How to set up and use AI-powered crypto trading bots

Key takeaways AI-powered crypto trading bots use machine learning to make smarter, faster trading decisions — without emotions. Setting up a bot involves choosing a platform, connecting your exchange, configuring strategies and running backtests. Bots can run 24/7, react to data instantly and are ideal […]

Analysis

Forget PEPE—This New Memecoin Has a 20,000% Growth Target by Q4!

The post Forget PEPE—This New Memecoin Has a 20,000% Growth Target by Q4! appeared first on Coinpedia Fintech News A new memecoin has emerged, capturing attention with ambitious growth predictions by year’s end. Forecasts suggest an eye-popping 20,000% surge, drawing interest from across the crypto […]

Sponsored

What are XRP futures and how to invest in them?

If you’re following developments in the cryptocurrency market, you’ve likely noticed that Coinbase Derivatives has introduced XRP futures contracts to its US derivatives exchange. This move is part of a broader trend where regulated platforms are expanding access to futures trading, giving investors new ways […]

Analysis

How to set up and use AI-powered crypto trading bots

Key takeaways AI-powered crypto trading bots use machine learning to make smarter, faster trading decisions — without emotions. Setting up a bot involves choosing a platform, connecting your exchange, configuring strategies and running backtests. Bots can run 24/7, react to data instantly and are ideal […]

Analysis

Key takeaways

-

AI-powered crypto trading bots use machine learning to make smarter, faster trading decisions — without emotions.

-

Setting up a bot involves choosing a platform, connecting your exchange, configuring strategies and running backtests.

-

Bots can run 24/7, react to data instantly and are ideal for passive income seekers and active traders.

-

While powerful, they’re not “set-it-and-forget-it” tools. You’ll need to monitor performance and tweak strategies over time.

-

Understanding your goals (long-term investing, day trading, etc.) helps you choose the right bot and strategy.

AI-powered crypto trading bots use machine learning to make smarter, faster trading decisions — without emotions.

Setting up a bot involves choosing a platform, connecting your exchange, configuring strategies and running backtests.

Bots can run 24/7, react to data instantly and are ideal for passive income seekers and active traders.

While powerful, they’re not “set-it-and-forget-it” tools. You’ll need to monitor performance and tweak strategies over time.

Understanding your goals (long-term investing, day trading, etc.) helps you choose the right bot and strategy.

Crypto markets move fast and rarely sleep. That’s why AI-powered crypto trading bots are no longer a novelty. These bots use machine learning to analyze data, identify patterns and execute trades in real time, often faster and with more discipline than human traders.

From beginners looking to automate simple strategies to professionals deploying predictive models, AI bots offer a scalable way to participate in volatile markets.

This guide explains how to build the best AI trading bots for crypto, how AI trading bots work, how to set them up correctly and what to avoid for long-term performance, not just short-term automation.

What are AI-powered crypto trading bots?

AI-powered crypto trading bots are programs that automatically buy and sell crypto assets based on machine learning algorithms, rather than fixed rules. These bots ingest large volumes of historical and real-time data — price action, order book depth, volatility, even social sentiment — and use that information to detect opportunities.

Unlike traditional bots that act only when predefined conditions are met, AI bots can adjust dynamically. For example, a bot trained on past market behavior might delay execution during uncertain conditions or increase position sizing during high-confidence periods. This adaptability makes them particularly useful in high-frequency, volatile environments where speed and objectivity matter.

Advanced platforms like Freqtrade and Trality allow users to import custom-trained models, while others like Stoic by Cindicator use in-house quant research to automate portfolio balancing. The core advantage lies in their ability to reduce emotional trading and operate around the clock without fatigue.

How to set up an AI crypto trading bot

Getting started with an AI-powered crypto trading bot is easier than ever, especially with today’s user-friendly platforms.

But behind the ease of clicking “Start” lies a setup process that determines whether the bot performs reliably or becomes a source of costly errors. Proper setup ensures alignment with market conditions, trading goals and risk tolerance.

Below are a few key points to bear in mind while setting up crypto trading bots:

-

Choose a platform that supports AI functionality. Tools like Freqtrade, Trality and Jesse AI allow importing machine learning models. Others like 3Commas, Pionex and Cryptohopper focus on user-friendly automation and visual strategy builders.

-

Connect the bot to an exchange using API keys. Security settings should always disable withdrawal permissions, enable 2FA and restrict access via IP whitelisting where possible.

-

Configure the strategy. This includes defining trade pairs, order sizes, stop-loss and take-profit rules, cooldowns and maximum concurrent positions. Some platforms support prebuilt logic, while others allow full scripting with Python.

-

Backtest the strategy using historical data. Platforms like 3Commas, Cryptohopper and Freqtrade support robust backtesting to measure risk-adjusted performance across different market phases.

-

Deploy in live conditions with minimal capital. Initial live testing should include real-time monitoring of execution logs, fill prices, slippage and fees. Alerts should be set for failed orders or drawdowns. Most bots support integrations with Telegram, Slack or email for notifications.

Choosing the right AI bot

Selecting the right AI-powered crypto trading bot is a foundational step toward building a sustainable, automated trading strategy.

The decision should align with the desired strategy complexity, technical skill level, risk appetite and required exchange support. Bots differ not only in interface and pricing but also in how deeply they incorporate machine learning and adaptive logic.

Some bots, like Pionex and Stoic by Cindicator, prioritize simplicity and automation with minimal configuration, targeting users who prefer passive execution or prebuilt strategies.

Others, such as Freqtrade, Trality and Jesse AI, offer full control, deep customization and support for importing externally trained AI models — catering to users with programming experience or quantitative backgrounds.

-

Strategy fit: Pionex and Bitsgap could be ideal for grid and dollar-cost-averaging (DCA) strategies. For trend-based or breakout strategies, 3Commas supports custom logic with popular indicators. Freqtrade and Jesse AI are best for those building predictive models with Python.

-

Level of AI support: Some bots like Stoic by Cindicator use built-in quant models. Others like Trality and Freqtrade allow importing externally trained machine learning models for advanced control.

-

User experience: No-code users can explore platforms like Cryptohopper and Kryll. Intermediate users often prefer 3Commas. Developers will benefit from Trality’s Python IDE or Freqtrade’s scripting interface.

-

Exchange compatibility: Most bots support Binance, Kraken, KuCoin, Coinbase and Bybit. Platforms such as 3Commas and Bitsgap offer multi-exchange support and are especially popular among copy-trading users, allowing them to mirror professional strategies across multiple accounts in real time.

-

Backtesting capabilities: Trality, Cryptohopper and 3Commas include visual backtesting. Jesse AI and Freqtrade offer deeper simulations with latency and slippage modeling.

-

Security features: Look for bots with encrypted API key storage, IP whitelisting and two-factor authentication. These are standard on 3Commas and Trality.

-

Pricing models: Pionex is free to use. Platforms like 3Commas and Trality run on subscriptions. Freqtrade and Jesse AI are open-source but require technical setup.

Common mistakes while using AI bots and how to avoid them

Despite the availability of powerful AI tools, some mistakes still lead to poor outcomes. These errors typically arise from misconfiguration, over-optimization or lack of oversight.

-

Overfitting backtests: Many bots look great on paper but fail when they go live. Use walk-forward testing and avoid strategies that only succeed in past conditions.

-

Relying on marketplace bots: Marketplace strategies from platforms like Kryll or Cryptohopper often lack adaptability. Always test and tweak before deployment.

-

Weak risk controls: Skipping stop-losses or using oversized positions can wipe out capital. Bots like Freqtrade and Trality let users define precise risk limits. Make sure to use them.

-

Ignoring trading costs: Backtests often ignore slippage and fees. Jesse AI and Freqtrade offer built-in tools to simulate these costs more accurately.

-

Lack of monitoring: Bots need regular checks. Platforms like 3Commas and Trality support real-time alerts for failed trades or sudden drawdowns.

