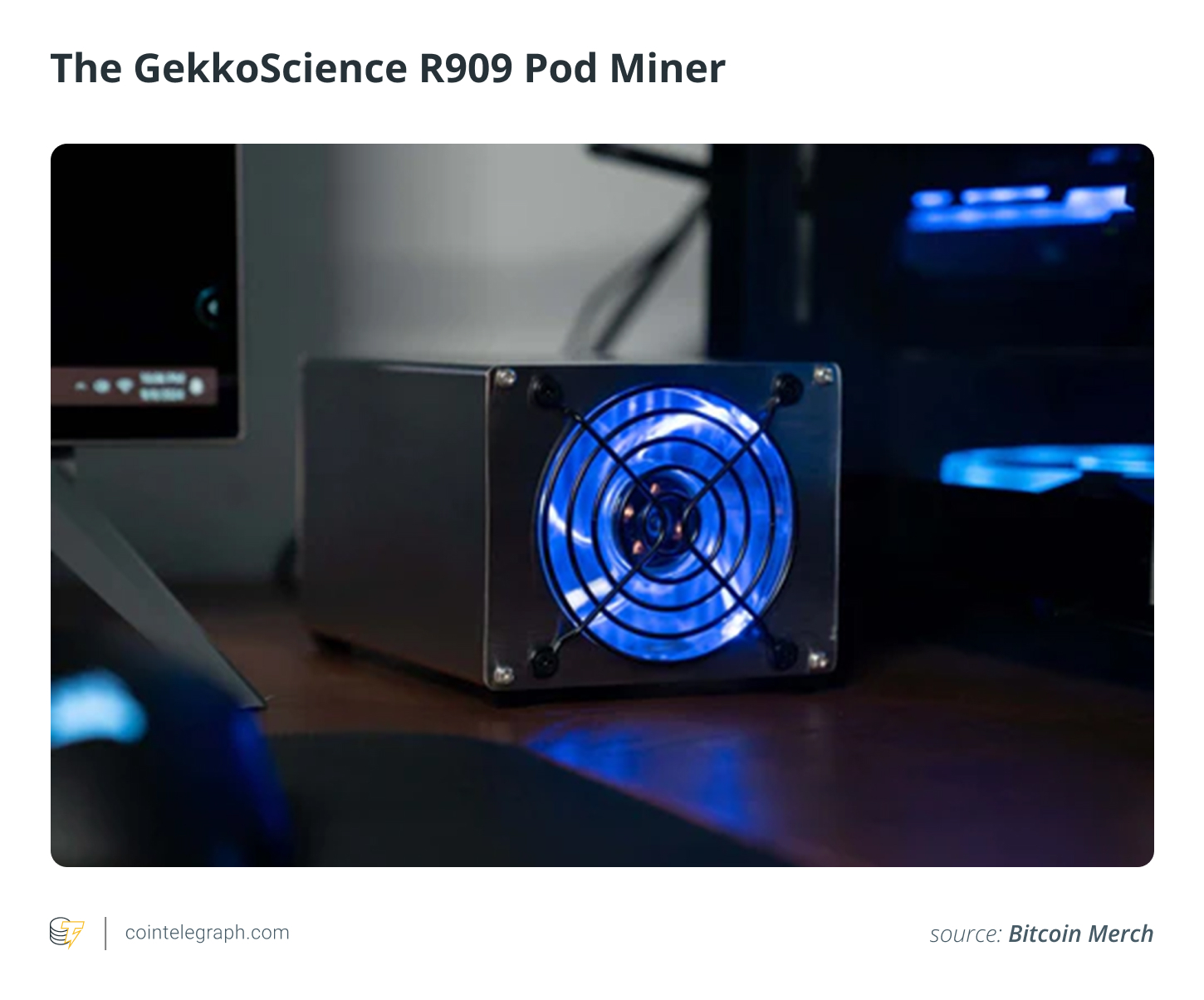

Most lottery miners use small, low-power devices like the Bitaxe HEX, an open-source miner built with actual Antminer chips. It runs at around three TH/s, costs about $600 and pairs easily with a Raspberry Pi. Another popular option is the GekkoScience R909, a USB miner running at 1.5 TH/s and a favorite among hobbyists.

These devices aren’t built for steady income. They’re closer to digital slot machines, but ones that still contribute to securing the Bitcoin network.

So why do people do it?

Three main reasons:

- Running an independent node supports the health and resilience of the Bitcoin network.

- It’s a good way to get familiar with how mining works.

- A single successful block can be worth a lot, and it’s all yours if it happens.

For most, it’s not about making money. It’s about the challenge and the curiosity, like building a custom PC or restoring a vintage radio. And yes, it also looks great plugged in on a shelf, blinking quietly under a glowing Bitcoin lamp.

Next up: ASICs, the heavy-duty hardware of serious miners.

Did you know? Solo CKPool is designed for independent miners who want to submit their shares directly to the Bitcoin network. Unlike traditional mining pools, if you’re successful here, the entire reward goes to you (minus a small pool fee). There’s no revenue sharing, no splitting blocks.

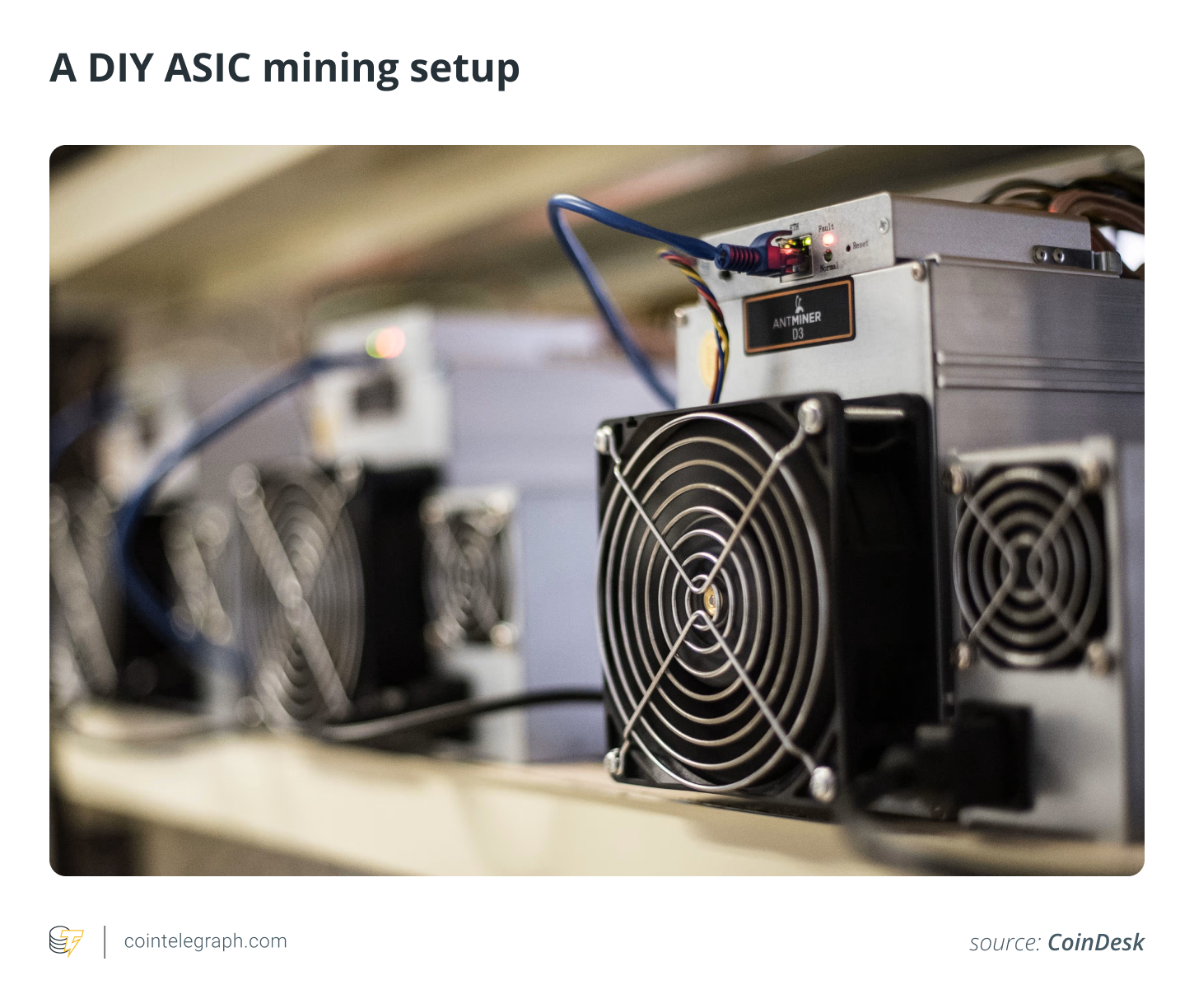

Option 2: ASIC mining – Solo mining with real hardware

If lottery mining is like buying a single ticket and hoping for a lucky break, solo mining with an ASIC is showing up with a small stack. Your chances improve, but it’s still a long shot.