-

Overleveraging: Using high leverage on exchanges like Bybit or Binance Futures (crypto derivative exchange) can lead to liquidation. Apply strict limits from the start.

-

Wrong market fit: DCA works well in declining markets; breakout bots don’t. Platforms like Stoic and Kryll offer filters or pause triggers to prevent misfires.

Avoiding these common errors requires thoughtful setup, continuous validation and disciplined risk controls. AI bots can enhance performance but require human oversight, strategic clarity, and technical awareness to deliver consistent results.

The future of crypto AI trading

AI crypto trading is entering a new phase where real-time learning replaces static strategy templates. Instead of relying on predefined signals, emerging trading systems use reinforcement learning and online model retraining to adapt continuously to shifting market dynamics.

Platforms such as Freqtrade, combined with cloud-native tools like Google Vertex AI or AWS SageMaker, enable this shift by supporting pipelines that monitor live order books, price volatility and macroeconomic indicators to automatically refine decision-making thresholds during active trading.

A major evolution is the integration of large language models (LLMs) into trading workflows. Unlike traditional bots limited to charts and price data, LLM-enhanced agents interpret unstructured information — central bank statements, tokenomics updates, SEC filings or even Discord announcements — and convert it into actionable insights.

Early implementations are emerging in institutional quant desks and experimental tools like Delphi AI and Kaito, which allow bots to pause or adjust positions based on narrative sentiment, regulatory shifts or reputational risk events in real time.

AI is also expanding its footprint onchain, with smart contract-based agents executing trades, managing liquidity and optimizing DeFi yield in a fully decentralized manner.

Projects like Fetch.ai are developing AI agents that operate autonomously across protocols without human intervention. These agents interact directly with AMMs, lending pools and governance protocols, ushering in an era where the lines between algorithmic trading, protocol participation and AI reasoning are entirely blurred within the blockchain itself.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Forget PEPE—This New Memecoin Has a 20,000% Growth Target by Q4!

The post Forget PEPE—This New Memecoin Has a 20,000% Growth Target by Q4! appeared first on Coinpedia Fintech News A new memecoin has emerged, capturing attention with ambitious growth predictions by year’s end. Forecasts suggest an eye-popping 20,000% surge, drawing interest from across the crypto […]

Sponsored

The post Forget PEPE—This New Memecoin Has a 20,000% Growth Target by Q4! appeared first on Coinpedia Fintech News

A new memecoin has emerged, capturing attention with ambitious growth predictions by year’s end. Forecasts suggest an eye-popping 20,000% surge, drawing interest from across the crypto sphere. Could this be the next breakout sensation, eclipsing previous favorites? This article explores the buzz around this intriguing newcomer and what might be driving its anticipated rise.

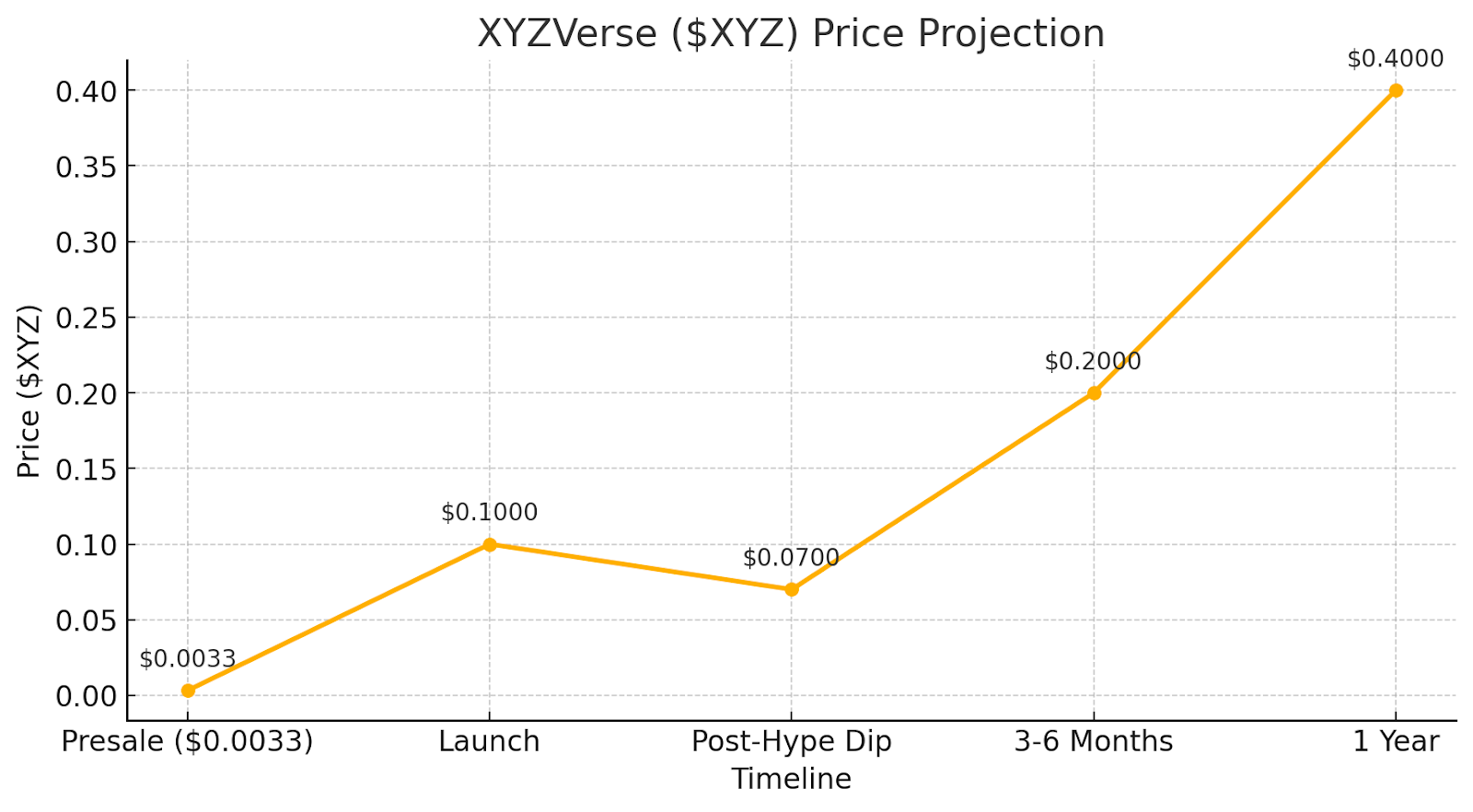

Price Prediction for XYZVerse ($XYZ): Is a 30x Jump Possible?

XYZVerse has entered the meme coin market at a time when community-driven tokens continue to dominate speculative trading. The rise of meme coins like PEPE, Dogwifhat, and Bonk proves that strong branding, viral marketing, and community engagement can drive massive gains.

The broader market sentiment also plays a key role in XYZVerse’s potential. As the altcoin season is about to start, lower-cap meme coins are seeing increased investor interest. Given that XYZVerse is still in presale, it could benefit from this wave if it secures strategic exchange listings and maintains community hype post-launch.

Key Strengths of XYZVerse in the Current Market:

- Strong branding with sports and influencer partnerships, broadening its appeal

- Deflationary mechanics (17.13% token burn) to reduce supply pressure

- Liquidity allocation (15%) to support stability after launch

- Community incentives (10%) fostering engagement and holding

Price Prediction for $XYZ

- Current Presale Price: $0.003333

- Projected Post-Presale Target: $0.10 (as per project’s estimates)

- Potential ATH (First 1-2 Weeks Post-Launch): $0.15 – $0.25 (if demand surges and listings drive FOMO)

- Long-Term Potential (6-12 Months): $0.20 – $0.40 (if the project secures major partnerships and listings)

Buy $XYZ Early to Increase Its Profit Potential

Realistic Expectations: Will XYZ Hit $0.10?

A 30x jump from presale to $0.10 is possible but depends on:

- Strong Exchange Listings – If XYZVerse lands on major CEX platforms like KuCoin, OKX, or Binance, its price could skyrocket on launch day.

- Sustained Community Growth – Meme coins need viral momentum. If XYZVerse delivers on its sports influencer partnerships, it could drive massive social media engagement.

- Market Conditions – If Bitcoin and altcoins remain bullish, speculation-driven assets like XYZVerse tend to benefit.

Is a 3000% Surge Possible for $XYZ?

XYZVerse has the ingredients for a strong launch, but its long-term success depends on execution. If the team delivers strong marketing, high-profile listings, and real community engagement, the $0.10+ target, which is around 3000% from the current price, could be achievable.

Invest in $XYZ Before It Surges

PEPE: A Deflationary Memecoin Inspired by Pepe the Frog

PEPE is a deflationary memecoin launched on the Ethereum blockchain, drawing inspiration from the Pepe the Frog internet meme created by Matt Furie. The cryptocurrency seeks to capitalize on the popularity of meme-based coins like Shiba Inu and Dogecoin. PEPE appeals to the crypto community with a no-tax policy and by being transparent about its lack of utility, embracing its identity purely as a memecoin.

In late April to May 2023, PEPE experienced a significant surge, with its market capitalization reaching a peak of $1.6 billion, resulting in substantial gains for early holders. This surge contributed to a period some refer to as a “memecoin season,” leading to the rapid rise and fall of other meme-based cryptocurrencies. The PEPE roadmap includes listings on major exchanges and a “meme takeover” as part of its three-phase plan. The coin’s recent activity and community support highlight its influence in the current market cycle, reflecting ongoing interest in meme-based digital assets.

Conclusion

Though coins like PEPE have impressive gains, XYZVerse’s unique sports ecosystem and 20,000% growth target make it a standout memecoin with significant potential by Q4.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

What are XRP futures and how to invest in them?

If you’re following developments in the cryptocurrency market, you’ve likely noticed that Coinbase Derivatives has introduced XRP futures contracts to its US derivatives exchange. This move is part of a broader trend where regulated platforms are expanding access to futures trading, giving investors new ways […]

Analysis

If you’re following developments in the cryptocurrency market, you’ve likely noticed that Coinbase Derivatives has introduced XRP futures contracts to its US derivatives exchange. This move is part of a broader trend where regulated platforms are expanding access to futures trading, giving investors new ways to engage with digital assets like XRP (XRP).

But what exactly are XRP futures? And how do you get involved as an investor or trader?

Let’s take a closer look.

What are XRP futures?

XRP futures are standardized financial contracts that allow you to agree to buy or sell XRP at a predetermined price on a specific future date. Rather than trading the actual token, you’re trading a contract that tracks the price of XRP.

These contracts are overseen by the US Commodity Futures Trading Commission (CFTC), meaning they operate within a regulated framework. That adds a level of oversight and structure that appeals to many investors, particularly those wary of the risks tied to unregulated platforms.

On April 3, 2025, Coinbase Derivatives announced it had filed with the CFTC to self-certify XRP futures contracts, and the contracts were launched on April 21, 2025.

Types of XRP futures contracts offered by Coinbase

Coinbase’s offering includes:

-

Nano XRP futures represent 500 XRP per contract, cash-settled in US dollars. These are designed for retail traders and smaller institutions, offering lower capital requirements while still providing exposure to XRP price movements.

-

Standard XRP futures cover 10,000 XRP per contract, are also settled in USD, and are aimed at larger institutions and active traders.

This variety lets you choose a position size that matches your risk tolerance and investment strategy.

But what do terms like “cash-settled” actually mean?

Both Nano and Standard XRP futures are contracts that let you trade based on the price of XRP — but you don’t actually own or receive XRP. You’re trading contracts that track XRP’s price.

And, when the contract closes, the difference between your entry and exit price is calculated (profit or loss) and settled in USD — this is what cash settlement means.

Did you know? Other products offered by the Coinbase Derivatives exchange include more than 20 futures contracts on assets such as Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE), Solana (SOL), Chainlink (LINK) and Stellar (XLM).

Why choose XRP futures contracts over buying XRP?

You might be wondering why someone would choose futures over simply buying XRP on the spot market.

Here are a few reasons:

-

Leverage: Futures often allow you to control a large position with a relatively small amount of capital. While this can amplify gains, it also increases potential losses.

-

Hedging: If you already hold XRP and expect short-term volatility, futures can be used to protect your portfolio.

-

Speculation: Futures allow you to take both long (bullish) and short (bearish) positions, so you can potentially benefit from market moves in either direction.

-

No wallet or storage needs: Buying XRP requires a secure wallet and managing private keys, which carries risks like hacking or loss. Futures contracts are financial instruments traded on exchanges, eliminating the need for direct XRP custody.

-

Liquidity and accessibility: Futures markets often have high liquidity, making it easier to enter and exit positions. Some exchanges offer XRP futures with lower barriers than buying XRP on certain crypto platforms, especially in regions with regulatory restrictions.

-

Cash settlement: Many XRP futures are cash-settled, meaning you settle profits or losses in fiat or stablecoins without handling XRP itself, simplifying the process for traders avoiding crypto custody.

When to choose futures contracts:

-

You want to trade XRP price movements with leverage or flexibility to go long or short.

-

You prefer not to deal with crypto wallets or custody.

-

You’re hedging an existing XRP position or portfolio.

-

You’re comfortable with the risks and complexities of derivatives.

When to buy XRP:

-

You believe in XRP’s long-term value and want to hold it as an investment.

-

You plan to use XRP for transactions or in its ecosystem (e.g., Ripple’s payment network).

-

You want to avoid the risks of leverage and futures margin calls.

Ultimately, futures suit active traders or those seeking leveraged exposure, while buying XRP could be ideal for long-term holders or users of the asset. You must always assess your risk tolerance and goals before deciding whether to invest in XRP or XRP futures.

Did you know? The MarketVector™ Coinbase XRP Benchmark Rate provides a robust USD price reference exclusively for XRP traded on the Coinbase Exchange. It includes no other assets and no other exchanges — just XRP, just Coinbase.

Where to invest in XRP futures

If you’re looking to invest in XRP futures, there are several platforms (other than Coinbase) offering access depending on your location and trading needs.

-

Kraken Futures: Kraken provides XRP futures with leverage. In Australia, access is limited to wholesale clients through Beaufort Fiduciaries Pty Ltd (AFSL no. 545124). In the United Kingdom, only clients classified as Professional Clients under Financial Conduct Authority rules can trade through Crypto Facilities Limited (FRN: 757895).

-

Binance: Binance offers XRP/USDT perpetual futures contracts, allowing users to trade XRP without an expiry date. These contracts support leverage, giving traders flexibility in managing exposure. However, as of May 28, 2024, Binance no longer supports XRP as a margin asset under its “Multi-Assets Mode,” though XRP futures remain available in other trading modes.

-

OKX: OKX also provides XRP/USDT perpetual swaps, which let traders speculate on XRP price movements continuously. While OKX delisted XRP expiry futures contracts in December 2024, perpetual swaps are still supported. Traders can apply leverage and adjust positions based on their risk strategy.

-

Bitget: It is a globally accessible platform that offers XRP futures with options to take long or short positions. It features a user-friendly interface, making it suitable for both new and experienced traders, though availability depends on regional regulations.

-

KuCoin Futures: KuCoin supports XRP perpetual contracts (XRP/USDT) with leverage. The platform is known for low trading fees and offers various features for different trading strategies. It’s accessible in many countries, with some regional restrictions.

-

MEXC: It provides XRP futures in both USDt-margined and coin-margined formats. MEXC supports high leverage and offers educational tools, catering to traders of all levels. The platform is available in most regions, though users should check for local compliance.