ASICs — application-specific integrated circuits — are purpose-built for Bitcoin mining. In 2025, high-end models like the Antminer S21 Hydro deliver impressive performances, reaching around 400 terahashes per second with improved energy efficiency over previous generations.

Let’s look at the numbers.

The Bitcoin network currently runs at around 500 exahashes per second. With one S21 Hydro, you’d control roughly 0.00008% of the total hashrate. That gives you odds of about one in 8.6 billion of finding a block on any given day. It’s still extremely unlikely, but it’s far better than what you’d get with low-power USB miners.

To meaningfully improve your chances, you’d need to scale up.

Running 20 ASICs could put you past eight petahashes per second, enough, in theory, to find a block about once a year. But that setup requires significant capital, proper ventilation or immersion cooling and a reliable energy supply. Even then, outcomes are unpredictable. The Bitcoin network might find several blocks in an hour or none at all.

Still, some miners go this route. The appeal is simple: If you do find a block on your own, you keep the entire reward, currently over three BTC, plus transaction fees. There is no need to split the payout with anyone else.

But for most people, even those with top-tier ASICs, solo mining remains a high-risk approach with uncertain rewards.

Did you know? The cost of the latest mining equipment has significantly decreased, with prices around $16 per terahash in 2025, compared to $80 per terahash in 2022, enhancing mining efficiency.

That’s why many home miners eventually turn to a more consistent and scalable model:

Joining a mining pool.

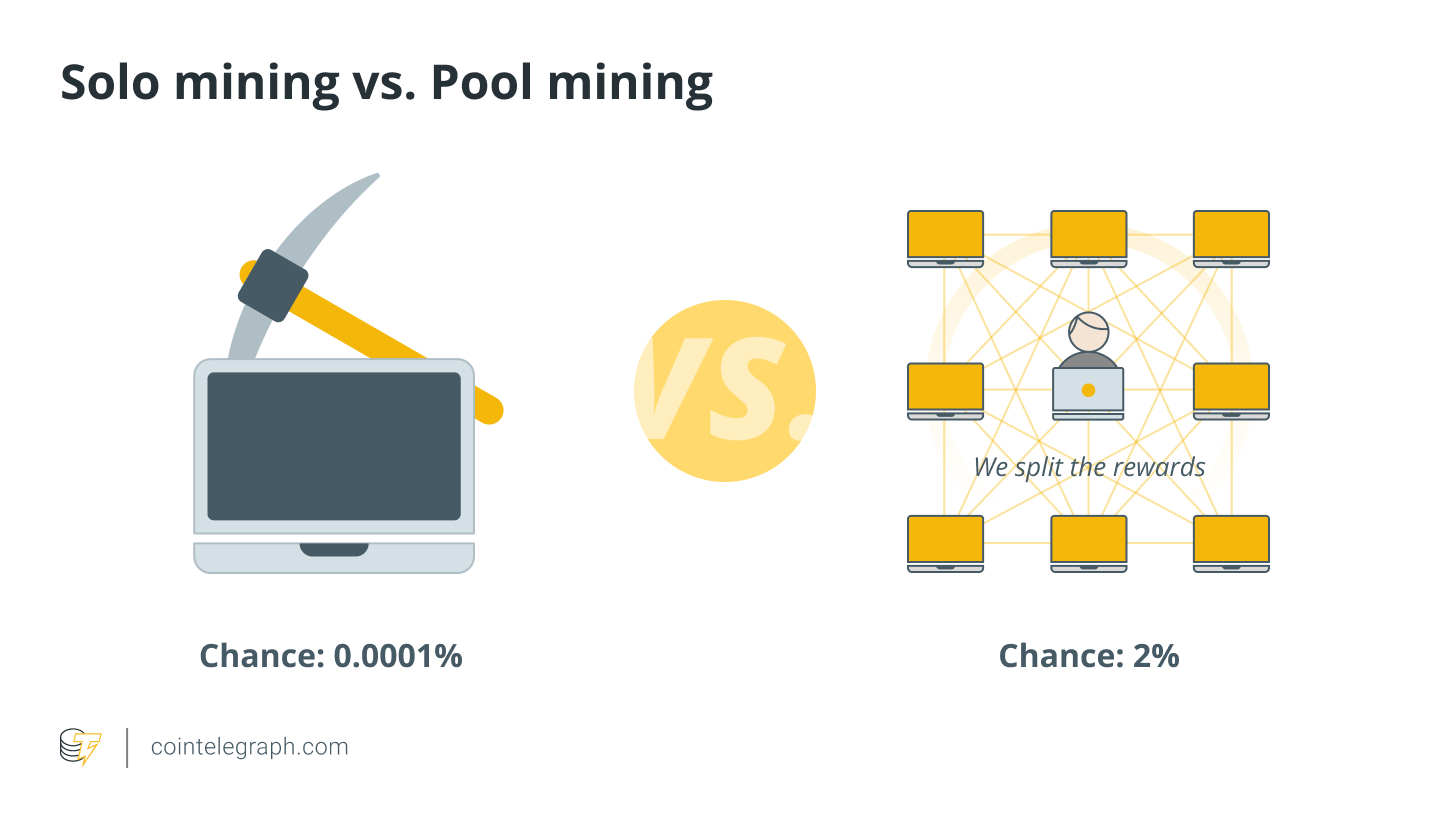

Option 3: Pool mining – Strength in numbers

If solo mining is a long shot, pool mining is the practical alternative. It’s how most home miners approach Bitcoin mining in 2025 – and with good reason.

By joining a mining pool, you combine your hashrate with thousands of other participants. When the pool successfully mines a block, the reward is split based on each miner’s contribution. You’re no longer chasing a rare solo win, but earning smaller, steady payouts. It’s more predictable, less risky and not so dependent on luck.

For example, if you’re running an Antminer S21 Hydro at 400 TH/s, that hash power earns you a proportional share of the pool’s rewards. You’ll likely see consistent daily income tied directly to your contribution.

The largest pools today — Foundry USA, Antpool, ViaBTC, F2Pool — handle thousands of blocks every month. Many offer FPPS (Full Pay Per Share) models, where you’re paid for every valid share you submit, regardless of whether a block is found that day.

Others use PPLNS (Pay Per Last N Shares), which only pays out when a block is discovered, but can result in slightly higher returns over time. The choice depends on how much payout fluctuation you’re comfortable with.

Setting things up is straightforward:

- Create an account with your chosen pool.

- Point your ASIC miner to the pool’s server.

- Add your Bitcoin payout address.

- Monitor your stats from the pool’s web dashboard.

The returns won’t be massive, but they’ll be consistent, and for many miners, that’s exactly the goal.

But what if you want to skip the hardware, the setup and the electricity costs altogether? What if you want exposure to mining without running a machine?

That’s where cloud mining comes in.