-

Delta Exchange: It lists XRP perpetual futures with leverage up to 100x. It’s known for low fees and advanced risk management tools. The platform is available to traders in several countries, depending on local laws.

-

Bitfinex: Lastly, Bitfinex offers XRP futures as part of its broader derivatives portfolio. Its platform caters to advanced users with customizable strategies. Access is region-dependent, and traders must ensure eligibility based on their location.

Did you know? Coinbase crypto derivatives are not available to retail clients based in the United Kingdom or Spain due to local regulatory restrictions.

How to invest in XRP futures

If you’re interested in trading XRP futures, here are general steps to get started:

-

Choose a platform: Select a regulated exchange offering XRP futures, such as Coinbase’s US Derivatives Exchange. Create an account and complete identity verification, which typically involves submitting a valid ID and proof of address.

-

Understand the product: Research how XRP futures contracts work, including contract sizes (e.g., Coinbase offers standard contracts of 10,000 XRP or nano contracts of 500 XRP), margin requirements, leverage options and fees. Futures are complex, so review the exchange’s documentation and understand risks, such as liquidation.

-

Fund your account: Deposit USD or another accepted currency to use as collateral (margin) for trading. Check the platform’s minimum deposit and margin requirements. For example, Coinbase settles futures in USD, and you can fund via bank transfer or debit card.

-

Place your trade: Use the platform’s trading interface (e.g., Coinbase Advanced) to select XRP futures contracts (symbol: XRL for standard XRP contracts on Coinbase). Decide whether to go long (buy) or short (sell), set your position size, and apply any leverage if available. Confirm the trade after reviewing details.

-

Practice risk management: Futures carry high risks due to leverage and volatility. Set stop-loss orders, limit position sizes based on your risk tolerance, and avoid risking more than you can afford to lose. For instance, some exchanges pause trading if the underlying asset’s price moves over 10% in an hour to mitigate volatility risks.

-

Monitor the market: Track XRP’s price, market sentiment, funding rates and external factors like regulatory news or macroeconomic trends. Use tools like candlestick charts or technical indicators on the platform to inform your strategy. Stay updated to adjust positions and avoid unexpected losses.

Oregon targets Coinbase over XRP, cites securities violations

Oregon’s Attorney General has sued Coinbase, claiming the exchange offered unregistered securities, including XRP. The lawsuit argues that a wide range of digital assets traded on the platform qualify as investment contracts under state law.

State officials say the case is part of a broader effort to step in where federal enforcement has pulled back. Legal experts note that while the outcome won’t set a national precedent, it could influence how regulators and courts approach similar cases.

The timing is notable — just weeks after the SEC dropped its case against Ripple and days after Coinbase listed XRP futures on its US derivatives exchange.

Did you know? On March 25, 2025, Ripple Labs settled its long-standing legal dispute with the SEC. As part of the agreement, Ripple consented to pay a reduced fine of $50 million — down from the original $125 million — without admitting any wrongdoing.

How risky are crypto futures?

Futures trading offers opportunities, but it comes with significant risks — especially if you’re new to derivatives. Here’s what you should keep in mind:

-

Leverage risk: While leverage can increase your returns, it also amplifies losses. A small price move in the wrong direction can quickly deplete your account.

-

Volatility: XRP is known for its sharp price swings. Futures contracts can exaggerate the impact of volatility on your position.

-

Funding rates: Perpetual futures contracts charge periodic funding fees, which can eat into profits if held long-term.

-

Liquidation: If the market moves against you and your margin falls below the required level, your position may be automatically closed — often at a loss.

-

Complexity: Futures are more complicated than spot trading. Understanding contract terms, funding rates and expiry dates is crucial to managing your trades effectively.

-

Market liquidity: While XRP is a liquid asset, futures trading depends on active participation. Thin order books can lead to slippage and unexpected price movements.

-

Emotional pressure: The fast-paced nature of futures trading can lead to impulsive decisions. Discipline and a clear strategy are essential.

If you’re new to this type of trading, consider starting with a demo account or using nano contracts to reduce your exposure while you learn. Trade smart — your safety’s on you!

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Solana (SOL) Price Forecast: This Token Will 42x Your $500 While SOL Lags

The post Solana (SOL) Price Forecast: This Token Will 42x Your $500 While SOL Lags appeared first on Coinpedia Fintech News Recently, Solana’s price slipped below the $130 support level, worrying a good share of investors and market observers alike. This drop comes against massive […]

Sponsored

The post Solana (SOL) Price Forecast: This Token Will 42x Your $500 While SOL Lags appeared first on Coinpedia Fintech News

Recently, Solana’s price slipped below the $130 support level, worrying a good share of investors and market observers alike. This drop comes against massive transfers associated with FTX and Alameda Research wallets. Despite improving broader market conditions, such as the cooling inflation trend signaled by the latest U.S. CPI and PPI data, Solana’s potential for a price rebound appears limited.

However, a strong newcomer is beginning to take the front stage within the constantly shifting industry: Rexas Finance (RXS). Priced at just $0.20 and set to launch at $0.25, RXS is now being hailed as the next breakout altcoin—one that might multiply a $500 investment into over $21,000, a possible 42x gain, all while Solana moves onward in its post-peak trajectory.

Solana’s Slowing Momentum

The price of Solana continues to be under pressure. After a brief recovery to the $131 mark, the Sol price was dramatically reversed due to bearish pressure. Recently, the Solana price has fallen further and is now trading below the $125 support zone, which has now flipped into a key level regarding future price movement. As per some analysts’ predictions, an Elliott Wave pattern may be forming, indicating a potential reversal at $112.

According to TA, if the price of Solana fails to hold support in this proximity, there is a growing likelihood of further downward movement. Solana may still develop, but its course seems more steady than explosive. Rexas Finance fills in here with buzz and a complete ecosystem ready to upset many sectors in decentralized finance.

Rexas Finance (RXS): A $0.20 Giant in the Making

Rexas Finance arrived to rule rather than merely show up to participate. Rexas is linking the traditional and decentralized finance worlds in a way very few companies have accomplished, with an ambitious goal to change how real-world assets (RWAs) interact with blockchain.

It is a toolset, a launchpad, and a whole DeFi ecosystem, not only a token. Retail and institutional users can start tokens and mint assets and bring real-world objects such as real estate, commodities, and intellectual property on-chain from the Rexas Launchpad, Token Builder, and QuickMINT Bot. Most coins promise utility “someday,” but Rexas already proves value long before its formal release.

Rexas stands out not only for its high aspirations but also for its rapid execution. Starting at just $0.03, the presale has jumped more than six times to reach its final stage price of $0.20. More than 458.8 million tokens have already been sold, and $47.7 million has been raised thus far. This is investor conviction on full display. While presales may inspire mistrust, Rexas Finance passed its Certik assessment, the highest standard for smart contract security. Already registered on CoinMarketCap and CoinGecko, it provides openness and accessibility even before its June 19, 2025, release—when it will first show up on exchanges at a listing price of $0.25.

The 42x Math and Realistic Potential

A $500 investment gets 2,500 RXS tokens at $0.20 per token. Given its foundations and present buzz, if Rexas reaches $8.40—a reasonable price—that $500 leaps into $21,000. That is a 42x return without depending just on buzz. And concerning the long run? Echoing how early Ethereum or Solana ascended from cents to hundreds, more significant gains could be in play if RXS reaches its predicted multi-dollar targets by 2026. Still, the improvements are astounding relative to Solana’s already inflated position, even in a cautious $5–$10 range.

Conclusion

Solana is still a mainstay in the crypto scene, but its opportunity for life-changing profits is closing. Rexas Finance is only getting started in the meantime. RXS is primed to be among the most explosive prospects of 2025, with excellent presale traction, actual utility, and a scalable ambition.