Option 4: Cloud mining – Mining without the machines

Cloud mining lets you rent hash power from a remote provider, who runs the hardware on your behalf. You don’t have to manage equipment, deal with heat or noise, or worry about electricity costs. You simply buy a contract, and if all goes well, you will receive a portion of the mining rewards.

On paper, it sounds straightforward. You select a provider, choose how much hash power you want to rent, and pay either upfront or through a subscription. The provider takes care of the infrastructure, including maintenance and cooling. In return, you earn a share of the Bitcoin mined, proportional to your rented power.

But there are trade-offs – and risks.

Cloud mining has gained a mixed reputation. Over the years, the space has been flooded with questionable operators, unrealistic return promises and outright scams. Many contracts turn out to be unprofitable once you factor in service fees, maintenance costs and the increasing difficulty of mining. You’re effectively trusting a third party to operate machines you’ll never see.

That said, there are a few reputable providers. Platforms like NiceHash, BitDeer and ECOS have remained active in the space and offer flexible, transparent options. Some let you choose specific coins or pools. Still, even with these more established names, margins tend to be very thin, especially during bear markets or when global hashrates spike.

Cloud mining may be worth considering if:

- You have limited access to cheap electricity or space for equipment.

- You’re looking for a low-effort way to get exposure to mining.

- You view it more as a speculative bet than a reliable income stream.

However, if your goal is consistent returns or hands-on experience, then running your own gear or just buying and holding Bitcoin is likely a better use of resources.

The bottom line

There’s no single right way to mine Bitcoin at home in 2025. It comes down to what you’re after. Lottery mining is fun and cheap, but the odds are long. Going solo with an ASIC gives you full control and full risk. Mining pools are the go-to for steady, reliable payouts. Cloud mining offers convenience but not much certainty.

If you’re in it for the learning, the experience, or to slowly stack sats over time, there’s a setup that’ll fit. Just know what you’re getting into and why you’re doing it.

New York bill proposes legalizing Bitcoin, crypto for state payments

A New York lawmaker has introduced legislation that would allow state agencies to accept cryptocurrency payments, signaling growing political momentum for digital asset integration in public services. Assembly Bill A7788, introduced by Assemblyman Clyde Vanel, seeks to amend state financial law to allow New York […]

Litecoin

A New York lawmaker has introduced legislation that would allow state agencies to accept cryptocurrency payments, signaling growing political momentum for digital asset integration in public services.

Assembly Bill A7788, introduced by Assemblyman Clyde Vanel, seeks to amend state financial law to allow New York state agencies to accept cryptocurrencies as a form of payment.

It would permit state agencies to accept payments in Bitcoin (BTC), Ether (ETH), Litecoin (LTC) and Bitcoin Cash (BCH), according to the bill’s text.

Source: Nysenate.gov

According to the bill, state offices could authorize crypto payments for “fines, civil penalties, rent, rates, taxes, fees, charges, revenue, financial obligations or other amounts,” as well as penalties, special assessments and interest.

Related: Trump’s tariff escalation exposes ‘deeper fractures’ in global financial system

Cryptocurrency legislation is becoming a focal point in New York, with Bill A7788 marking the state’s second crypto-focused legislation in a little over a month.

In March, New York introduced Bill A06515, aiming to establish criminal penalties to prevent cryptocurrency fraud and protect investors from rug pulls.

Crypto-focused legislation has gathered momentum since President Donald Trump took office on Jan. 20, with Trump signaling during his campaign that his administration intends to make crypto policy a national priority, as well as making the US a global hub for blockchain innovation.

Related: Illinois Senate passes crypto bill to fight fraud and rug pulls

New York may mandate state “service fee” on crypto payments

If passed, the bill would mark a significant shift in how New York handles digital assets. It would allow state entities to integrate cryptocurrency into the payment infrastructure used for collecting public funds.

The proposal also includes a clause allowing the state to impose a service fee on those choosing to pay with crypto. According to the text, the state may require “a service fee not exceeding costs incurred by the state in connection with the cryptocurrency payment transaction.” This could include transaction costs or fees owed to crypto issuers.

Assembly Bill A7788 has been referred to the Assembly Committee for review and may advance to the state Senate as the next step.

New York’s legislation comes shortly after the state of Illinois passed a crypto bill to fight fraud and rug pulls after the recent wave of insider schemes related to memecoins, Cointelegraph reported on April 11.

Magazine: XRP win leaves Ripple and industry with no crypto legal precedent set

What is a bear raid, and how do whales use them in crypto trading?

Key takeaways Bear raids involve deliberate efforts by whales to drive down crypto prices using short-selling, FUD and large-scale sell-offs to trigger panic and profit from the dip. These raids create volatility, trigger liquidations and damage retail confidence. However, they can also expose weak or […]

Analysis

Key takeaways

-

Bear raids involve deliberate efforts by whales to drive down crypto prices using short-selling, FUD and large-scale sell-offs to trigger panic and profit from the dip.

-

These raids create volatility, trigger liquidations and damage retail confidence. However, they can also expose weak or fraudulent projects.

-

Signs include sudden price drops, high trading volume, absence of news and quick recoveries, indicating price manipulation rather than natural market trends.

-

Traders can guard against bear raids by using stop-loss orders, diversifying portfolios, monitoring whale activity and trading on reputable, regulated platforms.

Bear raids involve deliberate efforts by whales to drive down crypto prices using short-selling, FUD and large-scale sell-offs to trigger panic and profit from the dip.

These raids create volatility, trigger liquidations and damage retail confidence. However, they can also expose weak or fraudulent projects.

Signs include sudden price drops, high trading volume, absence of news and quick recoveries, indicating price manipulation rather than natural market trends.

Traders can guard against bear raids by using stop-loss orders, diversifying portfolios, monitoring whale activity and trading on reputable, regulated platforms.

Not all market moves are organic in the dynamic world of crypto trading; some are engineered to make quick profits. One such tactic is the bear raid, often driven by powerful market players known as whales.

These traders strategically use short-selling, where they borrow and sell assets at current prices, aiming to repurchase them cheaper once the price drops.

So, how exactly does this tactic play out?

This article dives into what a bear raid is and how it functions. It also covers how bear raids impact the crypto market, what the signs are and how retail investors can protect their interests.

What is a bear raid?

A bear raid is a deliberate strategy to drive down the price of an asset, typically through aggressive selling and the spread of fear, uncertainty and doubt (FUD). The tactic dates back to the early days of traditional stock markets, where influential traders would collaborate to manipulate prices for profit.

Execution of a bear raid involves selling large volumes of a targeted asset to flood the market. The sharp increase in supply creates downward pressure on the price. At the same time, the perpetrators circulate negative rumors or sentiments, often through media, to amplify fear and uncertainty. As panic sets in, smaller or retail investors often sell off their holdings, further accelerating the price drop.

Bear raids differ from natural market downturns. While both lead to falling prices, a bear raid is orchestrated and intentional, meant to benefit those holding short positions. Natural downturns are driven by broader economic trends, market corrections or legitimate changes in investor sentiment.

Bear raids are generally considered a form of market manipulation. Regulatory agencies monitor trading activities, investigate suspicious patterns and penalize fraudulent practices such as pump-and-dump schemes or wash trading. To enhance transparency, they require exchanges to implement compliance measures, including KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols. By imposing fines, bans, or legal action, regulators work to maintain fair markets and protect investors.

Regulators attempt to deter cryptocurrency market manipulation by enforcing strict rules and oversight. In the US, the Securities and Exchange Commission (SEC) focuses on crypto assets that qualify as securities, while the Commodity Futures Trading Commission (CFTC) regulates commodities and their derivatives. Under the Markets in Crypto-Assets Regulation (MiCA) law, enforcement in the EU is the responsibility of financial regulators in the member states.

Did you know? In 2022, over 50% of Bitcoin’s daily trading volume was influenced by just 1,000 addresses — commonly called whales — highlighting their market-shaking power.