Should history repeat itself—and crypto cycles suggest it often does—the real millionaires of this cycle will be those supporting tomorrow’s leaders today rather than those clutching yesterday’s victors. Should Rexas Finance perform on even a quarter of its promise, a meager $500 investment might be remembered as the best choice of the decade.

For more information about Rexas Finance (RXS) visit the links below:

Website: https://rexas.com

Win $1 Million Giveaway: https://bit.ly/Rexas1M

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Bitcoin enters world's top 5 largest assets, surpassing Google, Silver, Amazon

Bitcoin (BTC) has overtaken Alphabet (Google) to become the world’s fifth most valuable asset by market capitalization. As of April 23, Bitcoin’s market cap surged to $1.87 trillion, edging past Alphabet’s $1.859 trillion valuation, according to asset ranking data. BTC is now behind only gold, […]

Analysis

Bitcoin (BTC) has overtaken Alphabet (Google) to become the world’s fifth most valuable asset by market capitalization.

As of April 23, Bitcoin’s market cap surged to $1.87 trillion, edging past Alphabet’s $1.859 trillion valuation, according to asset ranking data. BTC is now behind only gold, Apple, Microsoft and Nvidia.

Bitcoin beats Nasdaq 100 returns in April

Bitcoin’s edge over Alphabet coincides with its ongoing “decoupling” from its long-standing correlation with US tech stocks, especially in April, when BTC’s price rallied 15% despite the Nasdaq 100’s returns of 4.50% in the same period.

This decoupling followed months of disappointment for crypto bulls, who expected a stronger post-election rally.

Even with April’s gains, BTC’s price remains 16% below its $109,000 all-time high set in January, when Trump was re-inaugurated as the US president.

Trump’s recent criticism of Federal Reserve Chair Jerome Powell and his executive order to create a Strategic Bitcoin Reserve (SBR) — which is nearing its 60-day review window — is helping reignite investor interest in crypto.

Related: Bitcoin could hit $1M if US buys 1M BTC — Bitcoin Policy Institute

“Chatter questioning Fed independence is having positive spillover effects on BTC,” said Vetle Lunde, head of research at K33.

Macro analyst Fejau stressed that capital outflows from US assets will likely benefit Bitcoin, given countries can’t tariff it — and that it “provides high beta to a portfolio without the current tail risks associated with US tech.”

“This market regime is what Bitcoin was built for,” he wrote, adding:

“One the degrossing dust settles, it will be the fastest horse out of the gate.

Bitcoin market worth more than two Teslas

Alphabet is facing headwinds in the form of regulatory crackdowns, antitrust challenges and a slowdown in digital ad revenue. The rise of AI-focused rivals and reduced growth projections have also dented confidence in Google’s long-term dominance.

To put Bitcoin’s $1.87 trillion valuation into perspective, it’s now worth more than two Tesla companies.

The EV giant famously added Bitcoin to its balance sheet in early 2021, when it was trading for around $33,500. It is now sitting on around 180% gains worth over $1 billion.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Heads Up: This Week Is Packed With Economic News and Altcoin Catalysts – Here Are the Top 5 Coins to Track Hour by Hour

The post Heads Up: This Week Is Packed With Economic News and Altcoin Catalysts – Here Are the Top 5 Coins to Track Hour by Hour appeared first on Coinpedia Fintech News This week holds significant events that could shake up the cryptocurrency market. Major […]

Sponsored

The post Heads Up: This Week Is Packed With Economic News and Altcoin Catalysts – Here Are the Top 5 Coins to Track Hour by Hour appeared first on Coinpedia Fintech News

This week holds significant events that could shake up the cryptocurrency market. Major economic news and developments are expected to create movements among various altcoins. Five specific coins stand out in this scenario. Monitoring these coins closely might reveal important shifts and opportunities as the situation unfolds hour by hour.

XYZVerse Sets a New Trend, Could This be the Next 50x Meme Coin?

The buzz around XYZVerse is real. As the first-ever all-sports meme token, it’s attracting both sports fans and crypto enthusiasts, creating a unique crossover that’s gaining serious traction. With a strong presale and an engaged community, some investors are already eyeing major potential gains.

More Than Just a Meme Coin

Unlike most meme coins that ride trends without much substance, XYZVerse is setting a new trend. It is blending the high-energy world of sports with the viral nature of meme culture. And it’s working. The presale is moving fast, with early buyers locking in tokens at a fraction of what some believe could be its future value.

Right now, XYZVerse is still in its presale phase, but demand is high. The price has already climbed from $0.0001 in Stage 1 to $0.003333 by Stage 12, with over 70% of the $15 million milestone already raised. Investors who got in early have secured a steep discount, and with a final presale target price of $0.1, those numbers have people paying attention.

Still Time to Get in Before the Presale Ends

Bullish Mood on $XYZ

XYZVerse is already featured on CoinMarketCap where the community has shown a strongly bullish mood on this coin, with 95% voters anticipating $XYZ to grow.

XYZ was further noticed by reputable crypto influencers. DanjoCapitalMaster, who has close to 800,000 followers, recently expressed his support for the project, calling XYZVerse a “moonshot opportunity.” Of course, in crypto, nothing is guaranteed, but the excitement is undeniable.

Beyond just hype, XYZVerse has a structured tokenomics model aimed at long-term sustainability. A share of 15% is allocated to liquidity to create a solid market foundation.To reward its community via airdrops and bonuses, the team has put aside 10% of the total supply. Moreover, a big chunk of 17.13% is designated for deflationary burns, which could reduce supply and drive demand for $XYZ over time.

A Community-Driven Project With Big Plans

One thing setting XYZVerse apart is how it engages its community. The team recently launched the Ambassador Program, giving users the chance to earn free tokens by supporting the project. And that’s just the start—there are already talks with major sports celebrities to help boost visibility. By bringing together traditional sports fans and the fast-moving crypto space, XYZVerse is building something different—something with entertainment value and real engagement.

Could XYZVerse Be the Next Big Meme Coin?

With a fast-growing presale, a strong community, and an ambitious roadmap, XYZVerse has the ingredients of a project with serious potential. While the crypto market is always unpredictable, many investors see this as an opportunity to get in early on something big. The presale won’t last forever—so if you’re interested, now might be the time to take a closer look.

Join XYZVerse, the Next Moonshot Opportunity

Bitcoin: The First Decentralized Digital Currency

Bitcoin (BTC) is the original cryptocurrency introduced by Satoshi Nakamoto. It operates on blockchain technology, allowing direct transactions between users without intermediaries like banks. Bitcoin’s network uses a distributed ledger spread across many nodes, ensuring transparency and security. Transactions are verified through mining, where participants solve complex puzzles to validate and record operations on the blockchain. Miners are rewarded with bitcoins, and this process maintains the integrity of the system.

Every four years, the Bitcoin network experiences a “halving,” which cuts miners’ rewards by half. This mechanism controls the supply, aiming toward a maximum of 21 million bitcoins. The halving can impact mining profitability and network stability. In the current market cycle, Bitcoin remains influential due to its pioneering status and widespread recognition. Its decentralized nature and limited supply continue to attract interest from various sectors, reflecting its ongoing role in the evolving landscape of digital currencies.

Solana and SOL: A Scalable Blockchain Platform and Its Native Cryptocurrency

Solana is a blockchain platform designed for scalability, providing a foundation for decentralized applications (dapps). It competes with networks like Ethereum and Cardano but stands out through architectural choices that aim for faster transactions and flexible development options. Solana supports multiple programming languages, making it accessible to a wide range of developers. The platform avoids using sharding or second-layer solutions, focusing instead on building a high-capacity network that can handle significant activity.

SOL is Solana’s native cryptocurrency and is central to its ecosystem. It facilitates transactions, runs custom programs, and rewards network participants. The coin holds value as it underpins Solana’s operations, allowing users access to various projects on the platform. Given Solana’s focus on scalability and high performance, SOL may appeal to those interested in efficient blockchain solutions. Its capacity to host high-activity products and services without additional scaling layers positions it uniquely in the current market cycle.