Who executes bear raids?

In the crypto world, “whales” are big investors capable of executing bear raids. Because of their substantial holdings of cryptocurrencies, whales can influence market trends and price movements in ways smaller retail traders cannot.

Compared to other traders, whales operate on a different scale, thanks to their access to more capital and advanced tools.

While you might be looking for short-term gains or simply following trends, whales often use strategic buying or selling to create price shifts that benefit their long-term positions. Their moves are carefully planned and can affect the market without you even realizing it.

If you are a regular crypto trader, you might be aware of the massive crypto movement between wallets. Such large-scale transfer of crypto causes panic or excitement in the cryptocurrency community. For example, when a whale transfers a large amount of Bitcoin (BTC) to an exchange, it may signal a potential sell-off, causing prices to dip. Conversely, removing coins from exchanges to self-custodial wallets might suggest long-term holding, which can lead to a price upswing.

The relatively low liquidity of crypto markets gives whales such influence over crypto trading. With fewer buyers and sellers compared to traditional financial markets, a single large trade can dramatically swing prices. This means whales can manipulate market conditions, intentionally or not, often leaving retail traders struggling to keep up.

Did you know? Bear raids often trigger automated liquidations in leveraged positions, sometimes causing crypto prices to nosedive by over 20% in minutes.

Real-world examples of whales profiting from falling prices

In crypto, cases of bear raids are generally hard to confirm due to anonymity. Nevertheless, these examples of incidents when whales made profits from falling cryptocurrency prices will help you understand how such scenarios work:

Terra Luna collapse (May 2022)

A Bank for International Settlements (BIS) report disclosed that during the 2022 crypto market crash, triggered by the collapse of Terra (LUNA), whales made a profit at the expense of retail investors. Smaller retail investors predominantly purchased cryptocurrencies at lower prices, whereas whales primarily sold off their holdings, profiting from the downturn.

In May 2022, the Terra blockchain was briefly suspended following the failure of its algorithmic stablecoin TerraUSD (UST) and the associated cryptocurrency LUNA, resulting in a loss of nearly $45 billion in market value in one week. The company behind Terra filed for bankruptcy on Jan. 21, 2024.

FTX collapse (November 2022)

In November 2022, close financial ties between FTX and Alameda Research set off a chain reaction: a bank run, failed acquisition deals, FTX’s bankruptcy and criminal charges for founder Sam Bankman-Fried.

Yet again, as FTX collapsed, retail investors rushed to buy the dip. Whales, however, sold crypto in bulk right before the steep price decline, according to the same BIS report that discussed the fall of Terra Luna.

Graph 1.B illustrates a transfer of wealth, where larger investors liquidated their holdings, disadvantaging smaller investors. Furthermore, Graph 1.C reveals that following market shocks, large Bitcoin holders (whales) reduced their positions, while smaller holders (referred to as krill in the report) increased theirs. The price trends indicate that whales sold their Bitcoin to krill before significant price drops, securing profits at the krill’s expense.

Bitconnect (BCC) shutdown (January 2018)

Bitconnect, a cryptocurrency promising unusually high returns via an alleged trading bot, experienced a dramatic collapse in early 2018. Despite reaching a peak valuation of over $2.6 billion, the platform was widely suspected of operating as a Ponzi scheme.

The token suffered a steep fall of over 90% in value within hours. While this was not a classic bear raid, the sudden exit of insiders and whale sell-offs, combined with negative publicity, created a cascading effect that devastated retail investors.

Did you know? Whale wallets are tracked so closely that some platforms offer real-time alerts for their trades, helping retail traders anticipate possible bear raids.

How whales execute bear raids in crypto, key steps

In the crypto space, whales can execute bear raids by leveraging their massive holdings to trigger sharp price drops and profit from the following panic. These tactics typically unfold in a few steps:

-

Step 1: Accumulating a position: Whales begin by taking positions that will benefit from falling prices, such as shorting a cryptocurrency or preparing to buy large quantities once the price drops.

-

Step 2: Initiating the raid: Next, the whale triggers the sell-off by dumping large volumes of the targeted crypto asset. This sudden surge in supply causes the price to drop sharply, shaking market confidence.

-

Step 3: Spreading FUD: To maximize the impact, whales may spread FUD using coordinated social media campaigns or fake news. Rumors like adverse regulatory action or insolvency can spread quickly, prompting retail traders to sell in panic.

-

Step 4: Triggering sell-offs: The combination of visible large sell orders and negative sentiment induces other investors to sell their holdings, amplifying the downward pressure on the asset’s price.

-

Step 5: Profiting from the dip: Once the price plunges, the whale steps in to either buy back the asset at a lower price or close their short positions for a profit.

The whales’ playbook: How do they manipulate the market?

Crypto whales use sophisticated tactics to carry out bear raids and manipulate the market to their advantage. These tactics give whales an edge over retail traders, enabling them to manipulate prices and profit while the latter are left to deal with the chaos:

-

Trading bots and algorithms: Advanced bots allow whales to execute large sell orders in milliseconds, triggering sharp price drops. Before the market can react, the whales turn the situation in their favor.

-

Leverage and margin trading: Whales rely (to a large extent) on leverage and margin trading to make profits. Borrowing funds enables them to increase their position size and amplify the sales pressure. It triggers stronger market reactions than would be possible with their holdings.

-

Low liquidity on certain exchanges: Whales can place large sell orders in illiquid markets with fewer participants and a low volume of trades, causing disproportionate price drops. They may even manipulate order books by placing and canceling large fake orders, known as spoofing, to trick other traders.

-

Collaborate with other whales: Whales may collaborate with other large holders or trading groups to coordinate attacks, making the bear raid more effective and harder to trace.

Impact of bear raids on the crypto market

Bear raids can significantly disrupt the crypto market. Here is how they impact different players and the broader ecosystem:

-

Effects on retail traders: Retail investors tend to react overwhelmingly during a bear raid. The sudden price drop and spread of fear often lead to panic selling, resulting in heavy losses for the investors who exit at the bottom. Most retail traders sell emotionally, not realizing they are playing into the whale’s strategy.

-

Broader market consequences: Bear raids increase market volatility, making it riskier for new and existing investors. These events can shake overall confidence in the crypto space, leading to reduced trading activity and investor hesitation. In extreme cases, they can even trigger liquidations across multiple platforms.

-

Potential positive outcomes: Bear raids can sometimes have cleansing effects on the crypto market. Market corrections induced by such raids remove overvalued assets from unsustainable highs. In some cases, these raids may expose weak or fraudulent projects, forcing investors to reassess their choices.

Signs of crypto bear raids

Bear raids are misleading market moves that resemble genuine downturns, often tricking traders into selling too soon. A quick drop in price may look like the start of a bearish trend, leading to impulsive decisions by retail traders.

Often, these dips are short-lived and followed by a swift recovery once the whales take their profits. Recognizing the signs of crypto bear raids is key to avoiding losses.

Here are a few signs of crypto bear raids:

-

A sudden price drop that seems to break support levels

-

Spike in trading volume during a market decline

-

Quick rebound after the dip

-

Negative sentiment causing trader panic

-

No major news to explain the drop

How to protect yourself from crypto bear raids

To safeguard your investments from crypto bear raids, you can use the following strategies:

-

Conduct thorough technical analysis: Regularly analyze price charts and indicators to discern genuine market trends from manipulative movements.

-

Implement stop-loss orders: Set predetermined sell points to automatically exit positions if prices fall to a certain level, limiting potential losses during sudden downturns.

-

Diversify your portfolio: Spread investments across various assets to mitigate risk. A well-diversified portfolio is less vulnerable to the impact of a bear raid on any single asset.

-

Stay informed: Monitor market news and developments to better anticipate and respond to potential manipulative activities.

-

Use reputable exchanges: Engage with trading platforms that have robust measures against market manipulation, ensuring a fairer trading environment.

The ethical debate: Crypto market manipulation vs free market dynamics

The principles of free market dynamics starkly contrast to market manipulation tactics, such as bear raids.

Proponents of free markets favor minimal regulatory intervention, arguing that it fosters innovation and self-regulation. A free market is an economic system in which supply and demand determine the prices of goods and services. Still, the decentralized and often unregulated nature of crypto markets has made them susceptible to manipulative practices.

Bear raids require coordinated efforts by perpetrators to drive down asset prices, misleading investors and undermining market integrity. Such tactics bring losses to retail investors and erode trust in the financial system.

Critics point out that without adequate oversight, these manipulative strategies can proliferate, leading to unfair advantages and potential economic harm.

While free market dynamics are valued for promoting efficiency and innovation, the implications of unchecked market manipulation in the cryptocurrency space can be disastrous. Incidents like bear raids highlight the need for balanced regulation to ensure fairness and protect investors.

Crypto regulations worldwide for market manipulation tactics

Cryptocurrency market manipulation, including tactics like bear raids, has prompted varied regulatory responses worldwide. In the US, the Commodity Futures Trading Commission (CFTC) classifies digital currency as commodities and actively pursues fraudulent schemes, including market manipulation practices such as spoofing and wash trading. The Securities and Exchange Commission (SEC) has also taken action against individuals who have manipulated digital asset markets.

The European Union has implemented the Markets in Crypto-Assets (MiCA) regulation to establish a comprehensive framework addressing market manipulation and ensure consumer protection regarding stablecoins.

These efforts notwithstanding, the decentralized and borderless nature of cryptocurrencies presents challenges for regulators. Global cooperation and adaptive regulatory frameworks are essential to effectively combat market manipulation and safeguard investors in the evolving landscape of digital finance.

Progression articles

Long and short positions in crypto, explained

A beginner’s guide on how to short Bitcoin and other cryptocurrencies

What is a bear trap in trading and how to avoid it?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

How to build a personalized crypto portfolio tracker using ChatGPT

Key takeaways AI tools like ChatGPT can help both experienced and new crypto investors track portfolios with ease, freeing up time for other investment activities and making the process more accessible. Defining specific requirements, such as which cryptocurrencies to track and the desired data points, […]

Analysis

Key takeaways

-

AI tools like ChatGPT can help both experienced and new crypto investors track portfolios with ease, freeing up time for other investment activities and making the process more accessible.

-

Defining specific requirements, such as which cryptocurrencies to track and the desired data points, is essential for building an effective portfolio tracker tailored to your investment goals.

-

By combining ChatGPT with real-time crypto data from APIs like CoinMarketCap, you can generate valuable market commentary and analysis, providing deeper insights into your portfolio performance.Developing additional features like price alerts, performance analysis and a user-friendly interface can make your tracker more functional, helping you stay ahead of market trends and manage your crypto investments more effectively.

AI tools like ChatGPT can help both experienced and new crypto investors track portfolios with ease, freeing up time for other investment activities and making the process more accessible.

Defining specific requirements, such as which cryptocurrencies to track and the desired data points, is essential for building an effective portfolio tracker tailored to your investment goals.

By combining ChatGPT with real-time crypto data from APIs like CoinMarketCap, you can generate valuable market commentary and analysis, providing deeper insights into your portfolio performance.Developing additional features like price alerts, performance analysis and a user-friendly interface can make your tracker more functional, helping you stay ahead of market trends and manage your crypto investments more effectively.

If you’re a cryptocurrency investor, you’ve clearly got a strong appetite for risk! Cryptocurrency portfolios involve many immersive stages, from desktop research on the profitability of cryptocurrencies to actively trading crypto to monitoring regulations. Managing a portfolio of cryptocurrencies can be complex and time-consuming, even for savvy investors.

Conversely, if you’re a newbie in the world of cryptocurrencies and want to set yourself up for success, you may be put off by the complexity of it all.

The good news is that artificial intelligence (AI) offers valuable tools for the crypto industry, helping you simplify portfolio tracking and analysis when applied effectively.

As an experienced crypto investor, this can help free up your valuable time to focus on other activities in your investment lifecycle. If you’re a new investor, AI can help you take that all-important first step. Read on to see how AI, and specifically, ChatGPT, can help you build a customized portfolio tracker.

To begin with, what is it?

Let’s find out.

What is ChatGPT?

ChatGPT is a conversational AI model that can deliver various tasks using user-defined prompts — including data retrieval, analysis and visualizations.

The GPT stands for “Generative Pre-trained Transformer,” which references the fact that it is a large language model extensively trained on copious amounts of text from diverse sources across the internet and designed to understand context and deliver actionable results for end-users.

The intelligence of ChatGPT makes it a powerful resource for building a crypto portfolio tracker specifically geared toward your investment profile and objectives.

Let’s learn how to build a custom portfolio tracker with ChatGPT.

Step 1: Define your requirements

Technical specifics notwithstanding, it is crucial to first define what you expect from your crypto portfolio tracker. For example, consider the following questions:

-

What cryptocurrencies will you track?

-

What is your investment approach? Are you looking to actively day trade cryptocurrencies or are you looking to “buy and hold” them for the long term?

-

What are the data points you need to compile for the tracker? These may include but are not limited to price, market cap, volume and even news summaries from the web that could materially alter your investment decisions.

-

What exactly do you need the tracker to deliver for you? Real-time updates? Periodic summaries? Perhaps a combination of both?

-

What do you want the output to look like? Alerts, performance analysis, historical data or something else?

Once you have a clear understanding of your requirements, you can move on to the next steps. It is best practice to write down your requirements in a consolidated specifications document so you can keep refining them later if required.

Step 2: Set up a ChatGPT instance

This is the fun bit! Well, it is if you enjoy geeking out on code. Remember that ChatGPT is a large language model with a vast amount of intelligence sitting underneath it.

Using ChatGPT effectively therefore requires you to be able to access the underlying model, which you can do via an Application Program Interface, or API.

The company that owns ChatGPT — OpenAI — provides API access to the tool you can utilize to build your tracker. It’s simpler than you might think. You can use a basic three-step process to set up your own ChatGPT instance:

-

Navigate to OpenAI and sign up for an API key.

-

Set up an environment to make API calls. Python is an ideal choice for this, but there are alternatives, such as Node.js.

-

Write a basic script to communicate with ChatGPT using the API key. Here’s a Pythonic script that you may find useful for incorporating OpenAI capabilities into Python. (Note that this is only intended as a representative example to explain OpenAI integration and not to be viewed as financial advice.)

Step 3: Integrate a cryptocurrency data source

With your ChatGPT instance set up, it is time to complete the other part of the puzzle, namely, your cryptocurrency data source. There are many places to look, and several APIs can help with the information required for this step.

Examples include CoinGecko, CoinMarketCap and CryptoCompare. Do your research on these options and choose one that fits your requirements. Once you’ve made your choice, choose one that fits your requirements and integrate it with the ChatGPT instance you spun up as part of Step 2.

For example, if you decide to use the CoinMarketCap API, the following code will get you the latest price of Bitcoin, which you may be trading as part of your crypto portfolio.

Step 4: Combine ChatGPT and crypto data

You’ve done the hard bit, and given that you now have both an AI capability (ChatGPT) and a cryptocurrency data source (CoinMarketCap in this example), you are ready to build a crypto portfolio tracker. To do this, you can leverage prompt engineering to tap into ChatGPT’s intelligence to request data and generate insights.