Cardano (ADA): A Sustainable Blockchain for Smart Contracts

Cardano is a blockchain platform designed for smart contracts and decentralized applications. It uses a proof-of-stake mechanism called Ouroboros, which aims to be more energy-efficient than traditional proof-of-work systems. The platform is divided into two layers: the Cardano Settlement Layer for transactions and the Cardano Computing Layer for smart contracts. This design allows for improved scalability and security.

The native cryptocurrency of Cardano is ADA, enabling users to store value, make payments, and participate in network staking. Cardano’s focus on sustainability and scalability sets it apart from other blockchain platforms. Its potential for high transaction processing capability and low fees may contribute to its appeal in the cryptocurrency market. The introduction of native tokens in March 2021 enhances its functionality for developers and users. The attractiveness of ADA in the current market depends on various factors that individuals may consider when evaluating this cryptocurrency.

Ethereum: A Proof-of-Stake Blockchain Advancing Smart Contracts and Scalability

Ethereum is a blockchain platform introduced by Vitalik Buterin in 2015. It pioneered smart contracts, allowing developers to build decentralized applications (dApps) across various sectors like finance, gaming, and more. Ethereum transitioned to a Proof-of-Stake consensus mechanism with the Merge in 2022, enhancing energy efficiency. Layer 2 solutions such as Arbitrum and Polygon have been developed to improve transaction speed and reduce costs. The platform also introduced ERC-20 tokens, widely used for governance, utility, and value storage within the ecosystem. Ether (ETH), the native cryptocurrency, is essential for transactions, staking rewards, and serves as a tradable asset.

Ethereum’s future developments aim to increase scalability and further reduce transaction fees through sharding. This approach divides the network to handle more transactions simultaneously, enhancing overall efficiency. Historical price trends of ETH have shown significant fluctuations, influenced by factors like network upgrades and market cycles. Predictions estimate the price could range between $2,700.31 and $6,580.53 in the coming years. Ethereum remains a central platform in the blockchain space, continuing to evolve its technology and expand its ecosystem, which maintains its significance in the current market landscape.

Conclusion

While BTC, SOL, ADA, and ETH are solid picks in this bullish market, XYZVerse (XYZ) distinguishes itself as the pioneering all-sport memecoin. Uniting fans of football, basketball, MMA, Dota 2, and more within its ecosystem, XYZ aims for an ambitious 20,000% growth, aspiring to outperform tokens like PEPE and MOG.

By blending meme culture with sports enthusiasm, it offers a unique platform for community engagement and benefits. Early adopters have the advantage of joining during the presale, potentially experiencing significant growth alongside the project. Emphasizing community autonomy, XYZ allows users to influence its direction and rewards active participation.

With a clear roadmap including GameFi integration and partnerships with sports media companies, XYZ seeks sustainable, long-term success. Positioned as the “G.O.A.T of all memecoins,” XYZ aims to become a cultural icon for both sports and crypto enthusiasts.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

100X MEMEBOX Launches to Redefine Wealth Building in Crypto

The post 100X MEMEBOX Launches to Redefine Wealth Building in Crypto appeared first on Coinpedia Fintech News 100X has officially launched one of its most powerful and forward-thinking ecosystem products to date—100X MEMEBOX—marking a bold leap into the future of structured, trend-driven wealth generation in […]

Sponsored

The post 100X MEMEBOX Launches to Redefine Wealth Building in Crypto appeared first on Coinpedia Fintech News

100X has officially launched one of its most powerful and forward-thinking ecosystem products to date—100X MEMEBOX—marking a bold leap into the future of structured, trend-driven wealth generation in the crypto space. In an industry where investors are constantly torn between risk and security, 100X MEMEBOX offers a fresh, intelligent approach: giving users access to market upside while eliminating the complexity of day-to-day trading.

What is 100X MEMEBOX?

100X MEMEBOX is a unique meme coin asset management system designed for users to earn from the explosive meme coin trend—without needing trading skills. It offers smart fund management, market timing, and profit sharing, with a guaranteed 5% monthly income.

Launched during a volatile market, MEMEBOX capitalizes on meme coin hype, emotion-driven cycles, and viral trends. The 100X team has transformed this momentum into a reliable, passive income opportunity for everyday investors.

Why 100X MEMEBOX is Different

Unlike typical high-risk DeFi projects or speculative meme tokens, 100X MEMEBOX is built on a stable, managed model. By integrating professional trading execution, smart portfolio allocation, and transparent distribution logic, MEMEBOX ensures that participants benefit from both fixed returns and bonus sharing. The 5% monthly return serves as a cornerstone of the platform’s offering, giving investors the confidence of knowing their wealth will grow steadily over time. This model is active, optimized, and designed with long-term sustainability in mind.

The 5% monthly income is guaranteed, making MEMEBOX one of the most secure passive income opportunities in the crypto space. Whether you are a novice or an experienced investor, this feature offers peace of mind, allowing you to invest without worrying about market fluctuations. With a blend of consistent fixed returns and profit sharing based on actual trading performance, MEMEBOX gives users both stability and growth.

Investor Protection and Multi-Income Advantage

To further enhance investor confidence—especially for larger contributors—100X MEMEBOX has implemented a dual-layered fund management structure. For any investor contributing $1 million or more, their capital is divided into two equal portions:

- 50% of funds are secured in a multi-signature wallet and used solely for fund management of high-potential meme coin investments. This ensures a strong security foundation and long-term strategic growth.

- The other 50% is actively deployed for meme coin trading, leveraging the 100X team’s real-time market analysis and trading infrastructure.

This structure not only protects investor capital but also enables diversified income streams. As a result, 100X MEMEBOX investors can benefit from four types of income:

- Fixed monthly income of 5%

- Profit sharing from meme coin trading

- Profit sharing from managed fund investments

- Airdrop rewards in the form of 100XT Tokens

Strategic Market Positioning

What sets 100X MEMEBOX apart is its bold and strategic positioning in this space. The 100X team has invested $3 million to purchase $18 million worth of a high-potential meme coin, acquiring approximately 20–30% of the coin’s total market capitalization. This significant holding gives the platform powerful leverage in wave-based trading and price cycles. With this infrastructure, MEMEBOX is able to capture upside and redistribute profits—empowering users to earn without trading on their own.

The Future of Crypto Investing

The launch of 100X MEMEBOX signals more than just a new product. It represents 100X’s commitment to innovation, market awareness, and empowering everyday investors. With MEMEBOX, users aren’t just investing in a trend—they’re investing with a strategy. More than that, they’re joining a movement that values clarity, consistency, and long-term value creation.

100X MEMEBOX is now live. The system is working. The trend is in motion. The only question left is: Will you follow the hype—or lead with strategy?

How to stake Solana (SOL) in 2025: A step-by-step guide for beginners

Key takeaways Staking Solana allows you to earn passive income through staking rewards while participating in network governance. There is no minimum requirement for staking Solana, but the practical minimum is around 0.01 SOL. All you need to start staking Solana is a SOL-compatible wallet. […]

Analysis

Key takeaways

-

Staking Solana allows you to earn passive income through staking rewards while participating in network governance.

-

There is no minimum requirement for staking Solana, but the practical minimum is around 0.01 SOL.

-

All you need to start staking Solana is a SOL-compatible wallet.

-

Staking is considered one of the safer ways to participate in crypto ecosystems.

Staking Solana allows you to earn passive income through staking rewards while participating in network governance.

There is no minimum requirement for staking Solana, but the practical minimum is around 0.01 SOL.

All you need to start staking Solana is a SOL-compatible wallet.

Staking is considered one of the safer ways to participate in crypto ecosystems.

Solana is a blockchain network known for its fast transaction speeds and extensive ecosystem of decentralized applications (DApps). It also combines the proof-of-stake (PoS) and proof-of-history (PoH) consensus mechanisms, allowing you to stake its native currency, SOL (SOL), to earn rewards.

This Solana staking guide walks you through the Solana staking process and explains why staking could be a smart move, especially if you’ve been wondering how to earn passive income with SOL.

What is Solana staking?

Solana staking consists of locking SOL into a cryptocurrency wallet. The process rewards you in the following ways:

-

Staking rewards: You earn rewards for staking SOL — a percentage based on how much you’ve staked, Solana’s current inflation rate (which fluctuates and is set to decrease every year), the total amount of SOL staked on the network, and how long you’ve been staking overall.

-

Governance: Staking gives you a say in governance, allowing you to vote on proposals that shape the Solana network. This approach prioritizes those with the largest investments, assuming they’ll act in the network’s best interest.

-

Network security: Staking increases security to create a stable investment environment. By staking, you’re directly contributing to Solana’s health and longevity. That said, if a few wallets stake large amounts, one could argue they’re centralizing the network.

If you earn rewards staking SOL, they’re paid out every two days — a period known as an epoch.

When staking SOL, you’re delegating funds to a Solana representative (a validator.) Validators process transactions, produce blocks, and vote on network proposals. It’s essential to choose a validator that aligns with your vision for Solana, as they’ll be voting in your stead, much like an elected official in traditional governments.

Validator votes are stake-weighted. The more stake a validator has, the more weight their vote carries.

-

Solana validator vs. delegator: By delegating funds to a validator, you become a delegator. The validator’s job is to vote in the network’s best interest. It’s your job to choose reputable validators that keep the network safe.

Did you know? Solana is one of the fastest blockchains in terms of transactions per second (TPS). It currently averages around 1,128 TPS, with a theoretical max of 65,000 TPS.

Staking Solana for beginners

There are a few things to consider as you prepare to stake Solana.

Understanding staking methods

On the surface, staking is quite simple; however, there are actually two staking methods — each affects your SOL liquidity.

-

Liquid staking: Earn rewards while retaining control of your SOL’s liquidity. When you liquid stake, you receive liquid staking tokens (LSTs) equivalent to the amount of SOL you stake. You can use those LSTs in Solana’s decentralized finance (DeFi) applications as you would if you weren’t staking funds.

-

Native staking: Native staking is the original method that locks your funds away, allowing you to earn rewards and participate in governance. However, you cannot use your funds without pulling them out via the unstaking process. This process is beginner-friendly but limits what you can do with your SOL.

The difference between the two is flexibility. Native staking is less flexible but easier for beginners, while liquid staking retains your liquidity for use in DeFi and other applications.

Solana staking tax 2025

In the United States, Solana staking rewards are subject to income and capital gains tax.

-

Income tax: You’re required to pay income tax on the value of SOL at the moment you unstake it. You also pay income tax on staking rewards when you gain the ability to withdraw them.

-

Capital gains tax: You’re required to pay capital gains tax once you sell or convert that SOL.

How to stake Solana

Now, let’s get into the Solana staking tutorial.

Choose a Solana wallet

First, you need a wallet to store and stake your SOL.

Most Solana wallets have built-in staking capabilities. This guide uses the Phantom Wallet for demonstration purposes.

Download Phantom Wallet from its official website by clicking the “Download” button.

Next, click “Create a new wallet.”

You’ll be asked to continue with an email or a seed phrase wallet. Click “Create a seed phrase wallet.”

Enter a password, and proceed to the recovery phrase screen. Write down your recovery seed phrase on piece of paper, check the confirmation box, and click “Continue.”

Create a username, click “Continue,” and you’ll have created a Solana wallet.

Fund the wallet

Fund Phantom with SOL by either transferring SOL from another wallet or buying it with a debit/credit card via the “Buy” button.

Phantom partners with companies such as Robinhood or Topper to facilitate card payments, allowing you to buy from within the wallet interface.

After funding your wallet, it’s time to start staking.

Stake your Solana

Open your token list and click on “Solana.”

Select “Start earning SOL.”

Now, choose between “Liquid Staking” or “Native Staking.”

Liquid staking is typically done via a third-party provider. Phantom integrates with Jito’s liquid staking platform, enabling you to receive JitoSOL LSTs when you liquid stake.

If you choose to liquid stake, Phantom will detail your estimated annual percentage yield (APY) and how much JitoSOL you’ll receive in return for staking.

JitoSOL will appear in your token list.

JitoSOL will appear in your token list.

If you choose native staking, you must commit to a validator. Phantom will list validators in order of how much SOL is staked to them and their estimated APY.

Select a validator, enter how much SOL you’d like to stake, and click “Stake.” The network will create your staking account, and you’ll start earning rewards in a few days.

Congratulations, you’re successfully staking SOL.

Did you know? Validators who act out of turn or experience significant downtime will have their rewards slashed, also reducing the rewards of those who stake with the validator.

How to unstake Solana

Whether you choose liquid or native staking, here’s how to unstake your funds. You might unstake if:

-

You want to convert SOL: If you want to swap or sell your SOL, you must unstake the funds first.

-

You want to stake elsewhere: If another network catches your eye, you’ll have to unstake your Solana funds to transfer them for staking on another network.

-

Validators act up: If your validator acts outside the network’s best interest, you may want to unstake and delegate to another validator.

Unstake natively staked tokens

To unstake natively staked tokens, click on “Solana” in your token list.

Next, click on “Your stake.”

Select the validator you want to unstake from and click “Unstake.” Then, select “Withdraw Stake” to pull the funds back into your wallet. The validator will show “Inactive” once you’ve unstaked.

Unstake LSTs

To unstake your LSTs, select them in your token list.

Click “More” in the options list, then select “Unstake.”

If you’re using Jito as your LST provider, clicking unstake will take you to Jito’s platform. Here, you have two options: unstake immediately or delayed unstaking.

-

Unstake immediately: Immediate unstaking costs a small fee, based on the amount you are unstaking. You can pay additional fees to prioritize your transaction or tip validators. Finally, you can adjust your slippage tolerance.

-

Delayed unstaking: Delayed unstaking can range from one day to a week, depending on network congestion, but you pay a much lower fee. You also don’t have to account for slippage, as the network won’t prioritize your transaction.

Choose whichever option works best for you, and click “Unstake SOL.” The funds will appear in your wallet.

Did you know? You can stake Solana with as little as 0.01 SOL, making it one of the most accessible PoS blockchain networks.

Is Solana wallet staking safe?

Staking Solana is relatively safe, but even if you know how Solana staking works, there are risks to be aware of:

-

Market volatility: Solana is subject to market volatility as much as any other cryptocurrency. The value of your staked SOL can fluctuate based on market conditions.

-

Validator behavior: Validators can act out of favor with the network and may experience “slashing.” Slashing penalizes the validator’s rewards, which affects your rewards as well. Your initial investment remains safe, however.

-

Cyberthreats: Blockchain networks are exposed to bad actors 24/7, meaning they can be vulnerable to hacks at any time, putting your funds at risk.

-

Past downtime: Solana has had various outages over the years, often due to congestion. While this doesn’t necessarily mean your funds are at risk, bad actors could target the network during its weak moments.

So, while staking on Solana offers potential rewards, it’s important to understand that staking always carries risk. As with any investment, there’s a possibility of loss, so it’s crucial to evaluate your risk tolerance and take necessary precautions.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

DOGE to $4? Dogecoin Plots a Comeback, While $0.20 Rival Token Shows Prospects of a 14560% Surge

The post DOGE to $4? Dogecoin Plots a Comeback, While $0.20 Rival Token Shows Prospects of a 14560% Surge appeared first on Coinpedia Fintech News Dogecoin has shown a 9.74% daily growth to reach $0.2021 in trading value and experts predict it will skyrocket to […]

Sponsored

The post DOGE to $4? Dogecoin Plots a Comeback, While $0.20 Rival Token Shows Prospects of a 14560% Surge appeared first on Coinpedia Fintech News

Dogecoin has shown a 9.74% daily growth to reach $0.2021 in trading value and experts predict it will skyrocket to $4 which represents a massive 1879% increase. Rexas Finance (RXS) emerges as a competitor token which experts predict will experience an astonishing 14,560% increase. The real-world assets (RWA) focus of RXS positions it as an innovative force in the multi-trillion-dollar asset market by providing stability together with enhanced liquidity.