For example, if you want your tracker to return a summary of cryptocurrency prices at a desired time, summarized in a data frame for visualization, consider writing the following code:

====================================================================

“`python

# Set your OpenAI API key

client = OpenAI(api_key=openai_api_key)

messages = [

{“role”: “system”, “content”: “You are an expert market analyst with expertise in cryptocurrency trends.”},

{“role”: “user”, “content”: f”Given that the current price of {symbol} is ${price:.2f} as of {date}, provide a concise commentary on the market status, including a recommendation.”}

]

try:

response = client.chat.completions.create(

model=”gpt-4o-mini”,

messages=messages,

max_tokens=100,

temperature=0.7

)

commentary = response.choices[0].message.content

return commentary

except Exception as e:

print(f”Error obtaining commentary for {symbol}: {e}”)

return “No commentary available.”

def build_crypto_dataframe(cmc_api_key: str, openai_api_key: str, symbols: list, convert: str = “USD”) -> pd.DataFrame:

records = []

# Capture the current datetime once for consistency across all queries.

current_timestamp = datetime.now().strftime(“%Y-%m-%d %H:%M:%S”)

for symbol in symbols:

price = get_crypto_price(cmc_api_key, symbol, convert)

if price is None:

commentary = “No commentary available due to error retrieving price.”

else:

commentary = get_openai_commentary(openai_api_key, symbol, price, current_timestamp)

records.append({

“Symbol”: symbol,

“Price”: price,

“Date”: current_timestamp,

“Market Commentary”: commentary

})

df = pd.DataFrame(records)

return df

# Example usage:

if __name__ == ‘__main__’:

# Replace with your actual API keys.

cmc_api_key = ‘YOUR_API_KEY’

openai_api_key = ‘YOUR_API_KEY’

# Specify the cryptocurrencies of interest.

crypto_symbols = [“BTC”, “ETH”, “XRP”]

# Build the data frame containing price and commentary.

crypto_df = build_crypto_dataframe(cmc_api_key, openai_api_key, crypto_symbols)

# Print the resulting dataframe.

print(crypto_df)

“`

====================================================================

The above piece of code takes three cryptocurrencies in your portfolio — Bitcoin (BTC), Ether (ETH) and XRP (XRP), and uses the ChatGPT API to get the current price in the market as seen in the CoinMarketCap data source. It organizes the results in a table with AI-generated market commentary, providing a straightforward way to monitor your portfolio and assess market conditions.

Step 5: Develop additional features

You can now enhance your tracker by adding more functionality or including appealing visualizations. For example, consider:

-

Alerts: Set up email or SMS alerts for significant price changes.

-

Performance analysis: Track portfolio performance over time and provide insights.

-

Visualizations: Integrate historical data to visualize trends in prices. For the savvy investor, this can help identify the next major market shift.

Step 6: Create a user interface

To make your crypto portfolio tracker user-friendly, it’s advisable to develop a web or mobile interface. Again, Python frameworks like Flask, Streamlit or Django can help spin up simple but intuitive web applications, with alternatives such as React Native or Flutter helping with mobile apps. Regardless of choice, simplicity is key.

Did you know? Flask offers lightweight flexibility, Streamlit simplifies data visualization and Django provides robust, secure backends. All are handy for building tools to track prices and market trends!

Step 7: Test and deploy

Make sure that you thoroughly test your tracker to ensure accuracy and reliability. Once tested, deploy it to a server or cloud platform like AWS or Heroku. Monitor the usefulness of the tracker over time and tweak the features as desired.

The integration of AI with cryptocurrencies can help track your portfolio. It lets you build a customized tracker with market insights to manage your crypto holdings. However, consider risks: AI predictions may be inaccurate, API data can lag and over-reliance might skew decisions. Proceed cautiously.

Happy AI-powered trading!

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

How to use ChatGPT to turn crypto news into trade signals

Key takeaways ChatGPT can analyze crypto news headlines and generate actionable trade signals, helping traders make faster and more informed decisions. Well-crafted prompts are essential — the more specific your instructions, the more accurate and useful ChatGPT’s responses will be. News-based signals work best when […]

Analysis

Key takeaways

-

ChatGPT can analyze crypto news headlines and generate actionable trade signals, helping traders make faster and more informed decisions.

-

Well-crafted prompts are essential — the more specific your instructions, the more accurate and useful ChatGPT’s responses will be.

-

News-based signals work best when combined with broader market context, like Bitcoin trends or altcoin momentum, for a complete trading picture.

-

AI is a tool, not a guarantee — always verify its insights with other research, charts and risk management practices before executing trades.

ChatGPT can analyze crypto news headlines and generate actionable trade signals, helping traders make faster and more informed decisions.

Well-crafted prompts are essential — the more specific your instructions, the more accurate and useful ChatGPT’s responses will be.

News-based signals work best when combined with broader market context, like Bitcoin trends or altcoin momentum, for a complete trading picture.

AI is a tool, not a guarantee — always verify its insights with other research, charts and risk management practices before executing trades.

The cryptocurrency market moves fast, and staying ahead of the curve can feel overwhelming — especially for beginners. News plays a huge role in driving crypto prices, but how do you sift through the noise and turn it into actionable trade signals?

Enter ChatGPT, a powerful AI tool that can help you analyze crypto news and spot opportunities. This guide will walk you through how to use ChatGPT (or similar AI tools like Grok) to transform crypto news into trade signals, step by step.

However, note that the examples used in this article are simplified and brief, intended purely for illustration purposes — executing AI-generated crypto trades in the real world requires deeper analysis, broader data inputs and thorough risk management.

What are trade signals?

Before you dive in, let’s clarify what a trade signal is. A trade signal is a suggestion to buy or sell a cryptocurrency based on specific information — like price trends, market sentiment or breaking news.

For example, if a coin’s price drops due to increased supply, it might be a “buy” signal if you think it’s undervalued — or a “sell” if you expect it to fall further. The goal here is to use ChatGPT to help you identify these signals from the news.

Now, let’s dive into how you can use ChatGPT to turn crypto news into potential trade signals.

Step 1: Gather crypto news

To get started, you need some crypto news to analyze. Here’s how to find it:

-

Websites: Check crypto media websites of your choice.

-

Social media: Platforms like X are goldmines for real-time crypto updates — search hashtags like #Bitcoin, #Ethereum, #CryptoNews or any specific project you’re tracking.

-

News aggregators: Use tools like Google News or Feedly with keywords like “cryptocurrency” or “blockchain.”

For example, let’s say you find this headline:

“Pi Network price nears all-time lows as supply pressure mounts.”

Step 2: Open ChatGPT

If you’re using ChatGPT, head to the OpenAI website and log in. Then, type your questions or prompts into the chat interface.

Step 3: Craft a simple prompt

A “prompt” is just a clear instruction you give the AI. For beginners, keep it simple and specific. Tell ChatGPT what news you have and what you want it to do. Below is an example based on the above-selected headline:

Prompt and ChatGPT’s response

Prompt: “I read this news: ‘Pi Network price nears all-time lows as supply pressure mounts.’ Can you analyze this and tell me if it’s a buy or sell signal for Pi Network? Explain why (in brief).”

The image below shows a ChatGPT 4o response analyzing this piece of news. It suggests a sell signal, citing the 126.6 million PI token unlock (1.87% supply increase) as a bearish factor likely to push the $0.65 price lower due to weak demand. Limited exchange listings (e.g., not on Binance) and bearish technicals like the relative strength index (RSI) in oversold territory reinforce this.

However, buy confidence is noted for long-term investors, as the all-time low might indicate an oversold condition, hinting at a potential rebound. It also advises caution and further research.

Step 4: Ask follow-up questions

The first response might not cover everything, as seen above. Dig deeper with follow-ups like:

-

Follow-up prompt 1: “Are there risks to buying Pi Network at its all-time low? Organize your answer in brief points.”

The ChatGPT 4o response to the follow-up prompt No. 1 lists the risks of buying Pi Network at its all-time low ($0.65), as shown in the above image. It highlights token unlocks increasing supply and downward pressure, ongoing bearish momentum with no reversal signs, low liquidity due to absence from major exchanges like Binance, limited real-world utility and adoption, a centralized structure raising concerns, and speculative nature, as success hinges on uncertain future developments. This reinforces a cautious approach.

-

Follow-up prompt 2: “What happened to Pi Network’s price in the past when supply increased? Organize your response in brief points.”

ChatGPT 4o’s response to follow-up prompt No. 2 explains that token unlocks, like mining rewards, increase supply, often causing sharp price drops. For instance, the April 2025 unlock of 126.6 million PI tokens led to a 77% decline from February highs as demand lagged. This recurring pattern of price falls due to oversupply reinforces the bearish signal for Pi Network.

Step 5: Combine news with market context

News doesn’t exist in a vacuum. You could ask ChatGPT to factor in broader market trends. For example:

Prompt:

“Given this Pi Network news, how should I trade if Bitcoin is booming? Keep your answer brief.”

ChatGPT 4o’s response to the above prompt advises against buying Pi Network (PI) despite Bitcoin’s (BTC) rise. It suggests avoiding PI due to its weak momentum and oversupply, recommending a focus on stronger assets like Bitcoin or altcoins benefiting from the market uptrend. It also advises waiting for PI demand or exchange listings to improve and using stop-losses if attempting to buy the dip, emphasizing capital protection.

Step 6: Test and refine

AI isn’t perfect — it’s a tool, not a crystal ball. Test its suggestions with small trades or paper trading (simulated trades without real money). Over time, tweak your prompts to get better results. For example:

-

“Analyze this news — “Pi Network price nears all-time lows as supply pressure mounts” — and give me a buy/sell signal with a confidence score.”

Caution: Limitations to be aware of

The example in this article is based on one news headline and a few prompts. In the real world, successful trading requires analyzing multiple news sources, market trends and technical indicators. Relying on a single news item or prompt can lead to incomplete insights, so always cross-check and diversify your research.

Did you know? In 2024, cryptocurrency scams generated a record-breaking $12.4 billion, with over 83% of the fraud tied to high-yield investment schemes and AI-driven “pig butchering” scams, according to Chainalysis — highlighting how artificial intelligence is now fueling the next wave of crypto crime.

Risks of using ChatGPT-powered crypto trading insights

Crypto trading with AI bots and tools like ChatGPT can be powerful, but it’s not without risks. Understanding these pitfalls can help you trade more safely.

-

Market volatility: Crypto prices can swing wildly, and bots may not react well to sudden crashes or pumps.

-

Overreliance on AI: ChatGPT’s signals are based on its interpretation of news, which might miss broader market trends or technical factors.

-

Technical issues: Bot platforms can face downtime, bugs or API connection errors, potentially leading to missed trades or losses.

-

Limited news scope: Relying solely on one news headline (like the Pi Network example) could lead to incomplete analysis.

-

Security risks: If API keys are compromised, your funds could be at risk. Always enable two-factor authentication (2FA) on your exchange.

Tips for success

A few best practices can help you get the most out of ChatGPT-powered trading insights while minimizing risks.

-

Be specific: Vague prompts like “What’s a good trade?” won’t help. Include the news and crypto you’re focused on.

-

Cross-check: Use ChatGPT’s analysis as a starting point, then verify with price charts or other traders’ opinions on X.

-

Stay updated: Crypto moves fast. Feed the AI the latest news for fresh signals.

-

Manage risk: Never trade more than you can afford to lose — AI can guide you, but it’s not foolproof.

-

Start small: Test your bot with a small amount of capital to understand how it performs with ChatGPT’s signals.

-

Diversify signals: Use ChatGPT to analyze multiple news sources, not just one, for a well-rounded strategy.

-

Set stop-losses: Protect your funds by setting stop-loss limits to cap potential losses.

-

Stay informed: Regularly check market trends and news to ensure ChatGPT’s signals align with the bigger picture.

Ready to try a new headline?

Now that you’ve seen how to turn crypto news into trade signals using ChatGPT, it’s time to put it into action! Pick a fresh headline and follow the steps above.

With practice, you’ll get better at spotting opportunities and making informed trades. However, keep in mind that ChatGPT is not a financial adviser — always assess your own risk tolerance before acting on AI-generated insights.

Safe trading!

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

How to use Render Network for decentralized GPU rendering

Key takeaways Render Network connects GPU owners with creators, allowing users to rent idle graphics power for AI training, 3D rendering and crypto-related projects. The RNDR token powers the ecosystem, enabling fast, transparent and decentralized transactions between creators and node operators. Decentralized rendering is more […]

Analysis

Key takeaways

-

Render Network connects GPU owners with creators, allowing users to rent idle graphics power for AI training, 3D rendering and crypto-related projects.

-

The RNDR token powers the ecosystem, enabling fast, transparent and decentralized transactions between creators and node operators.

-

Decentralized rendering is more accessible and cost-effective than traditional centralized GPU services, solving issues such as pricing, scalability and vendor lock-in.

-

Proof-of-render ensures verified outputs, rewarding only completed, validated tasks while maintaining blockchain-level trust and transparency.

Render Network connects GPU owners with creators, allowing users to rent idle graphics power for AI training, 3D rendering and crypto-related projects.

The RNDR token powers the ecosystem, enabling fast, transparent and decentralized transactions between creators and node operators.

Decentralized rendering is more accessible and cost-effective than traditional centralized GPU services, solving issues such as pricing, scalability and vendor lock-in.

Proof-of-render ensures verified outputs, rewarding only completed, validated tasks while maintaining blockchain-level trust and transparency.

The hunger for powerful graphics processing units (GPUs) has skyrocketed. Whether it’s training complex AI models or rendering high-fidelity 3D graphics, the demand often outstrips supply.

Traditional centralized GPU services, while effective, can be costly and sometimes inaccessible to smaller developers or artists. This is where the Render Network steps in, offering a decentralized approach to GPU rendering.

By connecting individuals who have idle GPU power with those who need it, Render Network creates a collaborative ecosystem that benefits both parties. This not only democratizes access to high-performance computing but also introduces a crypto-economic model, utilizing its native RNDR token to facilitate transactions.

In the sections that follow, you’ll learn how Render Network is contributing to the evolution of AI development and 3D rendering through decentralization and blockchain technology.

What is Render Network?

At its core, Render Network is like an Airbnb for GPU power. If you’ve got a powerful graphics card sitting idle, you can rent it out. And if you’re someone building an AI model or rendering a complex 3D scene but don’t have enough GPU muscle, you can tap into that unused power — on demand.

Here’s how it works:

Creators

These are the people who need serious computing power — think AI researchers training models, 3D artists rendering animations or developers working on visually demanding projects. Instead of buying expensive hardware or paying top dollar for centralized cloud services, they can just hop on Render Network and get access to what they need when they need it.

Node operators

On the flip side, there are folks who have GPUs collecting dust (or at least not being fully used). Maybe it’s a gaming rig that’s idle during work hours or a small mining setup looking for a better use case. These operators can plug into Render Network, offer up their GPU power, and earn crypto — specifically RNDR tokens — for their trouble.

RNDR token

The RNDR token (RNDR) is the fuel that keeps this whole ecosystem running. It’s the currency used to pay for jobs on the network. Creators pay in RNDR; operators earn in RNDR. Everything happens transparently onchain, and the token system helps keep things fair and efficient.

In short: Creators get access to affordable, decentralized computing power; node operators get rewarded for sharing their resources; and RNDR tokens make it all tick. It’s a win-win setup that’s especially useful in AI and crypto-heavy workflows.

Did you know? Render Network employs blockchain technology to ensure that every transaction and rendering task is securely recorded, promoting transparency and trust among users.

The role of decentralization in GPU rendering

If you’ve ever tried renting GPU power from a big cloud provider, you know it can get expensive fast. And even then, you’re often competing with major corporations for access to the best hardware. The whole system works, sure, but it’s not exactly built with flexibility or accessibility in mind.

That’s where decentralization comes in. Render Network flips the script by spreading the workload across a global network of independent GPU owners. Instead of relying on a single provider, you’re tapping into thousands of available machines — from gaming rigs to pro-grade render farms — that might otherwise sit idle.

What’s the problem with centralized GPU rendering?