RXS Presale 91.69% Complete – Buy Now Before It’s Gone Forever!

Rexas Finance (RXS) transforms the cryptocurrency market by creating a new method to tokenize physical assets (RWA). RXS functions differently from speculative tokens because it connects physical assets to blockchain technology which allows users to divide ownership of sought-after commodities including real estate and gold. The innovative model connects investors to a huge market worth trillions of dollars by enabling them to access both liquidity and investment possibilities.

Stage 12 of RXS presale has begun and 1 RXS token now costs $0.200. The current stage of the presale has achieved 91.69% completion while raising $47,687,290 from its $56,000,000 target by selling 458,434,161 tokens from the total 500,000,000 available. The exceptional speed of investor interest demonstrates that RXS has gained strong backing for its ability to transform asset management practices.

RXS: Certik-Audited & Built for Real Value – Not Just Hype!

Rexas Finance has implemented multiple measures to build trust in the crypto market space. A Certik security audit has thoroughly evaluated the token to guarantee its safety and reliability for investors. RXS maintains its presence on CoinMarketCap and CoinGecko platforms which increases exposure to retail and institutional investors seeking access to the token.

https://twitter.com/rexasfinance/status/1857692542290059502

The implemented security measures have strengthened investor trust that RXS functions as both a secure and utility-based token. RXS stands apart from Dogecoin because it provides real-world asset integration which delivers actual value instead of relying on social media popularity and celebrity promotions.

RXS Exchange Listing on June 19 – Next Stop: Massive Growth?

RXS demonstrates increasing investor demand based on its successful presale phase. Stage 12 contributed $48 million to RXS token sales and resulted in over 458 million tokens sold which will lead to a listing price of $0.25 on June 19th, 2025.

The upcoming exchange listing represents a critical phase for RXS because it moves the project from presale status to full trading availability on major platforms. The upcoming listing has generated market-wide excitement because investors believe RXS will achieve strong future performance. Market analysts believe RWAs-focused tokenization will cause the token price to increase strongly after its exchange listing.

Real-World Applications: A Game-Changer for Crypto

Rexas Finance demonstrates its value through its ability to tokenize real estate and gold among other RWAs. The implementation of blockchain technology through RXS enables users worldwide to manage their assets while cutting out brokers and banks to achieve reduced costs and simplified management.

The new approach makes investment opportunities that were once unreachable available to everyone. Users benefit from Rexas Token Builder and Rexas Launchpad to tokenize their assets and safely conduct token sales across various blockchain networks. The combination of features establishes RXS as an industry leader that connects traditional asset markets to digital economic opportunities.

Conclusion

Dogecoin attracts meme coin enthusiasts with its potential 1879% rise to $4 but Rexas Finance (RXS) provides much more promising prospects with an anticipated 14,560% increase. The RWA approach of RXS creates financial stability and enables investors to access investment potential in trillion-dollar markets.

Website: https://rexas.com

Whitepaper: https://rexas.com/rexas-whitepaper.pdf

Twitter/X: https://x.com/rexasfinance

Telegram: https://t.me/rexasfinance

Top Altcoins to Buy Before the Next Market Surge

The post Top Altcoins to Buy Before the Next Market Surge appeared first on Coinpedia Fintech News With the crypto market showing signs of renewed bullish momentum, investors are looking to position themselves before the next major rally. While Bitcoin and Ethereum often lead the […]

Sponsored

The post Top Altcoins to Buy Before the Next Market Surge appeared first on Coinpedia Fintech News

With the crypto market showing signs of renewed bullish momentum, investors are looking to position themselves before the next major rally. While Bitcoin and Ethereum often lead the charge, the biggest gains tend to come from smaller altcoins that catch fire mid-cycle. That’s why identifying the top altcoins to buy before the next market surge is a strategic move in 2025.

Altcoins with strong fundamentals, early adoption trends, and community support are now in the spotlight. One of the most talked-about emerging altcoins this quarter is Kaanch Network, currently in presale — giving investors early access ahead of its full launch and potential exchange listings.

Why Altcoins Outperform in Bull Markets

Historically, altcoins outperform Bitcoin in percentage gains during bull cycles. Once capital flows into BTC and ETH, investors begin rotating into smaller market cap tokens that offer higher upside potential. This creates an opportunity for those positioned early.

But not all altcoins are equal. The best performers tend to share these traits:

- Strong use cases and real-world applications

- Low-to-mid market caps with room for growth

- Committed developer teams and transparent roadmaps

- Presale access or recent token launches with strong tokenomics

Top Altcoin Picks for April 2025

1. Kaanch Network: Web3 Infrastructure from the Ground Up

Built for scalability and usability, Kaanch Network offers a suite of Web3 tools including governance, staking, and decentralized application support. Still in its presale phase, the project is drawing early investor interest thanks to its focus on solving friction in decentralized environments.

Smart investors are eyeing Kaanch now to get in before potential price surges post-listing.

2. Immutable X (IMX): The Future of NFT Gaming

Immutable X provides gas-free NFT minting and scaling solutions for blockchain games. With gaming adoption on the rise again, IMX is well-positioned for growth, especially as AAA titles start deploying on the chain.

3. Optimism (OP): Scaling Ethereum Efficiently

As Ethereum gas fees remain a hurdle, Optimism offers an efficient Layer 2 solution. With a growing ecosystem and token utility expanding across DeFi, OP remains a favorite altcoin to accumulate before the next leg up.

4. Synthetix (SNX): Reviving On-Chain Derivatives

Synthetix is powering a new wave of decentralized perpetuals and derivatives. The protocol is leaner and more efficient than ever — giving SNX a potential breakout setup as trading volumes increase across DeFi platforms.

5. Ocean Protocol (OCEAN): Monetizing Data in Web3

Ocean Protocol allows users to tokenize and monetize data while maintaining control. With data privacy becoming a key concern globally, OCEAN offers a future-ready solution — and it remains undervalued compared to competitors.

Timing Is Everything

Altcoins often move swiftly when the market turns bullish — and those who position themselves early typically benefit the most. Presale tokens like Kaanch Network provide an especially attractive risk/reward profile, allowing investors to enter before exchange-driven volatility begins.

A diversified altcoin strategy that includes both established Layer 2s and emerging presales is an ideal approach to capitalize on the next wave of growth.

FAQs – Best Altcoins to Buy Before the Market Surge

1. What altcoins are expected to perform well in the next crypto bull run?

Presales like Kaanch Network and established tokens like IMX, OP, and SNX are strong contenders.

2. Should I invest in altcoins or just stick with Bitcoin?

Altcoins often offer higher returns, especially during surges. A diversified approach provides the best balance of growth and safety.

3. What makes Kaanch Network a top altcoin to watch?

Its presale access, utility-driven ecosystem, and growth-focused roadmap make it a standout among emerging tokens.

4. Are altcoins riskier than BTC and ETH?

Yes, but they also offer greater potential returns. Research and timing are key.

5. How do I find the next altcoin to explode?

Look for tokens with strong fundamentals, community momentum, and early-stage access — like Kaanch Network in its current presale.

BE A PART NOW → https://presale.kaanch.com

Official Website: https://kaanch.com

Whitepaper: https://docs.kaanch.network

Twitter / X: https://x.com/KaanchNetwork

Telegram: https://t.me/kaanchnetwork

Disclaimer: Remember that investing in cryptocurrencies carries inherent risks. Always conduct thorough research (DYOR), stay informed, and make wise investment decisions.