Centralized services come with a few key headaches:

-

It’s pricey: Renting powerful GPUs from the likes of Amazon Web Services or Google Cloud can eat through your budget quickly, especially if you’re running long jobs like training an AI model.

-

Scalability is limited: If you suddenly need more power, scaling up isn’t always smooth or instant. You’re stuck waiting in line — or paying more for priority access.

-

Access isn’t equal: Big corporations tend to hoard the best GPU availability, which makes it harder for smaller teams or indie creators to get what they need when they need it.

-

Vendor lock-in is real: Once you build your pipeline around one provider, switching later can be a pain (and expensive).

Why decentralization makes more sense

Now, here’s what a decentralized network like Render offers instead:

-

Lower costs: Because you’re tapping into existing resources that would otherwise be unused, pricing tends to be way more affordable.

-

Flexible scaling: Need more power? The network can grow with you — just pull in more nodes.

-

Equal access: There’s no gatekeeping. Anyone can request GPU resources, and anyone can provide them. It’s a much more level playing field.

-

Earn while you sleep: If you’ve got a powerful GPU, you can make it work for you by sharing it on the network when you’re not using it.

All in all, decentralized GPU rendering is quickly becoming the practical choice for AI builders, 3D artists and crypto-native developers who want more control over their tools and budget.

The crypto economy within Render Network

As you briefly explored, at the heart of Render Network’s decentralized rendering platform is its native cryptocurrency, the RNDR token. Let’s dive deeper.

RNDR token mechanics

The RNDR token serves as the primary medium of exchange within the Render Network. Creators use RNDR tokens to pay for rendering services, while node operators earn these tokens by providing their GPU power to process rendering tasks. This system creates a self-sustaining economy where computational resources are efficiently allocated and fairly compensated.

Additionally, a small percentage of RNDR tokens, ranging from 0.5% to 5%, is charged on every transaction to support the ongoing development and maintenance of the network.

Earning RNDR tokens

Once onboarded, node operators can connect their GPUs to the network and start accepting rendering jobs. After successfully completing and submitting a rendering task, the work undergoes verification to ensure quality standards are met. Upon approval, the corresponding RNDR tokens are transferred to the node operator’s digital wallet as compensation for their contribution.

Spending RNDR tokens

Creators looking to access rendering services can acquire RNDR tokens through various cryptocurrency exchanges. Once they have the tokens, they can submit their rendering projects to the network. The system calculates the required RNDR tokens based on the project’s complexity and resource demands. After the rendering is completed and the output meets the creator’s expectations, the RNDR tokens are released from escrow and transferred to the node operators who processed the job.

This token-based economy not only streamlines the transaction process within the Render Network but also fosters a collaborative environment where both creators and node operators benefit from the decentralized exchange of rendering services.

Did you know? Render Network utilizes a unique proof-of-render mechanism, which validates completed rendering tasks before compensating node operators. This system mirrors blockchain’s transaction validation processes, ensuring that only verified work is rewarded.

Getting started with Render Network

Here’s how to get started with Render Network.

For creators

Setting up an account and submitting rendering tasks require the following:

-

Obtain an OctaneRender license: Ensure you have an active OctaneRender license or subscription, which can be purchased from OTOY.

-

Access the Creator Portal: With your OctaneRender credentials, log in to the Creator Portal.

-

Prepare your project: Export your project as an ORBX file using OctaneRender. This format encapsulates all necessary assets and settings for rendering.

-

Submit your job: Upload the ORBX file to the Creator Portal, configure your rendering parameters (such as resolution and sample size), and choose a service tier that fits your needs.

-

Monitor and retrieve results: Once submitted, you can monitor the progress of your rendering tasks through the portal. Upon completion, download your rendered assets directly from the platform.

For node operators

Registering GPUs on the network requires:

-

Express interest: Complete the Render Network Interest Form to join the onboarding queue.

-

Await onboarding instructions: Once a slot becomes available, the Render Network team will provide further instructions for setting up your node.

By following these steps and best practices, both creators and node operators can effectively engage with the Render Network, leveraging its decentralized infrastructure for efficient rendering solutions.

A bright future for Render Network?

Render Network is quickly becoming a go-to solution for anyone needing serious GPU power — especially in AI and crypto. Decentralizing access to high-performance computing makes rendering and model training faster, cheaper and way more accessible.

What’s exciting is where it’s headed. The network is expanding to support more advanced AI workflows and exploring deeper integration with other blockchain ecosystems. That means more tools, more flexibility and even broader use cases — whether you’re building with AI, working in 3D or developing onchain applications.

At the end of the day, Render Network is creating a new kind of infrastructure where creators and GPU owners can work together, earn and scale. Whether you’re here to build or contribute, it could be a space worth jumping into.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Tried automating crypto trades with Grok 3? Here’s what happens

Key takeaways Grok 3 adjusts its predictions based on evolving market trends by analyzing real-time data patterns. Combining technical analysis with sentiment data improves accuracy; Grok 3 effectively identifies potential trade opportunities. Backtesting strategies before live trading is crucial; testing Grok 3’s prompts using historical […]

Analysis

Key takeaways

-

Grok 3 adjusts its predictions based on evolving market trends by analyzing real-time data patterns.

-

Combining technical analysis with sentiment data improves accuracy; Grok 3 effectively identifies potential trade opportunities.

-

Backtesting strategies before live trading is crucial; testing Grok 3’s prompts using historical data helps refine conditions and improve performance.

-

While Grok 3 can automate trades, human oversight remains critical in adapting to unexpected market conditions.

Grok 3 adjusts its predictions based on evolving market trends by analyzing real-time data patterns.

Combining technical analysis with sentiment data improves accuracy; Grok 3 effectively identifies potential trade opportunities.

Backtesting strategies before live trading is crucial; testing Grok 3’s prompts using historical data helps refine conditions and improve performance.

While Grok 3 can automate trades, human oversight remains critical in adapting to unexpected market conditions.

Crypto trading is complex. Prices can swing wildly, and even experienced traders struggle to keep up. That’s why automation tools are gaining attention, with many now exploring Grok 3, an advanced artificial intelligence (AI) model from xAI (founded by Elon Musk).

Grok 3 wasn’t built specifically for trading, but its ability to analyze data, spot patterns and interpret trends has encouraged traders to test it for automated strategies. The idea is simple: Let Grok 3 make data-driven decisions, removing the emotional guesswork that often leads to poor trades.

But does it actually work? Some traders report impressive results, while others find it unpredictable, especially in volatile markets.

This article digs into what happens when you automate crypto trades with Grok 3. From successful strategies to unexpected risks, you’ll get a clear picture of what to expect, plus actionable tips to improve your results.

What is Grok 3 and how does it relate to crypto trading?

Grok 3 is an AI model designed by xAI, an artificial intelligence company founded by Elon Musk. While its primary focus is natural language processing, some traders are now testing Grok 3 as a potential tool for improving crypto trading strategies. Unlike traditional trading bots operating on rigid rules, Grok 3’s flexible design allows it to analyze diverse data sources and uncover patterns that might be overlooked.

Why some traders are turning to Grok 3

Grok 3’s appeal lies in its ability to handle complex data, a crucial advantage in crypto markets, where price moves are often triggered by unexpected events or sentiment shifts.

Here’s where traders say Grok 3 has potential:

-

Identifying market sentiment trends: Crypto markets are heavily influenced by emotions like FOMO (fear of missing out) and FUD (fear, uncertainty, doubt). Grok 3 can analyze social media, news headlines and community discussions to assess changing sentiment, a key factor in crypto volatility.

-

Recognizing hidden patterns: Grok 3’s machine learning capabilities allow it to detect subtle correlations between indicators that traditional bots may overlook. For instance, Grok 3 may link an increase in social sentiment with rising whale activity to predict bullish momentum.

-

Flexible analysis based on prompts: Rather than following static rules like “Buy when RSI falls below 30,” Grok 3 enables traders to design more complex strategies using natural language instructions.

What happens when Grok 3 is used to automate crypto trades?